The Spot Bitcoin ETF market, which started with great enthusiasm, witnessed many events during the first week after the commencement of trading. In the first three days following the start of trading on Wall Street, Bitcoin ETFs reached the peak of investor interest with a trading volume of over 10 billion dollars. This resulted in surpassing the trading volume of the 500 ETFs approved last year.

Current Status of ETFs

Bitwise CEO Hunter Horsley made a recent statement. The CEO, stating that the Bitwise Bitcoin ETF ($BITB) witnessed $68 million in new entries, mentioned that a total of $370 million in entries occurred over the past four days. Horsley also conveyed his thanks to investors for their confidence in Bitwise and the ETFs it offers.

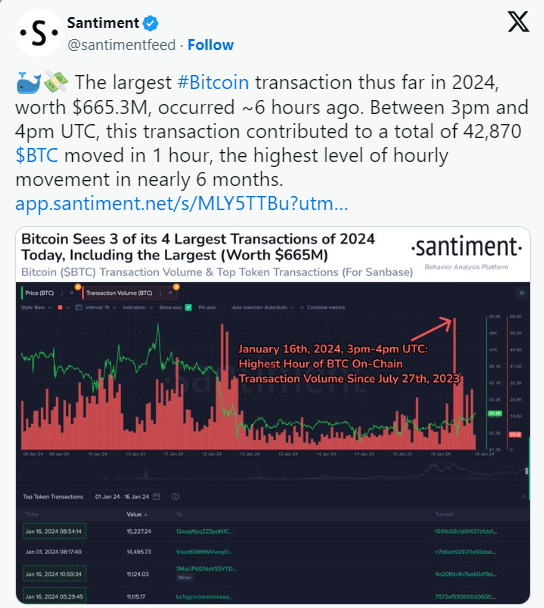

Another noteworthy aspect of Bitwise was its use of BRRNY vwap to purchase all the underlying Bitcoins in the spot ETFs. According to information released by CC15Capital, the Bitwise Bitcoin Spot ETF (BITB) made a net purchase of 1,598 Bitcoins on the last trading day.

As of January 18, the BITB ETF had approximately 8,309 Bitcoins valued at around 358 million dollars. On the most recent trading day, there was a share change worth approximately 70 million dollars, equivalent to 2.9 million dollars, specific to BITB.

Outflows at Grayscale Bitcoin Trust

There continues to be significant activity at the Grayscale Bitcoin Trust (GBTC). Strong outflows caught investors’ attention and created an atmosphere of unease following the launch of spot Bitcoin ETFs last week.

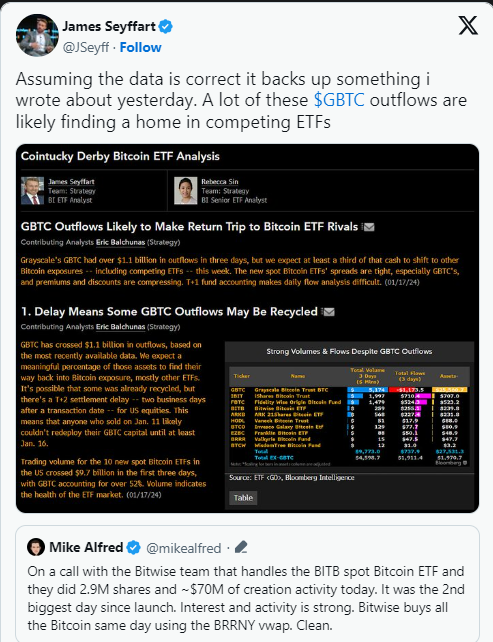

The fundamental purpose of ETFs is to enable investment instruments like Bitcoin to be used in a regular and secure manner. Market analysts suggest that the outflows from GBTC are also leading to strong inflows into ETFs.

On the other hand, Bloomberg strategist James Seyffart, whose name has been heard frequently lately, points out that there has been a significant flow from the Grayscale Bitcoin Trust ($GBTC) to the funds of ETFs owned by its competitors, but also emphasizes that such a trend is not finding the necessary response in the market at the moment.

According to data reached by Seyffart, there was an outflow of approximately 594 million dollars from $GBTC, and these outflows reached a total of 1.173 billion dollars.

While inflows continue in several other BTC ETFs, the analyst has sparked a debate about whether these inflows are sufficient to compensate for the outflows from $GBTC. Seyffart particularly highlights the inconsistent structure and volatility specific to $GBTC. As of the beginning of the week, the price of Bitcoin lost the $43,000 level and was unsuccessful in reclaiming this area.