Standard Chartered emphasized that the US Securities and Exchange Commission (SEC) is likely to approve spot Bitcoin (BTC) ETFs possibly within this week. The approval of the ETFs is seen as a significant factor that could trigger a substantial rise in BTC prices, in line with Standard Chartered’s earlier projection that Bitcoin could reach the $100,000 level by the end of 2024.

Charting a Course: Lessons from Gold ETPs

Standard Chartered draws parallels with the historical experience of gold-focused Exchange Traded Products (ETPs) to gauge the potential impact of Bitcoin ETF approval. The analysis, which examines the launch of the first US-based gold ETP in November 2004, reveals that gold prices increased by 4.3 times over a period of seven to eight years as gold ETP assets matured.

Based on this comparison, Standard Chartered anticipates that Bitcoin will also experience similar price increases but within a more condensed timeframe. Accordingly, the bank forecasts a one to two-year period for the gains to materialize. This acceleration is linked to expectations of rapid development in the Bitcoin ETF market.

Market Predictions: From a Potential $100,000 to $200,000

Starting from the forecast that Bitcoin will reach the $100,000 level by the end of 2024, Standard Chartered predicts even more significant growth if the inflows related to ETFs occur as expected. The prediction suggests the possibility of Bitcoin reaching close to $200,000 by the end of 2025.

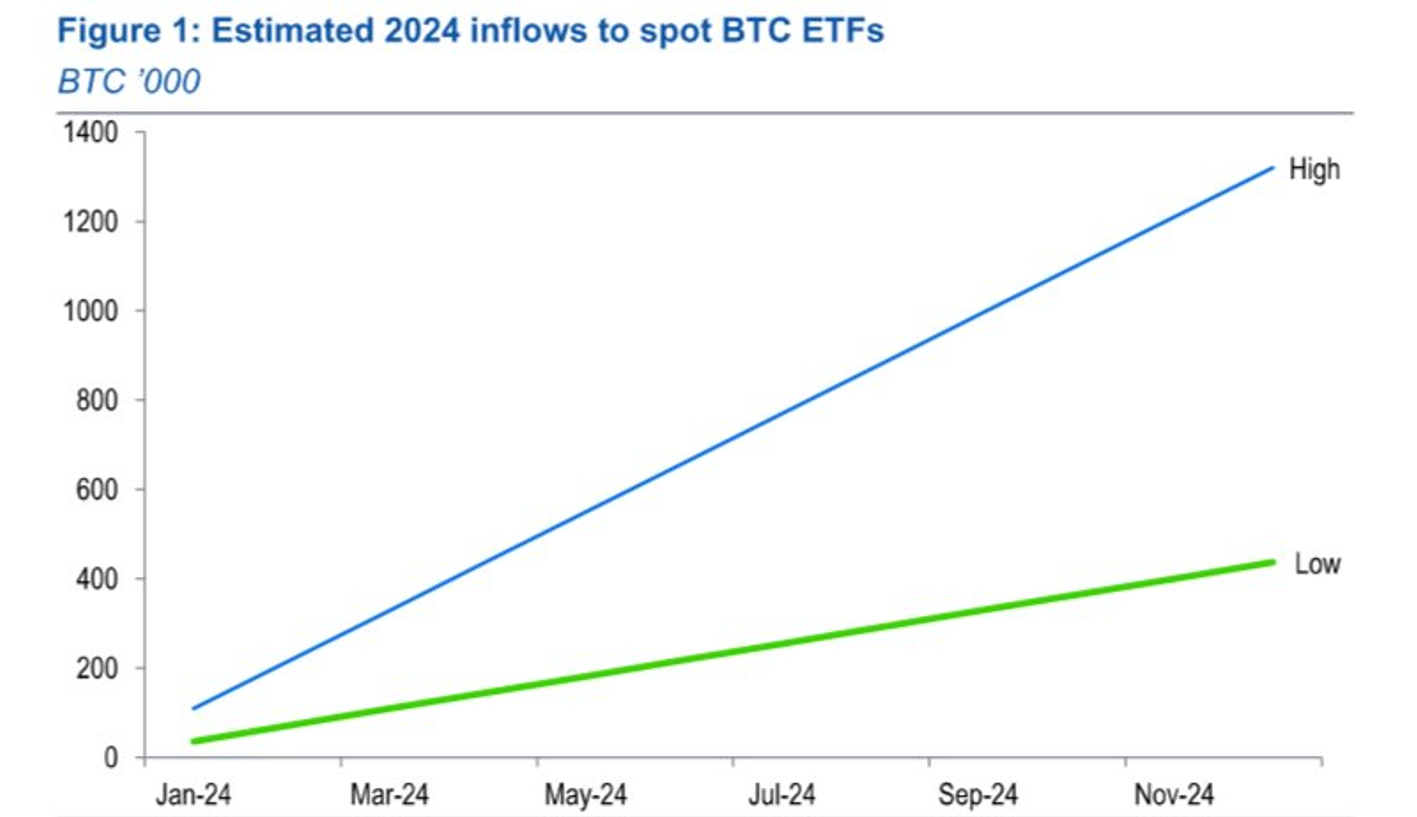

To achieve this, Standard Chartered anticipates that between 437,000 to 1.32 million new Bitcoins will be held in spot ETFs by the end of 2024. This would equate to 50-100 billion US dollars in terms of the US dollar.

Navigating the Bitcoin Landscape: Implications and Opportunities

The imminent approval of spot ETFs for Bitcoin is set to be a transformative phase in the cryptocurrency market, particularly in terms of increasing institutional participation. Standard Chartered’s forecasts point not only to significant potential price gains but also to an accelerated timeline for these gains to materialize.

The comparison with gold ETPs provides a historical perspective that illustrates the magnitude of growth Bitcoin could experience within a shorter timeframe.

As investors and market participants navigate this evolving environment, staying informed about regulatory developments and institutional trends becomes increasingly important. The potential approval of spot Bitcoin ETFs marks a significant milestone, unlocking new possibilities for the digital asset and shaping its trajectory in the coming years.

Türkçe

Türkçe Español

Español