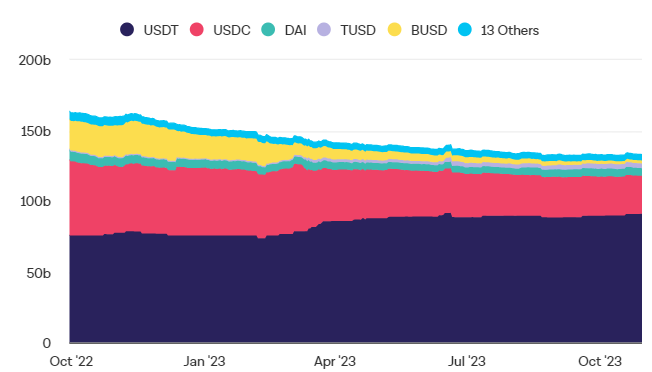

Crypto markets are highly volatile and it is considered positive that the markets have not been shaken before the Fed. As of the time this article is prepared, Bitcoin is being bought at $34,336 and volumes are starting to recover. Today, Tether reserves have also been announced. As the largest stablecoin, Tether always finds a place in the agenda during critical periods.

Tether (USDT) Reserves

Stablecoin issuer Tether has released its reserve report for the third quarter. We will see one more report from the company before implementing the live reserve application next year. According to the reserve attestation report, Tether has the largest cash and cash equivalent asset size to date, accounting for 85.7% of the reserve.

The majority of the reserves are invested in US Treasury bonds directly and indirectly. Paolo Ardoino, the new CEO of the company with $72.6 billion worth of bonds, said the following;

“We have reached the highest percentage of reserves held in cash and cash equivalent assets to date, demonstrating our commitment to maintaining liquidity and stability in the stablecoin ecosystem.”

The company also holds $1.7 billion worth of BTC and $3.1 billion worth of gold. The reserve surplus is $3.2 billion. Tether’s USDT accounts for 68.4% of the total stablecoin supply, with $91.1 billion.

Türkçe

Türkçe Español

Español