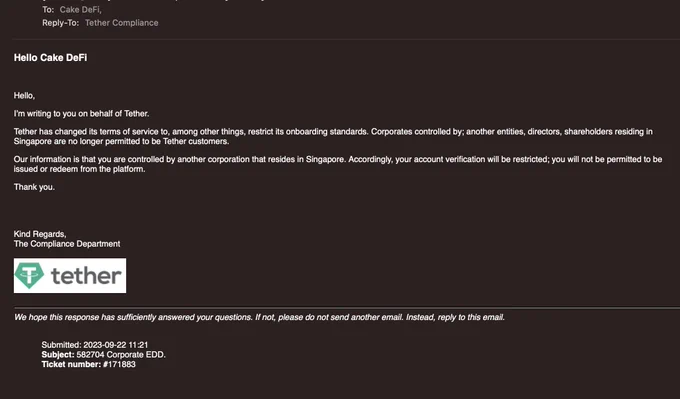

Tether (USDT) has made significant changes to its Terms of Service (ToS) in Singapore. Julian Hosp, the CEO of Cake DeFi, a decentralized finance (DeFi) protocol, shared an email he received from Tether on September 25th, revealing the changes. The email showed that Tether has banned certain customer segments from using USDT in exchange for US dollars.

Critical Changes in Tether!

The message from Tether stated that the sudden policy change was due to changes in the Terms of Service. The email created uncertainty for Cake DeFi regarding whether they can still convert USDT to US dollars because they are a Singapore-based organization. Furthermore, the critical changes in Tether’s Terms of Service revolved around tightened participation standards. The updated terms included the following statement:

Companies controlled by another organization, managers, and shareholders residing in Singapore are no longer allowed to be Tether customers.

This newly regulated clause may imply that Cake DeFi falls under the category of being controlled by another company in Singapore. Therefore, they will no longer be able to issue or use USDT through the platform. This situation has raised suspicion in the cryptocurrency community, especially due to the uncertainty surrounding the term “controlled by another entity.”

Statement from Tether Officials!

However, Paolo Ardoino, the Chief Technology Officer of Tether, stepped in to clarify the situation. He categorically denied the speculation surrounding the email as FUD. Ardoino claimed that the policy change has actually been in effect since 2020. However, Tether avoided giving a clear answer as to why Cake DeFi received this notification in early September.

This unexpected change in Tether’s Terms of Service took place against the backdrop of a major cryptocurrency money laundering scandal in Singapore. The seized assets from the crackdown have reached $1.7 billion. The timing and motivations behind Tether’s policy change remain uncertain.

Some analysts from the crypto community suggested that the changes in USDT payment terms could be specific to Cake DeFi. This theory suggests that the advanced due diligence (EDD) measures of the DeFi protocol may have been triggered, indicating a potential partnership issue between the two companies.

Türkçe

Türkçe Español

Español