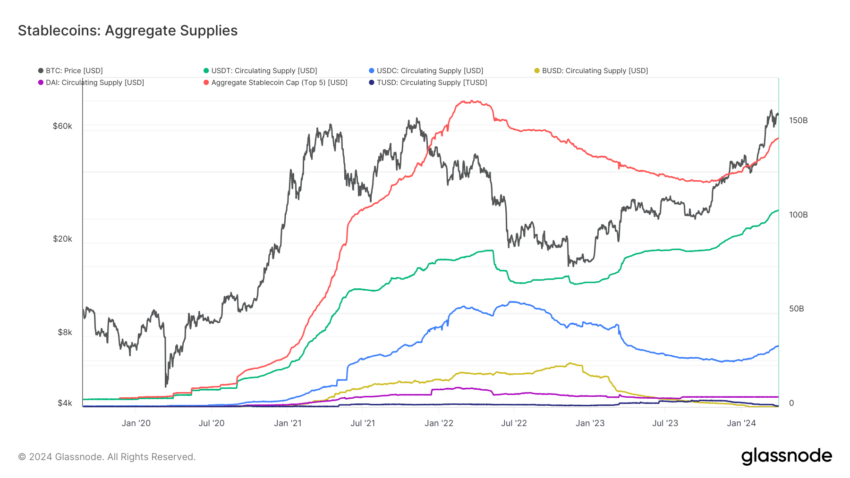

The cryptocurrency market has recorded significant growth since the beginning of the year, with the stablecoin sector experiencing considerable expansion. According to DeFiLlama, the stablecoin supply has increased by about 20 billion dollars since the start of the year, exceeding 150 billion dollars. This marks the highest level observed since the collapse of FTX in November 2022. Stablecoins serve as an important bridge between the cryptocurrency market and traditional currencies.

Growth in Stablecoins

Given their widespread use and popularity among investors, stablecoins significantly influence liquidity. Therefore, the recent increase could signal a prevailing optimism that is indicative of rising capital inflows in the cryptocurrency markets. Tether‘s USDT continues to lead with a market value recently surpassing 100 billion dollars. Its growth trajectory continues, and it currently stands at approximately 104 billion dollars.

Simultaneously, Circle’s USDC is experiencing a resurgence amidst current market conditions. Its expanding supply across various blockchain networks, reflecting increased activity and investor confidence, has risen to 32 billion dollars. Additionally, newcomers to the cryptocurrency market, such as FDUSD and USDe stablecoins, have also seen an increase in supply.

Analytical Report on Stablecoins

FDUSD’s growth is largely driven by adoption on platforms like Binance, while USDe benefits from solid support within the crypto community and offers attractive returns on deposits. CCData commented on the matter:

The increase in stablecoins in March can be associated with the rise in demand resulting from trading activities on centralized exchanges and decentralized applications, as Bitcoin reached its all-time highs for the first time since May 2021.

The surge in supply has led to a significant increase in the trading volume of various tokens. According to data from the cryptocurrency analytics platform CCData, the trading volume of stablecoins increased by 5.14% in February, reaching 1.09 trillion dollars. This marks the highest trading volume for stablecoins on centralized exchanges (CEX) since December 2021. Furthermore, CCData predicts that March will surpass this figure and that the trading volume will reach a significant level by mid-month.

Türkçe

Türkçe Español

Español