Bitcoin price fluctuations continue, with the price lingering around $70,000. What’s the latest on the DOGE front? Something unseen in three years has occurred. What are the predictions for DOGE, the largest meme coin by market value? What should Dogecoin investors expect in the coming period?

Dogecoin (DOGE)

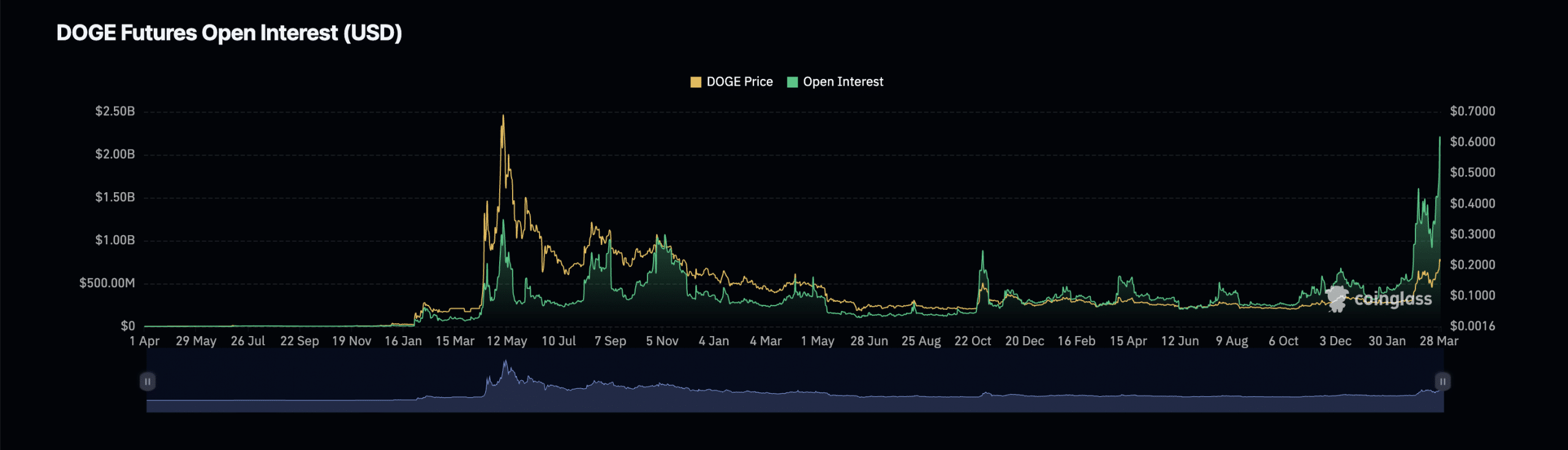

We are hours away from April, and the cryptocurrency markets experienced a positive March. Dogecoin saw even better days compared to the general market. The price challenged the $0.23 threshold. Today, there is a new development. According to Coinglass data, interest in Dogecoin futures has reached historic levels.

The Open Interest in Dogecoin futures has risen above $2 billion, on the verge of breaking all-time records. The peak in open positions, not seen in three years, is exciting. Since the beginning of March, open positions have increased by more than 100%. Now, investors with $2.21 billion in positions are anticipating that big move.

Dogecoin Predictions

The record levels of open positions reflect investor sentiment. The funding rate has remained positive since October 2023, indicating dominant bullish predictions. Despite the market downturn during the March 15-20 period, the strong demand for futures is a robust bullish signal.

Indeed, the price recently climbed to $0.23, showing its appetite for the $0.27 and $0.33 regions. While the price has dropped below $0.21 at the time of writing, the $0.20 threshold continues to hold.

Basic momentum indicators are above their respective neutral lines during writing, and the MACD supports a price increase. Although the RSI has retreated somewhat from the overbought zone, the MFI indicator remains positive. High volatility is expected in the coming hours as Bitcoin and altcoins close the March candles. If DOGE can maintain strength at $0.20, with the support of futures interest, it has the potential to initiate a strong move up to $0.33.

Moreover, optimism for April remains strong as Bitcoin continues to close above $69,000. Of course, no one can see the future, and even during the halving month, Bitcoin could see losses exceeding 30%. We have witnessed how historical data can trap investors during the last bear market.

Türkçe

Türkçe Español

Español