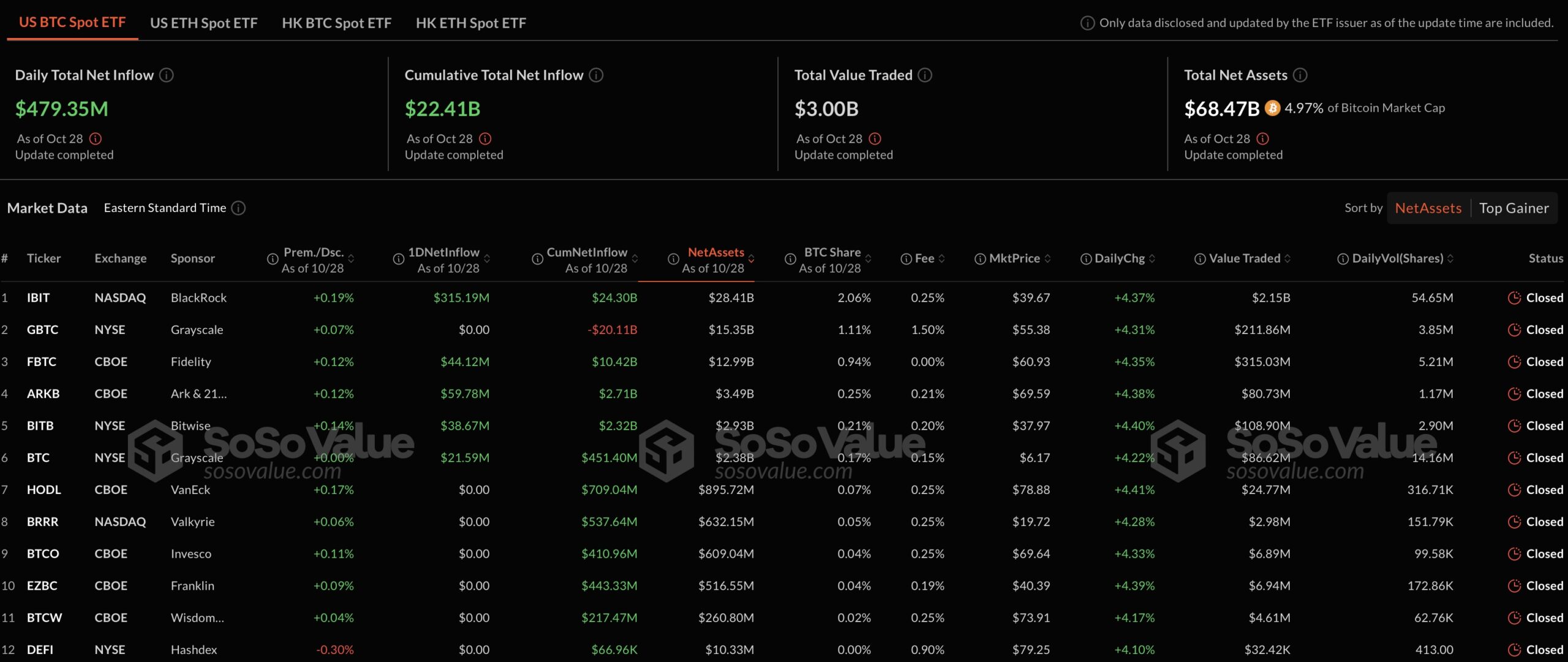

On the first trading day of the week in the United States, spot Bitcoin  $0.000034 ETFs drew a remarkable net inflow of $479.4 million, marking the highest daily influx since October 14. Leading the charge was BlackRock’s IBIT fund, which attracted $315.19 million, continuing its positive streak for eleven consecutive days.

$0.000034 ETFs drew a remarkable net inflow of $479.4 million, marking the highest daily influx since October 14. Leading the charge was BlackRock’s IBIT fund, which attracted $315.19 million, continuing its positive streak for eleven consecutive days.

Interest in Spot Bitcoin ETFs Continues

In addition to BlackRock’s IBIT fund, the ARKB fund, a collaboration between Ark and 21Shares, garnered $59.78 million, making it the second most popular ETF. Fidelity’s FBTC fund also saw a noteworthy inflow of $44.12 million. Additionally, Bitwise’s BITB and Grayscale’s Bitcoin ETFs recorded inflows of $38.67 million and $21.59 million, respectively. However, the remaining seven spot Bitcoin ETFs did not register any inflows.

This activity was supported by a total ETF trading volume that reached $3 billion on Monday, which represents an increase compared to Friday’s volume of $2.9 billion. Bitcoin rose by 4.75% in the last 24 hours to reach $71,200, the highest level since June. During this surge, Ethereum  $0.000114 also increased by 5.11%, reaching $2,619.

$0.000114 also increased by 5.11%, reaching $2,619.

Spot Ethereum ETFs Experience Outflows

In stark contrast to the record inflows in spot Bitcoin ETFs, spot Ethereum ETFs faced a net outflow of $1.14 million on Monday. This was a decrease from a $19.16 million outflow recorded on Friday. Grayscale’s ETHE product was notable with an outflow of $8.44 million, which was partially offset by $5.02 million in inflows to Fidelity’s FETH product and $2.28 million into BlackRock’s ETHA product.

No other six spot Ethereum ETFs recorded any inflows. The total trading volume for the nine Ethereum ETFs decreased to $187.49 million on Monday, compared to $189.88 million on Friday. The significant interest in spot Bitcoin ETFs indicates increased investor confidence in Bitcoin, as they track movements triggered by volatility.

Türkçe

Türkçe Español

Español