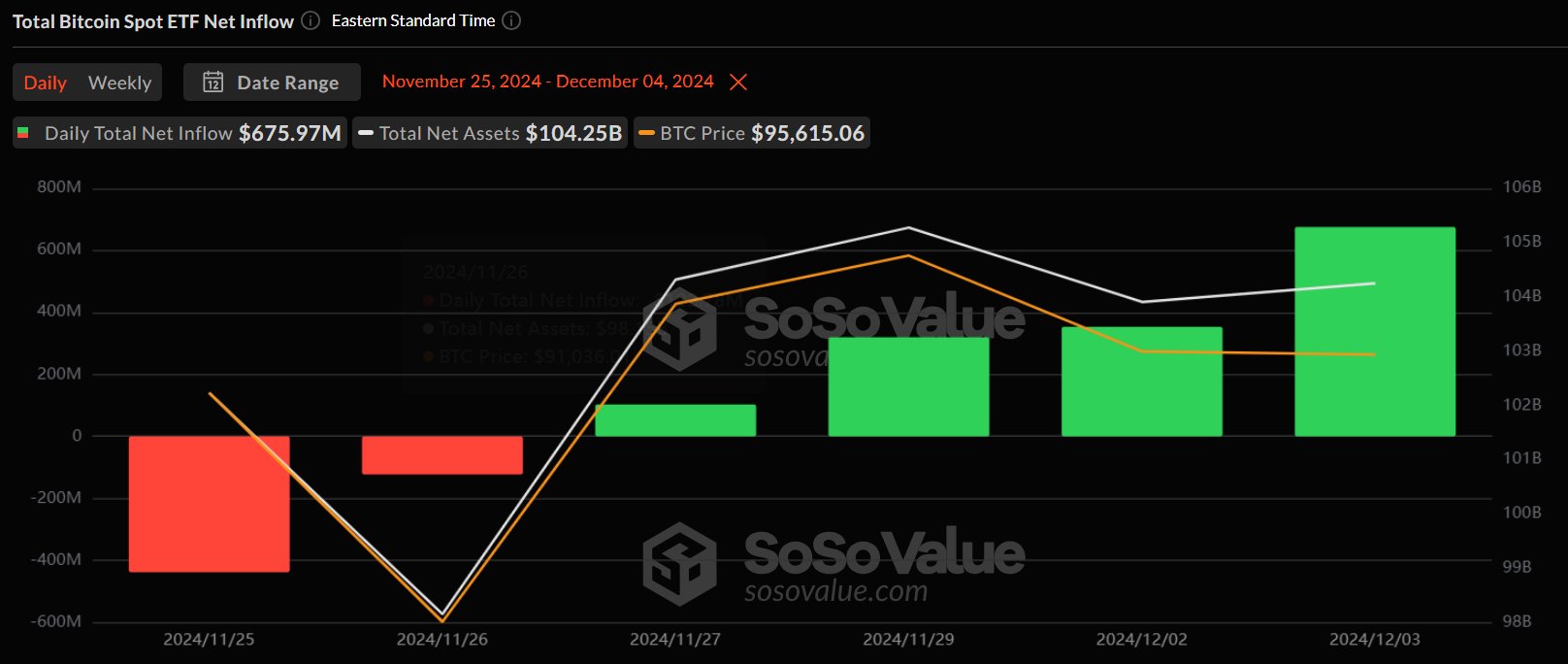

In December, spot Bitcoin  $91,967 ETFs in the United States experienced a rapid influx of capital. On December 3rd, total net inflows reached approximately $676 million, with cumulative entry amounts hitting $1.1 billion in the first four days. Notably, the ETFs managed by BlackRock and Fidelity gained particular attention during this period.

$91,967 ETFs in the United States experienced a rapid influx of capital. On December 3rd, total net inflows reached approximately $676 million, with cumulative entry amounts hitting $1.1 billion in the first four days. Notably, the ETFs managed by BlackRock and Fidelity gained particular attention during this period.

High Inflows in BlackRock and Fidelity ETFs

BlackRock‘s spot Bitcoin ETF, IBIT, recorded a net inflow of $693 million on December 3rd. On the same day, Fidelity‘s FBTC ETF achieved a net inflow of $52.17 million. These substantial inflows indicate a growing interest in spot Bitcoin ETFs, a trend that has remained consistent for four consecutive days.

Spot Ethereum  $3,139 ETFs also garnered significant interest from investors, recording a total net inflow of $133 million on December 3rd. This maintained a week-long trend of positive net inflows into spot Ethereum ETFs. Fidelity’s FETH ETF stood out with $73.72 million, while BlackRock’s ETHA ETF followed closely with $65.29 million in inflows.

$3,139 ETFs also garnered significant interest from investors, recording a total net inflow of $133 million on December 3rd. This maintained a week-long trend of positive net inflows into spot Ethereum ETFs. Fidelity’s FETH ETF stood out with $73.72 million, while BlackRock’s ETHA ETF followed closely with $65.29 million in inflows.

Interest in Crypto Asset ETFs on the Rise

The data recorded in the early days of December indicate a strong demand from investors for both Bitcoin and Ethereum ETFs. This trend reflects a growing popularity of regulated investment vehicles within the crypto market. Continued inflows at these levels could positively influence the market.

The rise in spot Bitcoin and Ethereum ETFs showcases increased investor confidence and a growing adoption of cryptocurrencies through regulated investment products. The positive trend in ETFs is expected to persist in the coming days.