According to crypto asset data tracker CoinGecko, the United States witnessed a 641% growth in tokenized treasuries in 2023, with the participation of traditional finance companies. On March 21, CoinGecko published its 2024 report titled The Rise of Real World Assets in Crypto, highlighting the progress in the tokenization process of real-world assets (RWA).

US and RWA Market

CoinGecko reported that the value of tokenized treasuries increased from $114 million in January 2023 to $845 million by the end of the year. This indicates a 641% growth in blockchain-based crypto tokens representing US Treasury securities within a year.

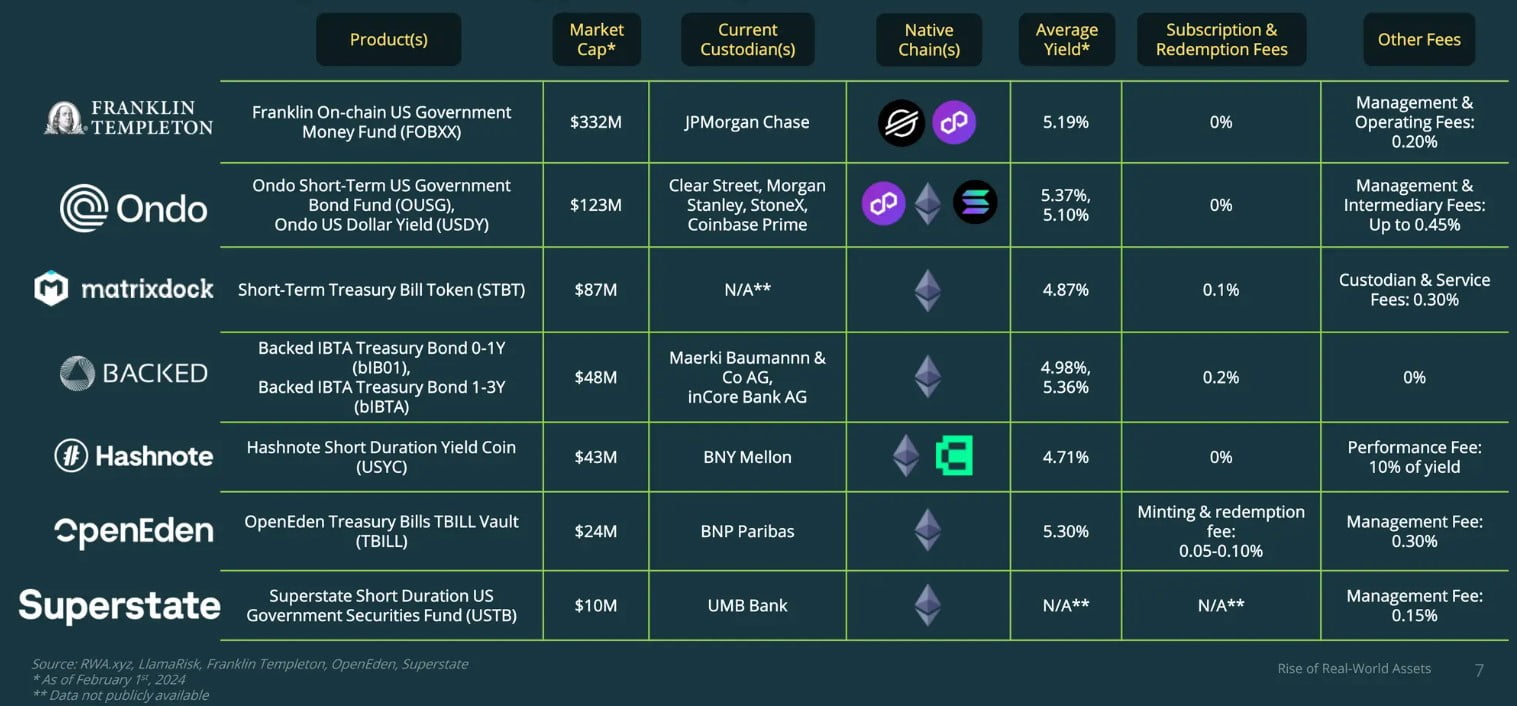

Tokenized securities stand out as crypto tokens backed by RWAs such as stocks and bonds. For example, the Ondo Short-Term US Government Bond Fund uses the OUSG token to represent ownership and yield of a share in the fund.

CoinGecko highlighted that asset management firm Franklin Templeton is currently the largest issuer of tokenized treasuries. The company issued tokens worth $332 million with its On-Chain U.S. Government Money Fund, controlling 38.6% of the market.

Franklin Templeton was one of the ten exchange-traded fund (ETF) issuers that launched a spot Bitcoin ETF fund in the US in January. It also applied to the US Securities and Exchange Commission (SEC) on February 12 for a Franklin Ethereum ETF fund, entering the race to launch an Ethereum ETF fund.

In addition to Franklin Templeton, other protocols including yield-bearing stablecoin projects backed by US Treasury bills are gaining popularity. The CoinGecko report emphasized that Mountain Protocol’s USDM tokens rose from $26,000 to $154 million since their launch in September 2023.

Notable Data on the Industry

Tokenized US treasuries are mostly based on the Ethereum network. The report by CoinGecko noted that 57.5% of the tokens were on Ethereum. Meanwhile, companies like Franklin Templeton and WisdomTree Prime issued tokenized securities on Stellar, contributing 39% to the network’s market.

While tokenized treasury bonds gained momentum in 2023, growth slowed down in 2024. In January 2024, tokenized treasury bonds grew by only 1.9%. As of February 1, their market value was recorded at $861 million.

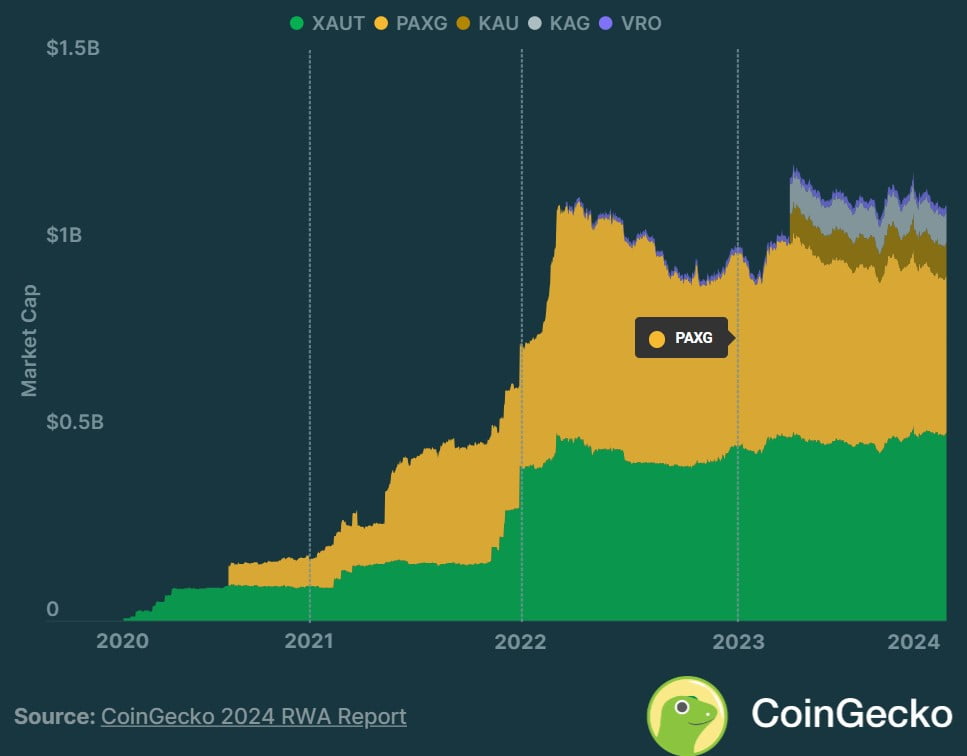

CoinGecko also emphasized that in addition to tokenized treasuries, commodity-backed tokens reached a market value of $1.1 billion as of February 1. Tether Gold (XAUT) and PAX Gold (PAXG) hold 83% of the market value for tokenized precious metals.

Türkçe

Türkçe Español

Español