In the US, spot Bitcoin ETF entries experienced a revival last week, securing a total of 485 million dollars in inflows. Despite the increase, the momentum of inflows into spot ETFs slowed down, leading to speculation on the potential effects on Bitcoin‘s (BTC) rise towards 100,000 dollars.

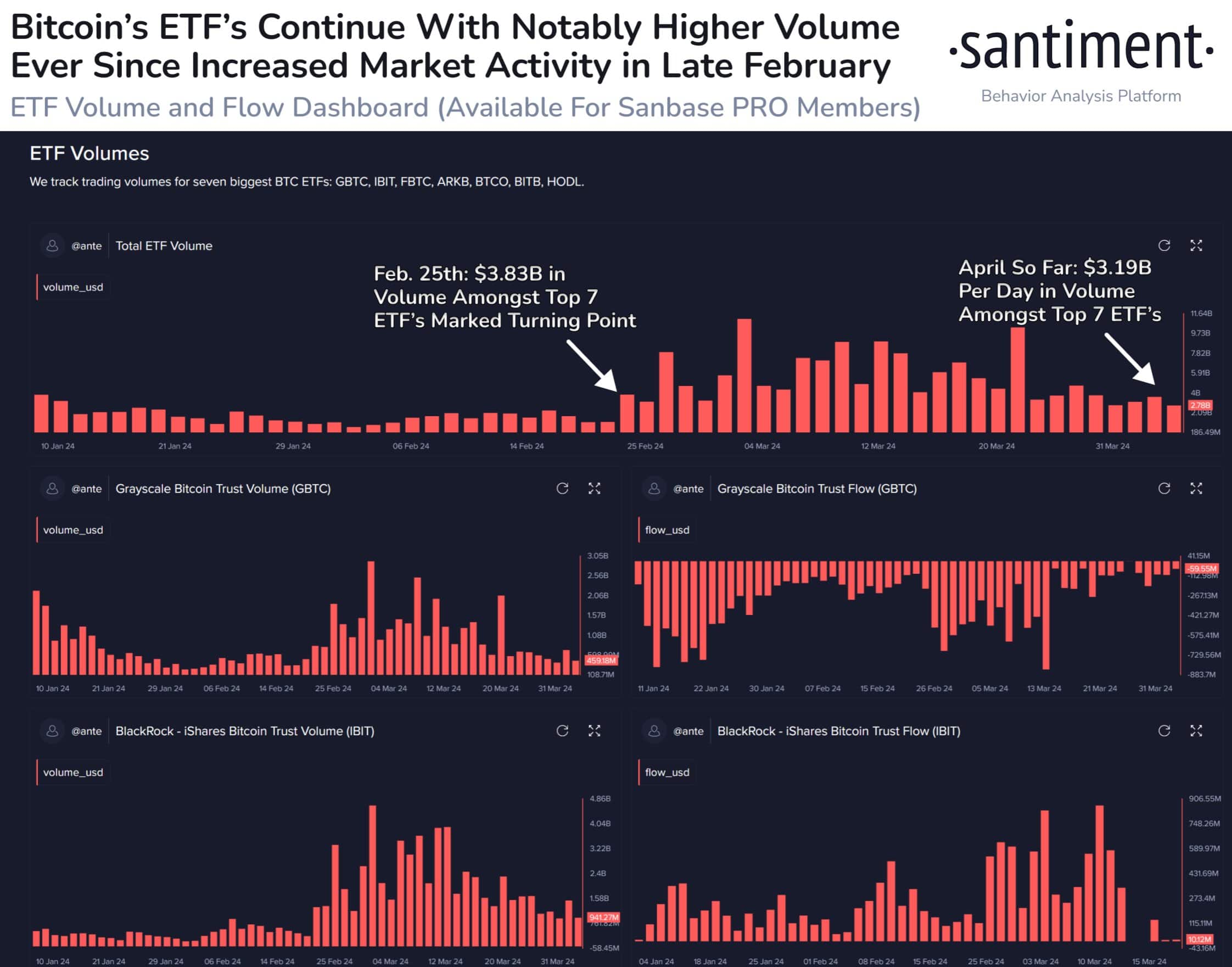

High Activity in ETFs Persists

Amid Bitcoin’s correction below 70,000 dollars from its peak, trading volumes for spot Bitcoin ETFs remained notably strong. Data provided by on-chain analysis firm Santiment shows that high trading activity continues in various ETFs, including GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL. This persistent engagement indicates ongoing market interest even four weeks after Bitcoin’s all-time high at the end of February.

As the 4th block reward halving is expected to occur on April 19th, market volatility is anticipated to continue. However, there is speculation about potential declines in both ETF and on-chain volumes after the block reward halving, necessitating careful observation of market dynamics moving forward.

The ongoing demand for spot Bitcoin ETFs provides a positive signal for Bitcoin, especially as the block reward halving approaches in the next ten days. Analysts believe that the ongoing demand from the spot Bitcoin ETF market combined with the upcoming supply reduction could potentially push Bitcoin’s price towards the 80,000 dollar threshold.

Nevertheless, the impact of the Fed’s monetary policy continues to be a significant determinant in the dynamics of the spot Bitcoin ETF market. Changes in US economic indicators, especially in response to potential adjustments in the Fed’s interest rates, could affect Bitcoin demand. This week’s US inflation data release is expected to influence market sentiment regarding the potential Fed interest rate decision in June.

Current Bitcoin Status

Currently, BTC is maintaining a steady position above both the 50-day and 200-day Exponential Moving Averages (EMA), confirming bullish price trends. Bitcoin surpassing the 70,000 dollar level could increase its upward momentum, potentially exceeding its all-time high of 73,750 dollars reached on March 14th. Surpassing this ATH could set a target of 75,000 dollars for the bullish trend.

According to recent data, Bitcoin is trading at 69,798 dollars, up 0.82% in the last 24 hours. The data indicates that the market value of the cryptocurrency king is at 1.37 trillion dollars.

Türkçe

Türkçe Español

Español