Toncoin’s value declined after Telegram CEO Pavel Durov’s arrest on August 24. Currently trading at $5.38, TON experienced a 9% drop in price. Despite sales and profit-taking, a significant on-chain data provided a buy signal hinting at a possible recovery. Analyzed through various moving averages, Toncoin’s (TON) MVRV ratios suggest it might be a strategic time to buy the altcoin.

What’s Happening with Toncoin?

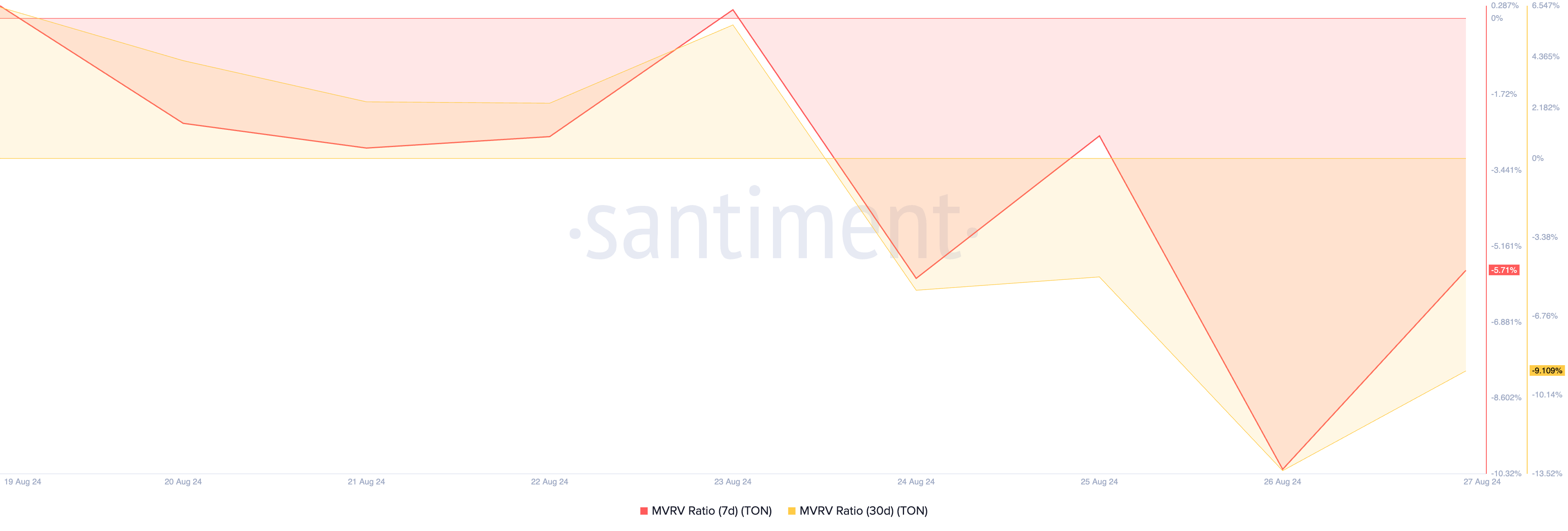

Data from Santiment shows the token’s 7-day and 30-day MVRV ratios are currently -5.71% and -9.10%, respectively. The MVRV data compares an asset’s current market price to the average price of its circulating tokens. An MVRV ratio below zero indicates undervaluation, meaning the asset is trading below the average acquisition cost of its circulating tokens.

Historically, a negative MVRV ratio signals a buying opportunity, allowing market participants to purchase assets at a lower price with the expectation of selling them later at a higher value. Additionally, TON’s futures market shows resilience despite recent challenges.

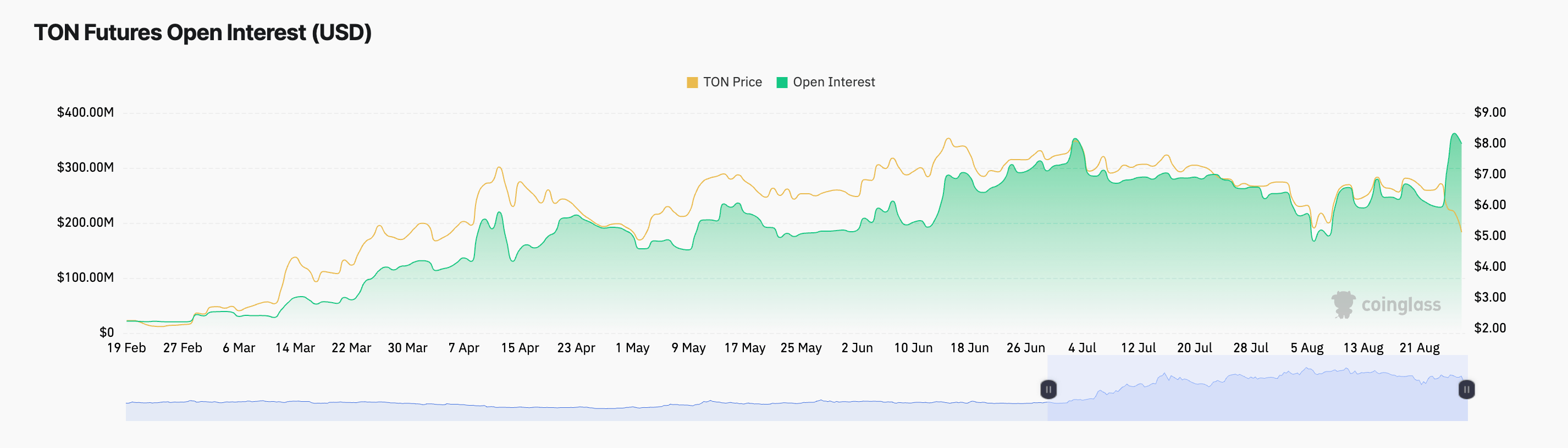

Rising futures open interest and positive funding rates on exchanges reflect stable confidence among investors. Currently, TON’s futures open interest has increased by 46% since Durov’s arrest, reaching $345 million. Futures open interest measures the number of ongoing contracts, and the increase indicates growing participation from investors opening new positions.

TON Chart Analysis

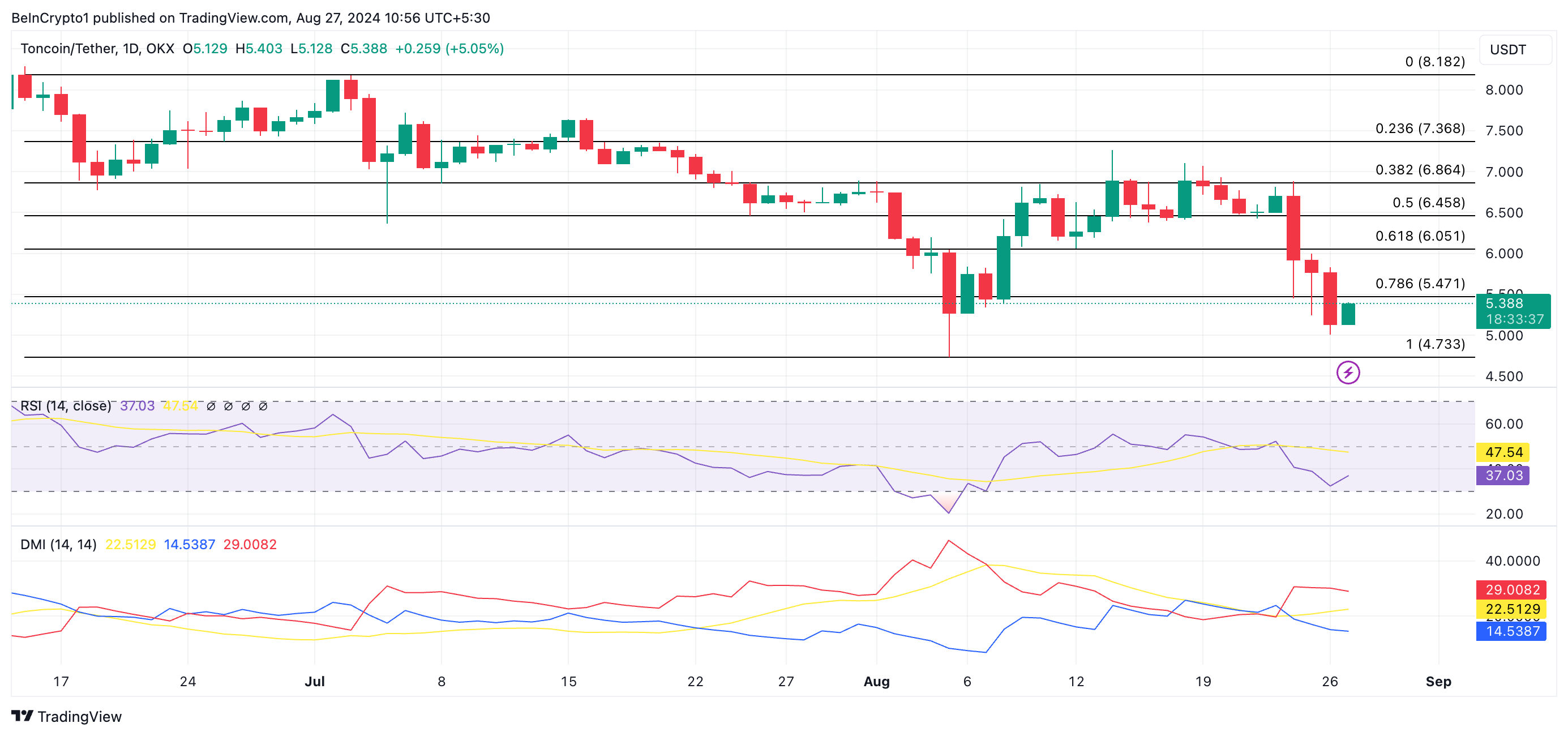

TON’s spot investors have become increasingly bearish since Durov’s arrest. The token’s technical indicators highlight an increase in selling pressure, overshadowing buying activity. For instance, TON’s Directional Movement Index (DMI) shows the positive directional indicator (+DI) below the negative directional indicator (-DI), indicating a strong downtrend and intensified selling pressure.

Additionally, the token’s Relative Strength Index (RSI) emphasizes the downward momentum. Since the arrest, TON’s RSI data has dropped from a neutral 50 to 36.98, approaching the oversold region, indicating increased selling activity. If the selling pressure continues, TON’s value could drop to $4.73. Conversely, a bullish trend could push the price to $5.47.

Türkçe

Türkçe Español

Español