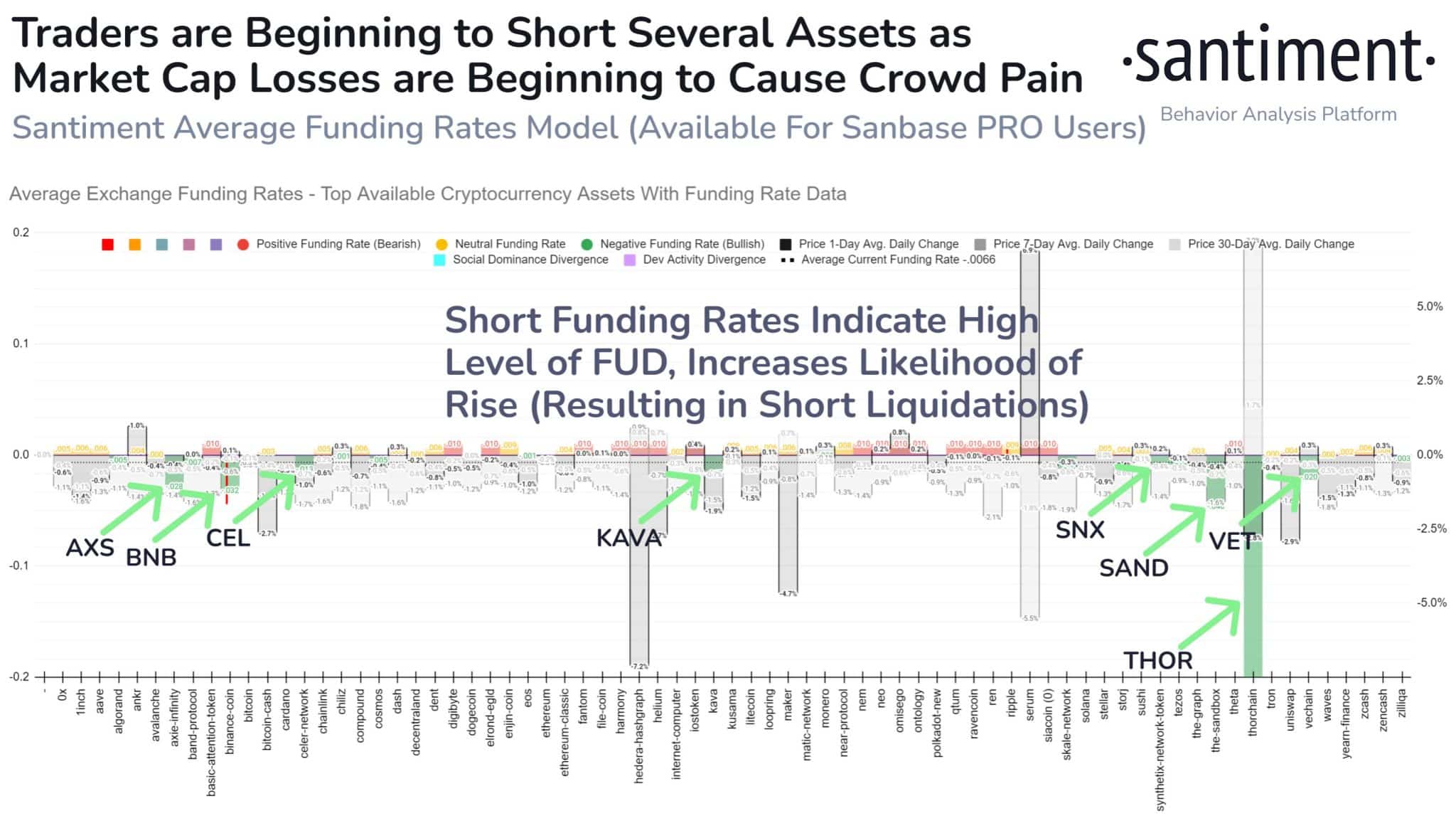

Last week, there were declines in most leading tokens in the cryptocurrency market. Some traders speculated that the downward trend would continue and opened short positions in the market. A recent post by Santiment showed that the dominant position in the cryptocurrency market was short. In response to falling prices, many investors seemed to adopt short positions in most tokens.

Stunning Report from Analytical Company!

Increasing short positions, clearly visible from the negative funding rate, can trigger Fear, Uncertainty, and Doubt (FUD) and lead to further liquidation. While these short positions reflect a pessimistic market sentiment, they can also serve as a precursor to an upward trend. This is because investors showing an upward trend can take advantage of the opportunity presented by price drops to initiate buying activity.

According to Coinglass data, the ongoing decline in cryptocurrency market prices resulted in less liquidation for short positions compared to long positions. Examining the liquidation table revealed significant liquidation activity for long positions on August 15 and 16. On August 15, long positions experienced liquidations exceeding $122 million, compared to approximately $9.5 million for short positions. Turning to August 16, long position liquidations reached $111 million, while short positions faced liquidation of approximately $15 million.

Current Situation of Bitcoin and Ethereum!

At the time of writing, long positions faced approximately $37 million in liquidation, while short positions reached around $6 million. Additionally, examining the long/short ratio of the best assets according to market value on Coinglass highlighted the prevalence of short positions.

The short position of Bitcoin exceeded $15 billion at the time of writing, aligning with total long positions surpassing $13 billion. For Ethereum (ETH), short positions were around $5.9 billion, while long positions were around $5.4 billion. Similarly, Ripple (XRP) and Binance Coin (BNB) also showcased significant figures. At the time of writing, XRP’s long and short positions exceeded $1 billion and $960 million, respectively.