Yesterday evening, the world’s attention was turned to the news of a spot Bitcoin ETF from the U.S. Securities and Exchange Commission (SEC). Following the SEC’s approval of 11 issuers’ applications, an incredible wave of activity began in the world of cryptocurrencies. Despite the volatile movement in Bitcoin prices, a remarkable revival was seen in altcoins. During all these developments, there was also an incredible increase in interest in cryptocurrencies in Turkey. Let’s take a look at which cryptocurrencies Turks have shown the most interest in over the past 24 hours, according to data from 21milyon.com.

Turks Remain Committed to Bitcoin

There are two different methods to find out which cryptocurrencies are most invested in Turkey. If you choose the first, you can visit Turkish exchanges one after another, collect the volumes of cryptocurrencies in an Excel file, and create your own lists.

It should not be forgotten that choosing such a path would cost a lot of time and effort. If you choose the second method, you can visit the 21milyon.com website and access the real-time price, 24-hour volume, and performance over different time frames in Turkish Lira of 411 different altcoins with just one click.

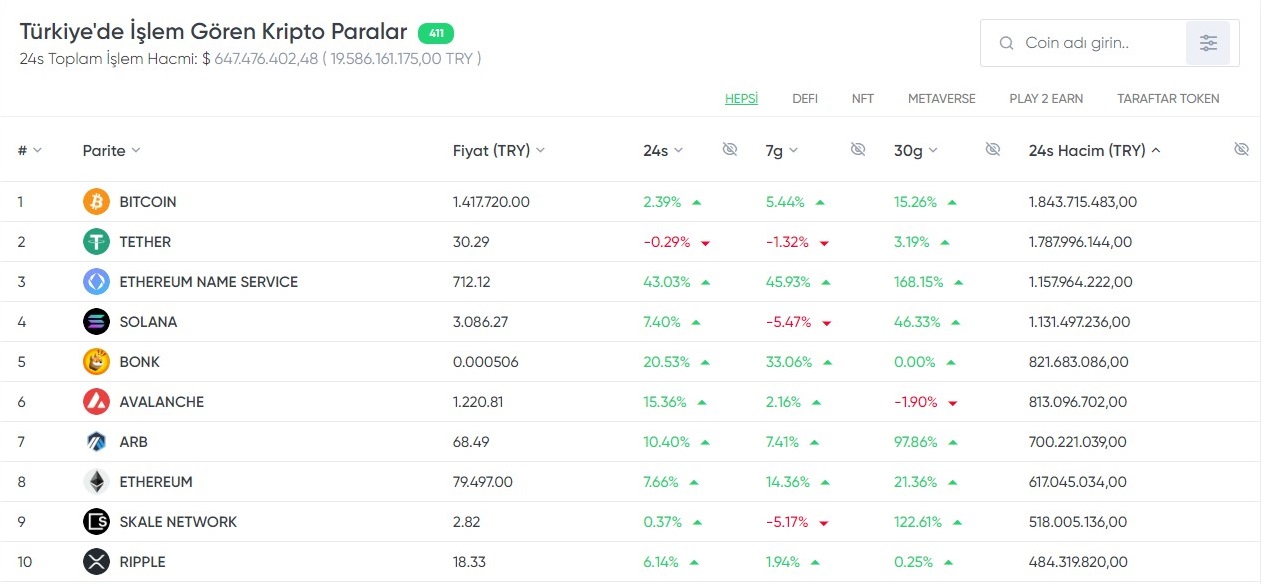

All you need to do is sort by volume in the cryptocurrencies section. Then what you are looking for will appear in front of you. To save myself 10 hours, I went to 21milyon.com and did this, and I came across the table below.

Approximately 24 hours have passed since the ETF decision for cryptocurrencies was made yesterday, and during this time, according to data from 21milyon.com, a total trading volume of over 636 million dollars was generated on Turkish exchanges. The overall volume settled over 19 billion dollars during this period.

The cryptocurrency that attracted the most interest from Turks, as expected, was Bitcoin, which gathered all the spotlight last evening. The ETF decision taken in the 24-hour period and the subsequent start of ETF trading played an important role in BTC transactions.

While Bitcoin was trading at a price of 1,417,720 Turkish Lira, it appears to have increased by 2.39% in the last 24 hours after all these events. In addition, the trading volume in the last 24 hours was over 1.8 billion Turkish Lira.

Altcoins of Interest to Turkish Investors

While everyone was expecting a rise in BTC price after the Bitcoin ETF, the significant bullish response came from altcoins. If we set aside Tether’s quick dollar buying/selling advantage, it wouldn’t be wrong to say that ENS, which started to rise after recent statements by Vitalik Buterin, is still a favorite among Turkish investors.

ENS was trading at 712 Turkish Lira with a 43% increase in the last 24 hours, and its trading volume was over 1.1 billion dollars.

Following ENS, altcoins like SOL, BONK, and AVALANCHE have been under the watch of Turkish investors for a long time. These altcoins had caught the attention of investors with their performance at the end of last year and had provided substantial gains. It is important not to forget that SOL rebounded from the 9 dollar level to over 120 dollars.

Additionally, BONK, being a Solana-based project, benefited greatly from the Solana craze. BONK did not disappoint Turkish investors, showing an increase of over 950% last year.

Therefore, the table that emerges based on the transactions made by Turkish investors appears to be different from the volume ranking in global exchanges, and investors can turn this into a positive scenario for themselves.

Considering the events in BONK, it is possible that the altcoins closely monitored by Turkish investors may continue to grow even more.

Now you can also access all the latest breaking news 24/7 from the news section of 21milyon.com.

Türkçe

Türkçe Español

Español