Steno Research‘s latest report shows that the cryptocurrency market underestimates the impact of soon-to-be-approved spot Ethereum (ETH) exchange-traded funds (ETFs) in the US. According to Steno Research, these ETFs are expected to attract significant capital inflows, reaching a potential of $15 billion to $20 billion in their first year. This capital flow is expected despite potential exits from the Grayscale Ethereum Trust (ETHE). Mads Eberhardt, a senior analyst at Steno Research, believes these significant net inflows will increase ETH’s value in both dollar and Bitcoin (BTC) terms.

Price Could Rise to $6,500 With ETF Support

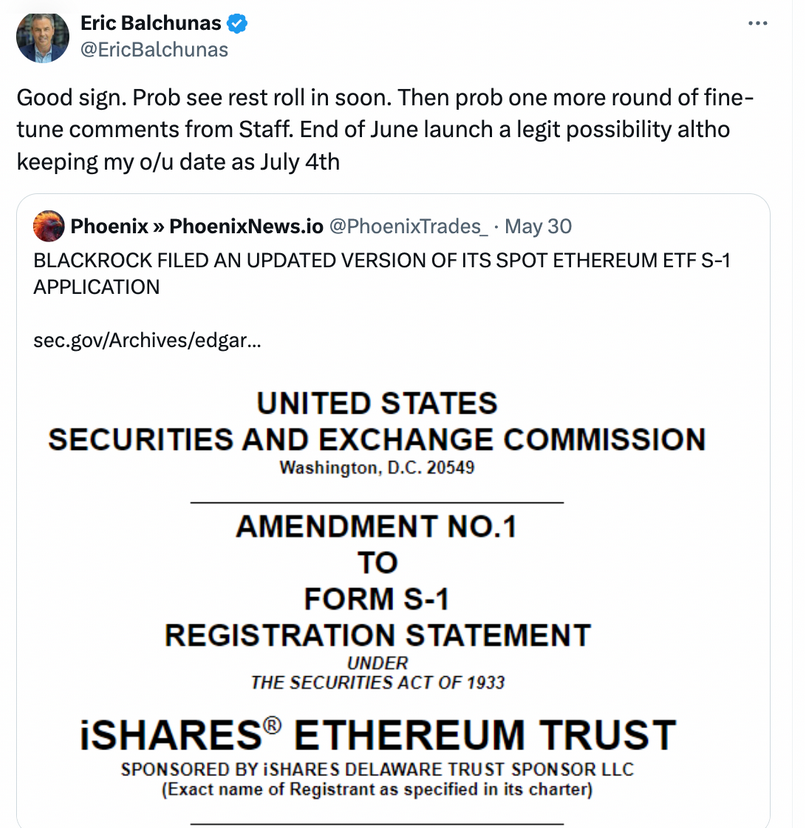

The report states that due to expected inflows into spot Ethereum ETFs and other positive factors, ETH’s price could climb to at least $6,500 by the end of this year. This optimistic forecast comes shortly after the US Securities and Exchange Commission (SEC) preliminarily approved ETF issuers’ applications, with these new financial products potentially becoming available as soon as next week.

Steno Research also predicts that if capital inflows meet expectations, the ETH/BTC ratio could rise to 0.065 later this year. The report notes that compared to spot Bitcoin ETFs, spot Ethereum ETFs will have a more pronounced impact on ETH due to smaller capital inflows, lower market value, and significantly weaker liquidity. This means that the inflows into spot Ethereum ETFs are more likely to exceed expectations rather than fall short.

Majority Not as Optimistic as Steno Research

On the other hand, most research firms, experts, and analysts are more conservative than Steno Research regarding spot Ethereum ETFs. Galaxy Research expects spot Ethereum ETFs to attract $5 billion in net inflows within the first five months. Similarly, Bitwise Asset Management forecasts $15 billion in net inflows for the ETFs within the first 18 months.

Despite these differing perspectives, Steno Research remains the most bullish on the potential impact of spot Ethereum ETFs.

Overall, the imminent launch of spot Ethereum ETFs represents a significant milestone for the cryptocurrency market. As institutional investors gain easier access to ETH through ETFs, the resulting capital inflows could lead to substantial price increases. This development is particularly critical as it highlights ETH’s growing appeal on Wall Street and its potential to outperform other cryptocurrencies in the short term.

Türkçe

Türkçe Español

Español