In the pre-market session, ETFs went through their first trading hours, but as of 5:30 PM, the US markets are now open. We now need to monitor how much volume these spot Bitcoin ETFs have generated until the market closes. We had mentioned how critical the volume data is and that it could further support FOMO.

Spot Bitcoin ETF Data

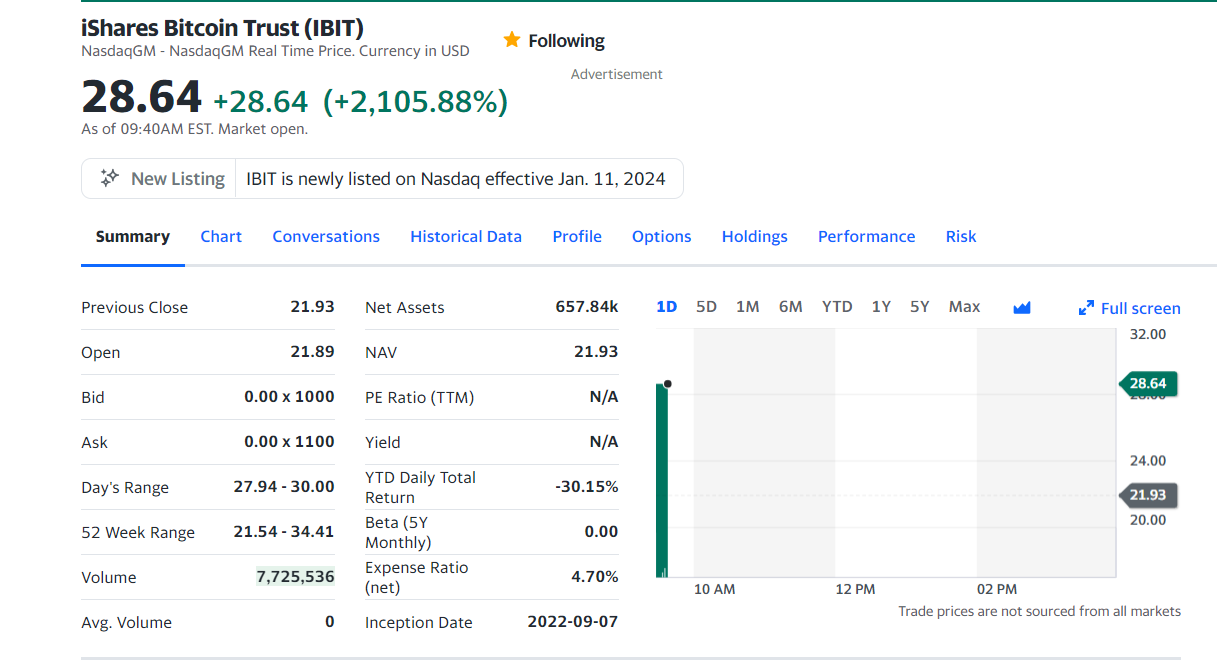

Today is a historic day as ETFs have started trading on the US stock markets. The SEC approved the ETF listing requests of Hashdex and Grayscale, among others, approximately 17.5 hours ago. Approval was granted to all at the same time in the interest of fairness. Now, we will monitor whether the massive volumes that have been discussed for days will indeed materialize.

We had seen that the market went into decline because the volume data for the futures ETH ETF approval a few months ago was terrible. If the Spot Bitcoin ETF does not attract the expected level of interest, we could face the same outcome. Meanwhile, the spot ETH ETF could be approved by mid-year (the final decision date), and the price of ETH has already surpassed $2,600.

The US stock markets have only been open for 7 minutes, but a few minutes ago, spot Bitcoin ETFs reached a trading volume of $1 billion. As a result, Bitcoin is finding buyers above $48,130.

The initial data from just BlackRock alone is enticing and shows that the “sell the news” narrative is not holding up.

Türkçe

Türkçe Español

Español