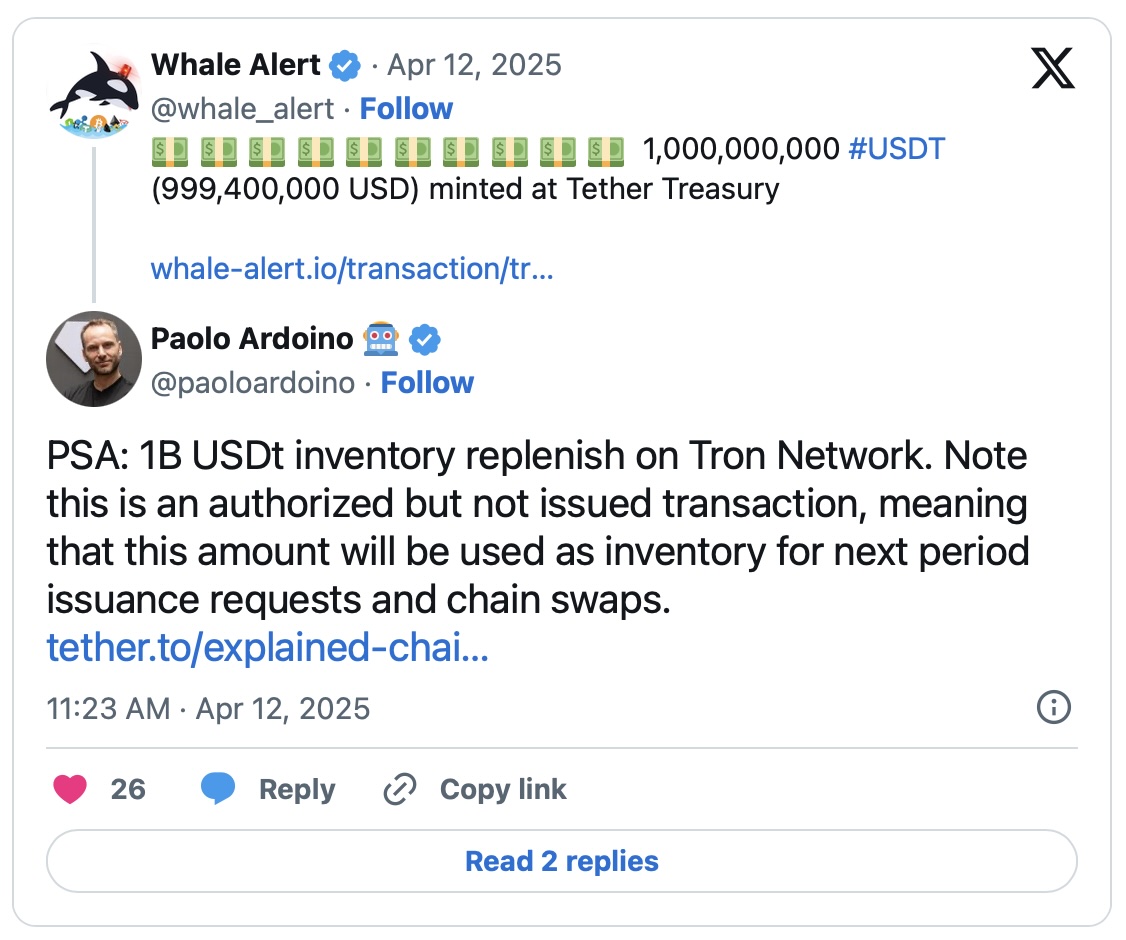

Tether, a leading stablecoin provider in the cryptocurrency market, has minted 1 billion USDT valued at $1 billion on the Tron network. This development is seen as a response to the rising demand for stablecoins, interpreted as a significant move to increase liquidity in the market. Tether’s CTO, Paolo Ardoino, clarified that this USDT minting is aimed at “inventory replenish.” Such operations are planned in advance to meet the future USDT needs of exchanges and institutions.

Stablecoin Demand Surges Again

Recently, there has been a notable increase in trading volumes in the cryptocurrency market. The resurgence of major cryptocurrencies like Bitcoin  $91,967 and Ethereum

$91,967 and Ethereum  $3,139 prompts users to rely on stablecoins, which are viewed as safe havens. Particularly, USDT continues to be one of the top choices for investors due to its rapid transaction capabilities and market value. Tether’s recent USDT minting is a direct result of the closely monitored market activity.

$3,139 prompts users to rely on stablecoins, which are viewed as safe havens. Particularly, USDT continues to be one of the top choices for investors due to its rapid transaction capabilities and market value. Tether’s recent USDT minting is a direct result of the closely monitored market activity.

However, macro factors such as the Federal Reserve’s monetary policy and global economic outlook introduce uncertainties in the cryptocurrency market. Investors often employ risk-averse strategies during these volatile times, shifting their positions to stablecoins. Thus, the demand for USDT is linked not only to market fluctuations or bullish trends but also to the search for safety during uncertain periods.

Tether’s Role in Market Liquidity and the Tron Network

Currently, Tether holds the position of the largest stablecoin by market capitalization. While the company operates on various blockchain networks like Ethereum, Solana  $143, and Avalanche, the recent significant USDT mints on the Tron network have drawn attention. The Tron network offers low transaction fees and fast approval times, making it an attractive platform for large stablecoin transfers. This explains Tether’s strategic preference for the Tron network.

$143, and Avalanche, the recent significant USDT mints on the Tron network have drawn attention. The Tron network offers low transaction fees and fast approval times, making it an attractive platform for large stablecoin transfers. This explains Tether’s strategic preference for the Tron network.

In a statement on X, Tether’s CTO Ardoino mentioned that the newly minted USDT is held as “stock” before being transferred to exchanges. This means that the coins minted today do not directly enter circulation, indicating they will only be utilized when demand arises. By anticipating the needs of users and institutions, Tether aims to prevent liquidity crises in the market.