After significant developments in spot Bitcoin ETFs, attention has shifted to Ethereum ETFs. Following their approval in January, spot Bitcoin ETFs, dubbed the largest ETF launch in history, changed all market dynamics. The price initially plummeted, then soared to historic highs, refreshing its all-time high (ATH) for consecutive days. Subsequently, everyone turned their eyes to the SEC for spot Ethereum ETFs. Just moments ago, Fidelity took a new step by filling out the S-1 form.

Fidelity’s ETF Move and Current Status

Statements emerging in recent months had cast a shadow of pessimism over investors expecting a spot Ethereum ETF following the spot Bitcoin ETF. Leading figures in the market had been making statements suggesting to be prepared for a possible rejection.

Eleanor Terret and top ETF experts in the market had been making increasingly downbeat statements one after another. Despite this, some executives of major institutions continued to hold high expectations.

On the other hand, news from the SEC that spot Bitcoin ETFs were sufficient cast a shadow over the expectations of hopeful investors.

Ignoring all this, Fidelity, a $4.5 trillion asset management company, recently filled out the S-1 form that includes staking, taking a bold new step. However, this move had little impact on the price of Ethereum.

Current Situation with Ethereum

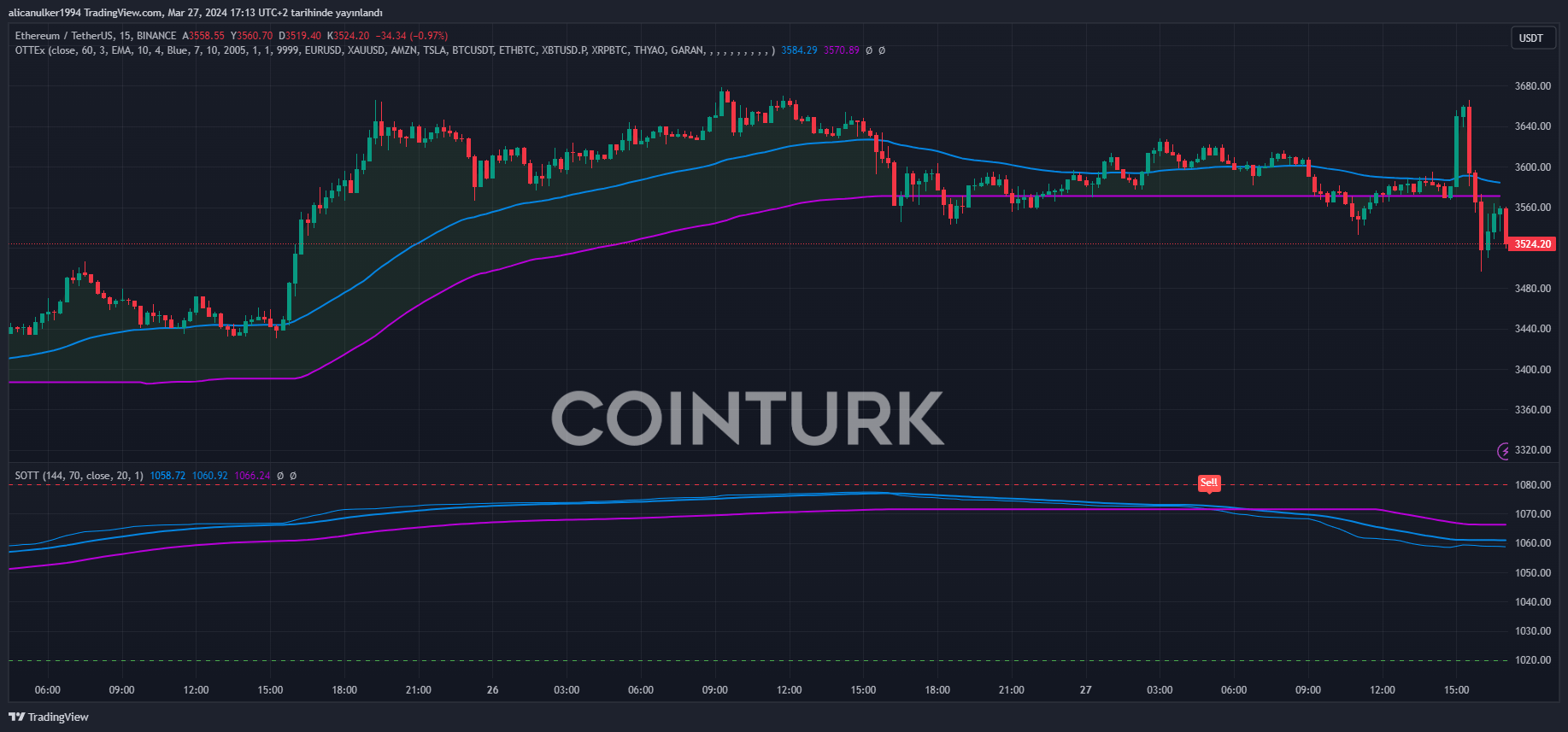

While all this was happening, eyes were also on the price of Ethereum. Ethereum’s price did not show a strong performance following the news and continued its decline.

At the time of writing, Ethereum is trading at $3,524. This price movement can be interpreted as Ethereum not displaying a strong outlook despite the existing market hesitation.

Ethereum’s (ETH) market cap has fallen to $422 billion, while the 24-hour trading volume is at $18.1 billion, indicating a 12% decrease.

Generally, such declines can be interpreted in different ways. Sometimes they are seen as a decrease in interest in cryptocurrency, while in other cases, they may be viewed as investors not wanting to execute trades to avoid selling their Ethereum investments at a loss.

Türkçe

Türkçe Español

Español