Last month’s approved Spot Bitcoin ETFs continue to be the center of attention for cryptocurrency investors. With GBTC reserves at approximately $20 billion and ongoing sales, it is crucial for other ETFs to see strengthened net inflows. So, what is the current situation for Spot Bitcoin ETF issuers today? Will the price of Bitcoin fall?

Current Status of Spot Bitcoin ETFs

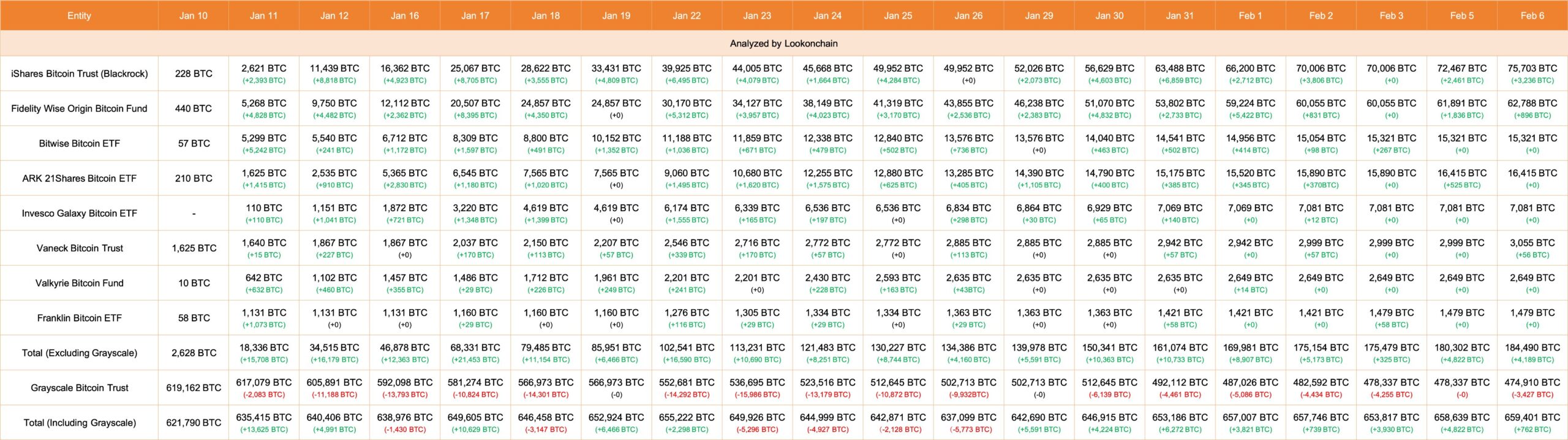

As of today, we have seen an outflow of $147 million from the Grayscale Bitcoin ETF. Starting with reserves of 619,162 BTC, GBTC has now reduced its reserves to 474,910 BTC due to the heavy sales by investors who have been waiting for a profit from the negative premium for a long time. While previous days saw outflows around 4-5 thousand BTC, the latest outflow has dropped to 3,427 BTC.

The weakening of outflows from GBTC is significant, and if this trend continues, the negative pressure on the market may decrease as long as inflows into other ETFs persist. BlackRock’s IBIF ETF saw an inflow of 3,226 BTC, almost single-handedly matching the GBTC outflow, and Fidelity added 896 BTC to its reserves.

Other ETF issuers, however, continue to see weak inflows. The winners of the ETF race seem to be BlackRock and Fidelity already. Excluding Grayscale, the cumulative reserves of other ETF issuers have reached 184,490 BTC. The cumulative reserves of all ETFs have finally reached the 660,000 BTC threshold.

Development Process of Spot Bitcoin ETFs

James from Bloomberg recently mentioned that the inflows into ETFs may not be as massive as expected. This is confirmed by the data we have seen in nearly a month of trading days. The volumes were impressive because the outflows from GBTC created significant activity. The net inflows were satisfactory because a portion of the GBTC outflows turned into inflows for BlackRock and Fidelity.

In other words, we see that an amount close to GBTC’s cumulative BTC reserves is being distributed to other ETFs due to lower transaction fees. What’s exciting is the strong volume seen by BlackRock’s ETF and the impressive growth in its reserves.

BlackRock and Fidelity are likely to represent the two main investment vehicles for Bitcoin ETFs in the long term. Their extensive customer base and trillion-dollar scale, which provide confidence, could monopolize them in this field for a while. Despite competitive transaction fees, other ETFs remain overshadowed by the liquidity depth brought by the concentrated volume in these two ETFs.

Türkçe

Türkçe Español

Español