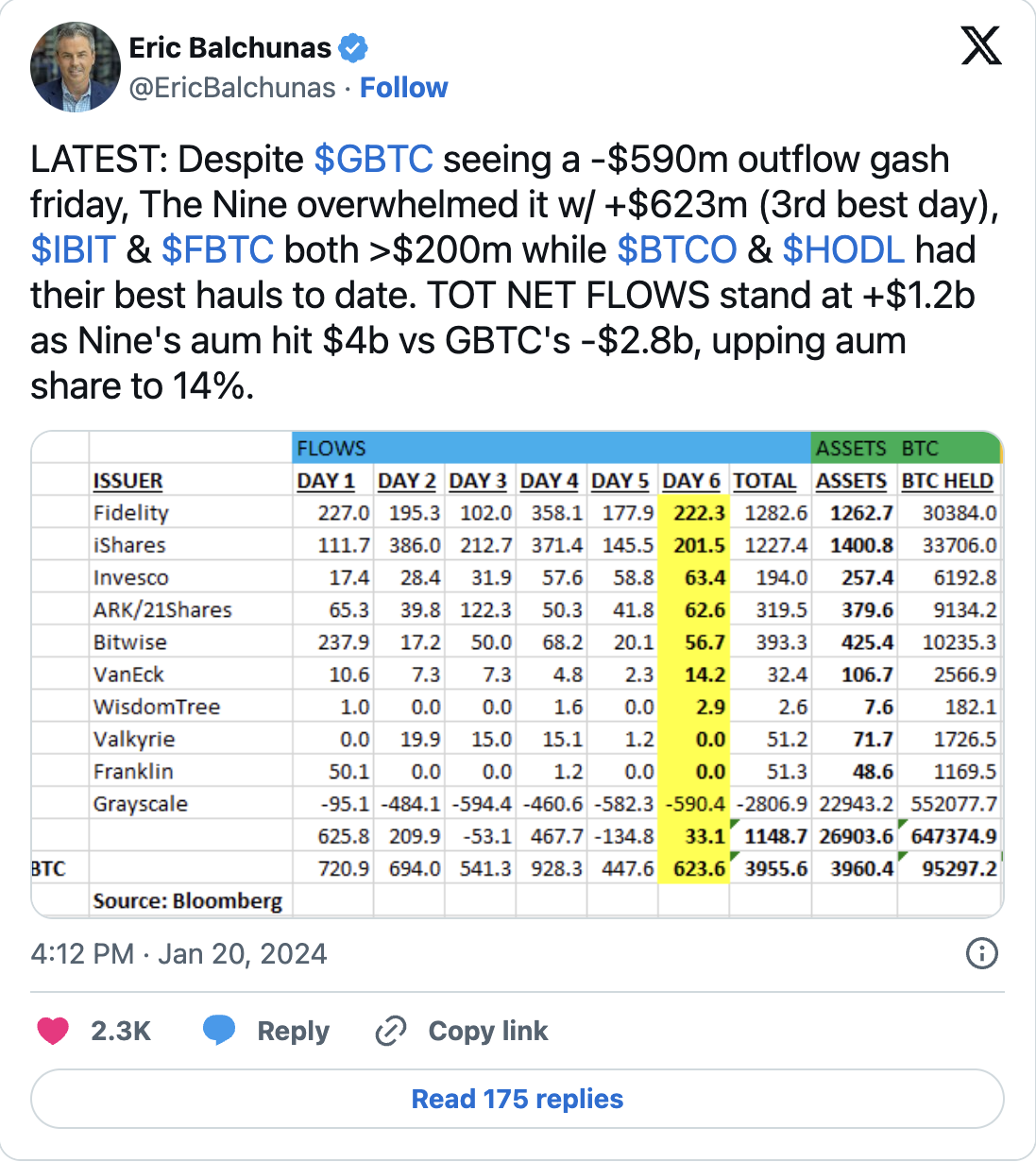

The nine approved spot Bitcoin exchange-traded funds (ETFs) are currently holding a total of 95,000 Bitcoin and have assets under management (AUM) valued at 4 billion dollars. According to data revealed by Eric Balchunas, a senior ETF analyst at Bloomberg, the recently launched nine ETF products have managed to surpass the capital outflows from Grayscale Bitcoin Trust (GBTC).

Continued Interest in the ETF Space

Regarding this matter, GBTC’s assets under management decreased by 2.8 billion dollars in six days. Among the nine ETFs, Fidelity’s (FBTC) and BlackRock’s iShares (IBIT) stood out, with both seeing inflows of over 1.2 billion dollars during the six-day trading period. Although Fidelity’s ETF product had slightly higher inflows, BlackRock’s ETF product now has more assets under management, with 1.4 billion dollars compared to Fidelity’s approximately 1.3 billion dollars.

Invesco’s ETF product (BTCO) ranked third on this list and continues to maintain steady growth. BTCO experienced its best day on January 19 with inflows exceeding 63 million dollars, but its total assets under management did not surpass the 200 million dollar mark. VanEck’s ETF product (HODL) also had its most significant day in terms of inflows, pushing its total assets under management over 100 million dollars.

Noteworthy Data in the ETF Sector

With these developments, according to data collected by the account CC15Capital on January 17, investors added a net worth of 440 million dollars in Bitcoin to their assets on the fifth trading day.

BlackRock’s ETF product continues to lead the race with approximately 358 million dollars worth of 8,700 Bitcoin. The data shows that, excluding Grayscale, the nine ETF products have purchased approximately 68,500 Bitcoin valued at around 2.8 billion dollars since their inception.

Meanwhile, on January 18, Balchunas shared data highlighting a 34% increase in daily trading volume on the fifth day of trading for the new spot Bitcoin ETF products, which he refers to as the Newborn Nine, excluding GBTC. These data suggest that the sell-offs on the GBTC side have not affected investor interest in the ETF space.

Türkçe

Türkçe Español

Español