Cryptocurrency venture capital financing saw a 52.5% increase in March compared to the previous month. Accordingly, cryptocurrency projects, primarily in infrastructure and decentralized finance (DeFi), received investments totaling $1.16 billion. Let’s look at the details.

USA Continues to Lead in Investment

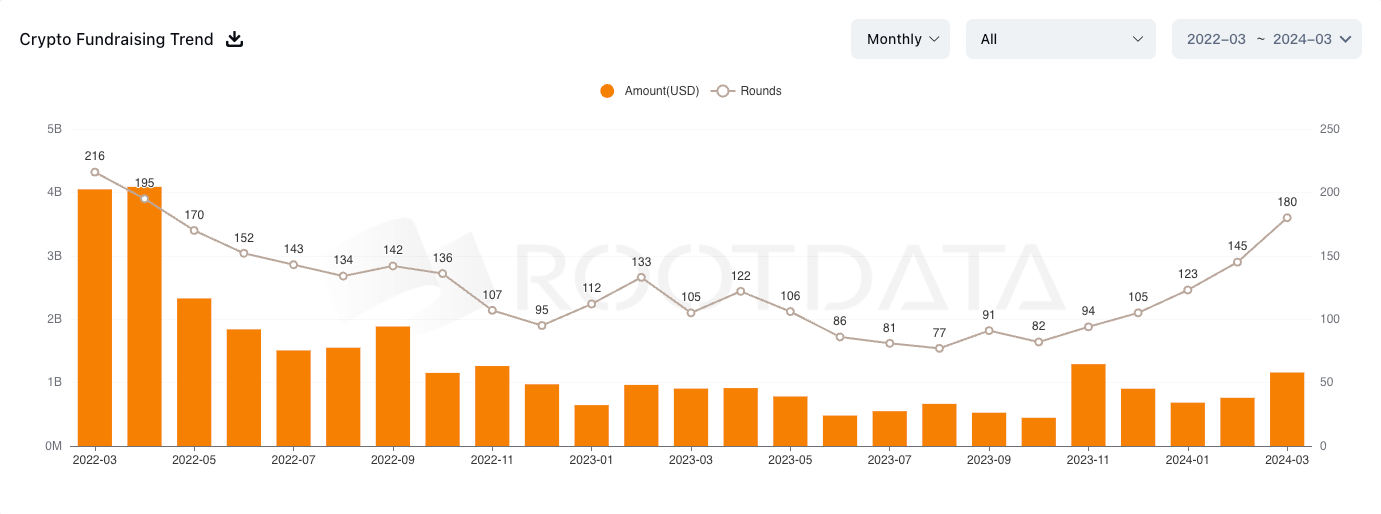

According to RootData figures, the 180 investments announced last month reached the highest monthly investment figure since April 2022. While one-fifth of the projects raised funds between $1 million and $3 million, just over 15% collected between $5 million and $10 million. The majority of the financed projects are located in the United States.

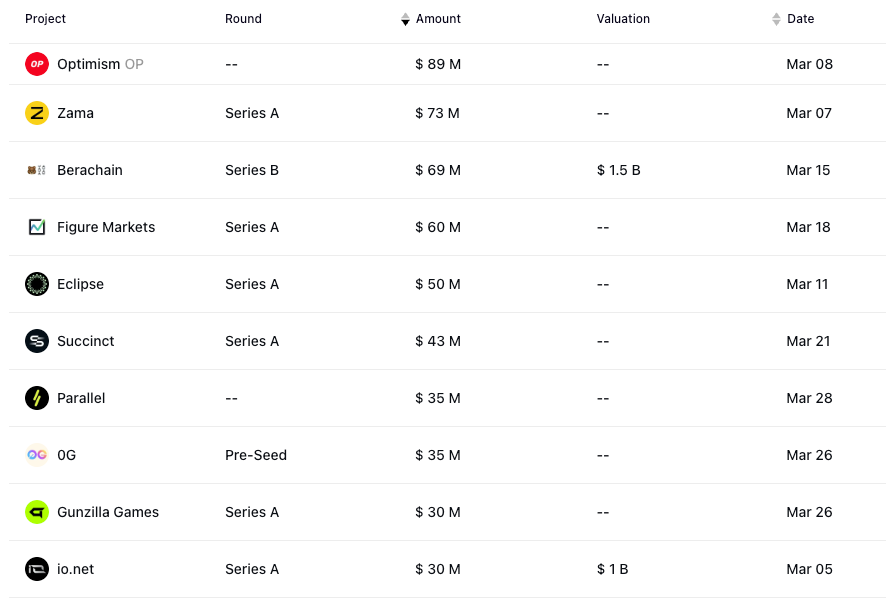

Ethereum  $2,460 Layer-2 Blockchain Optimism secured the largest investment income of the month by selling tokens worth $89 million in a private deal. Cryptography startup Zama followed with a $73 million Series A round.

$2,460 Layer-2 Blockchain Optimism secured the largest investment income of the month by selling tokens worth $89 million in a private deal. Cryptography startup Zama followed with a $73 million Series A round.

While the number of monthly deals increased by 25% compared to February and by over 70% compared to the previous year, the total amount raised also increased by 28% compared to March 2023.

Emerging Focus Areas in Crypto

VC firms recently hinted at their focus areas for crypto in the coming year. Andreessen Horowitz (a16z) set aside $30 million on April 1st for a fund focusing on Web3 games.

Last week, a16z co-founder Marc Andreessen and Galaxy Digital were among the top contributors to VC firm 1kx’s $75 million fund targeting crypto-based consumer applications. In February, Hack VC raised $150 million to finance early-stage crypto and artificial intelligence ventures.

Support for Infrastructure Projects

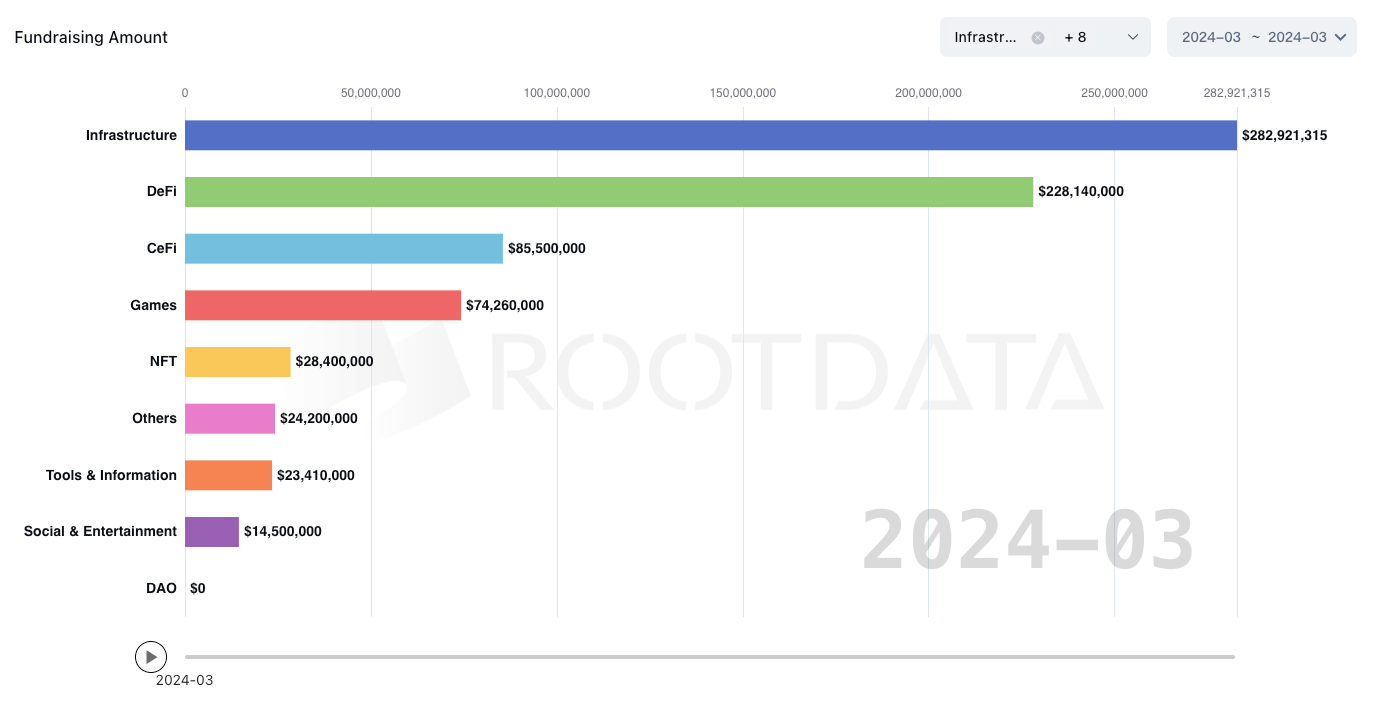

Infrastructure projects were the most funded in March, receiving about a quarter of the total $1.16 billion VC fund, which equates to approximately $283 million.

Decentralized finance (DeFi) projects accounted for nearly 20% of the total with $228.1 million in funding, while centralized finance (CeFi) projects like exchanges saw the third-highest funding at $85.5 million. No funds were raised in the DAO category.

Last month’s funding marked the first time since November that VC funding in the sector surpassed $1 billion. This milestone, following the collapse of FTX in late 2022 and its profound impact on the cryptocurrency market, indicates a revitalization of the sector.

Türkçe

Türkçe Español

Español