Tether, the most valuable stablecoin in the cryptocurrency market, announced in December 2022 that it would gradually reduce the Tether credits it gives against customer collateral to zero. However, despite this announcement, the company continued to provide stablecoin credits and the size of the credits increased significantly. Tether is experiencing one of its most profitable periods by increasing its credit amount and increasing its market dominance.

Tether to End Credits in 2024

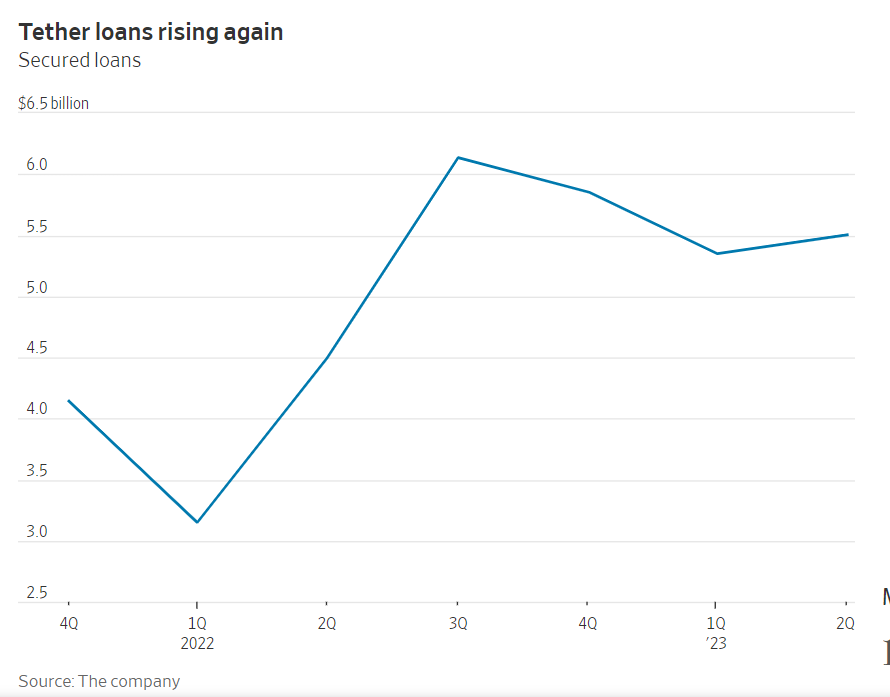

In its quarterly report released in June, Tether created $5.3 billion in credits for its customers. In the latest quarterly report, the company’s credit amount offered to customers was $5.5 billion. A Tether official claimed in an interview with the Wall Street Journal (WSJ) that this increase in credit has led to long-term relationships. The official added that this credit system will end by 2024.

This credit method is a service frequently offered by Tether to its customers, allowing customers to borrow USDT from the company against a certain amount of collateral. However, these collateralized loans have caused many discussions due to the lack of transparency regarding collateral and borrowers.

A report published by WSJ in December 2022 raised concerns about these loans. The reason was the allegation that the loans were taken with insufficient collateral. The WSJ, which published the report, questioned what Tether would do in a possible crisis, attracting the attention of many.

Tether Responds to Allegations

Before Tether announced its plans regarding the credit service, it exercised its right to respond to the report published in 2022. The company defended that it took significant collateral in credit agreements and argued that the criticisms about the company were “FUD.”

The issue of increasing Tether’s credit amount was raised at a time when the market dominance was increasing, and the company was experiencing one of its most profitable periods. Tether reported reserves of $3.3 billion in September, compared to only $250 million in reserves reported in 2022. In addition to all this, Tether also published a response claiming that these concerns were unfounded following the publication of the WSJ article:

“Tether has an excess of $3.3 billion in equity and as a company that is on track to make $4 billion in annual profit, it balances all the effects of collateralized loans and keeps such profits on its balance sheet. Tether is still determined to remove collateralized loans from its reserves.”

Türkçe

Türkçe Español

Español