The SEC’s decision to delay the spot <a href="https://en.coin-turk.com/a-prominent-crypto-analyst-predicts-a-decline-in-bitcoin-despite-recent-market-surge/”>Bitcoin ETF products that are currently in the application process has prompted investors and fund managers to consider the potential outcomes. As a result, price movements in the crypto market continue to decline. However, all eyes are now on the SEC’s decision regarding spot Bitcoin ETF applications on November 17.

Why is the Crypto Market Falling?

The increasing interest in a potential spot Bitcoin exchange-traded fund (ETF) approval in November has led to growing hype in the market. This hype caused the price of Bitcoin to rise above $38,000, reaching its highest level in the past 18 months. However, with a 2% drop in the price of Bitcoin during the week of November 17, investor optimism seems to be waning.

While the crypto market was speculating on positive spot ETF news this week, it does not seem likely with the SEC’s decision to delay the spot Bitcoin ETF conversion application submitted by Hashdex on November 15. BlackRock believes that the SEC does not have any legitimate reason to disapprove a cryptocurrency spot ETF product, but SEC officials are patiently waiting to take action.

The SEC postponed its decision on the Ethereum futures ETF product submitted by Grayscale on November 15. Some analysts believe that the 19b-4 form submitted by Grayscale may act as a potential Trojan horse for the institution.

Hope Diminishing on the SEC’s Side

The market downturn in the crypto market coincides with the period when the U.S. Securities and Exchange Commission (SEC) is expected to review pending spot Bitcoin ETF applications. Specifically, the securities regulatory agency needs to make a decision on the applications of Hashdex and Global X ETFs by November 17. The institution also needs to make a decision on Franklin Templeton’s Bitcoin ETF application by November 21. If this is not done, the application process will be extended until 2024.

According to James Edwards, a crypto analyst at Australian fintech firm Finder, the market is expecting another delay. Edwards provided information about a fake BlackRock XRP trust file that caused excessive price volatility in XRP and resulted in a request for an investigation by the U.S. Department of Justice.

Edwards believes that this incident, supported by SEC officials’ allegations of price manipulation in the crypto market, will harm the chances of launching a spot Bitcoin ETF product in the U.S. During this process, investors seem to be taking profits due to the potential waiting period and the current high prices in the crypto market over the past few months.

What is Happening in the Futures Market?

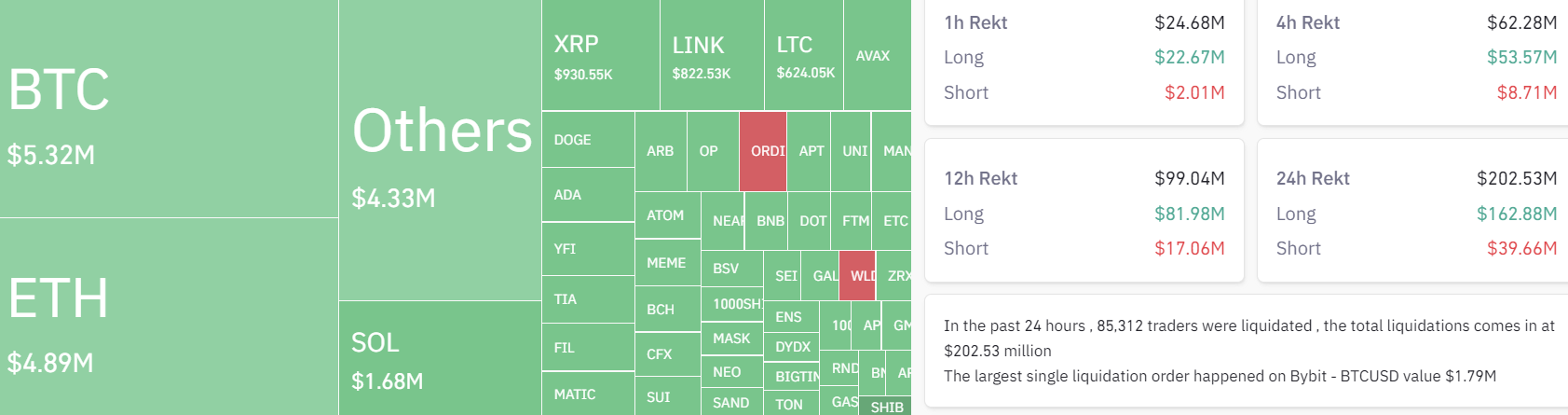

The major decline in the cryptocurrency market has led to a wave of liquidations in the futures market. In the past 24 hours alone, over $161.4 million worth of long positions have been liquidated, with $54 million worth of liquidations occurring in the previous 4 hours.

Market movements in the crypto market are negatively affected when futures long positions are liquidated without buying pressure from trading volume. In the short term, the crypto market seems to continue to struggle with various challenges, and various economic and regulatory factors will undoubtedly determine its trajectory for the foreseeable future.

Türkçe

Türkçe Español

Español