In January, the launch and trading of spot Bitcoin exchange-traded funds (ETFs) in the US attracted a surge of institutional investors to the cryptocurrency market. Leading this trend is BlackRock’s IBIT, which holds a significant market share in the emerging spot Bitcoin ETF space. The institutional appetite for spot Bitcoin ETFs has rapidly increased since their introduction, signaling a growing acceptance of cryptocurrencies in traditional financial circles.

ETFs Accumulate BTC with Strong Appetite

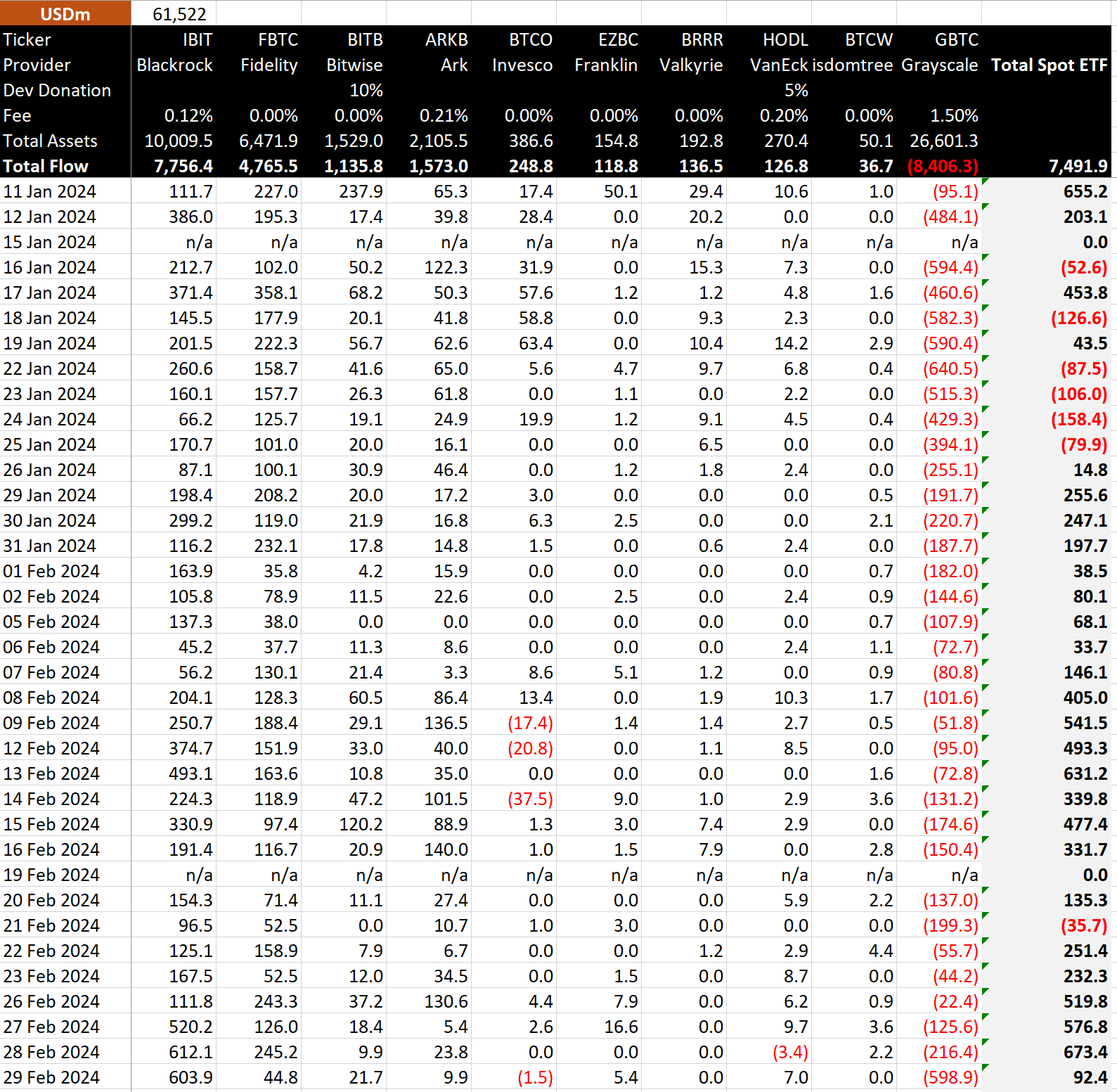

BitMEX Research reports that spot Bitcoin ETFs in the US currently hold about 4% of the total BTC supply collectively, indicating a significant accumulation trend by institutional players. This trend points to a major shift in corporate investment strategies as Wall Street giants adopt Bitcoin as a legitimate asset class with significant growth potential.

Among the significant players in the Bitcoin accumulation game is MicroStrategy, which has one of the world’s largest corporate treasuries and holds about 1% of Bitcoin’s supply. Under the leadership of strong Bitcoin proponent Michael Saylor, MicroStrategy has confirmed the value proposition of the leading cryptocurrency by realizing significant gains from its BTC investments since its initial purchase in August 2020.

On the other hand, the US government has become a significant Bitcoin holder with assets resulting from various criminal cases, including the seizure of Bitcoins from Silk Road and the 2016 hack of the Bitfinex exchange. These assets correspond to approximately 1.1% of Bitcoin’s circulating supply.

Everything Changed After Spot ETFs

The introduction of spot Bitcoin ETFs has differentiated the ongoing bull market from previous cycles characterized by speculative frenzy and volatility. Unlike previous rally and crash cycles driven by risk-loving speculators, spot ETFs offer investors a regulated and transparent way to invest in Bitcoin, contributing to the maturation of the cryptocurrency market.

The influx of institutional and individual investors into the cryptocurrency market indicates a broader transition towards a more regulated and institutionalized market environment. According to industry experts like Galaxy Digital’s founder Michael Novogratz, the ability of Baby Boomers and older individuals to access cryptocurrencies through spot ETFs could accelerate market growth and demographic change.

Türkçe

Türkçe Español

Español