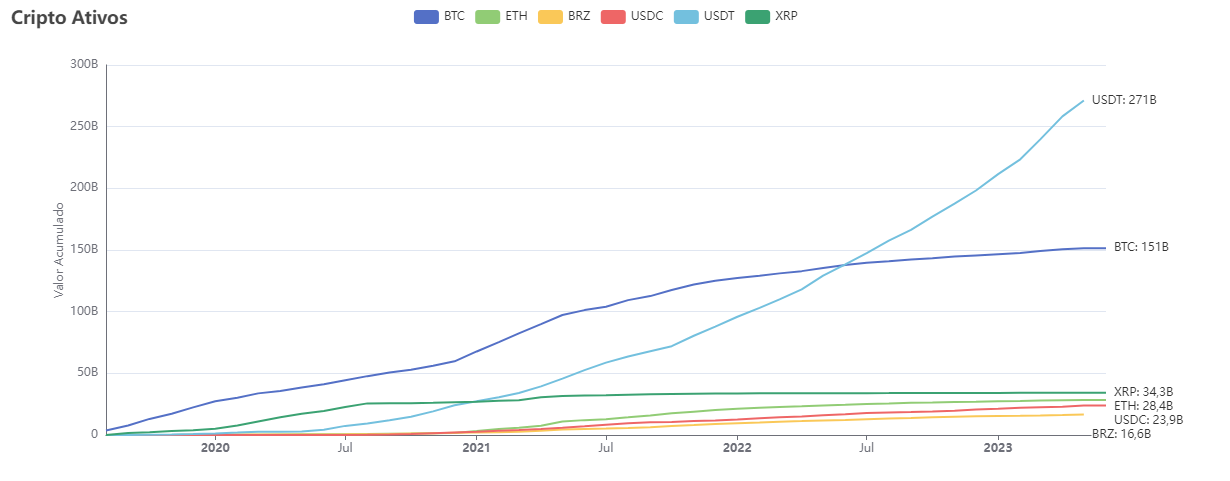

The issuer of the largest stablecoin, USDT, Tether’s adoption continues to grow. According to data provided by Brazil’s revenue services agency, the adoption of Tether’s USDT showed a significant increase in Brazil and accounted for 80% of cryptocurrency transactions in the country.

USDT’s Transaction Volume Almost Doubles Bitcoin

As of mid-October of this year, USDT transactions in Brazil reached 271 billion Brazilian reais (approximately 55 billion dollars), almost doubling Bitcoin‘s transaction volume. The transaction volume of Bitcoin in the country was recorded as 151 billion reais (approximately 30 billion dollars). Stablecoins are designed to have a stable value, typically pegged to fiat currencies such as the US dollar and the Brazilian real.

USDT transactions have been on the rise in Brazil since 2021, but it surpassed Bitcoin’s transaction volume for the first time in July 2022, during the period when crypto lending companies Three Arrows Capital and Voyager Capital collapsed.

Furthermore, data from Brazil’s revenue services agency shows that the crypto winter resulted in a 25% decrease in the country’s cryptocurrency transaction volume in 2022, dropping to 154.4 billion Brazilian reais or approximately 31 billion dollars. The Brazilian tax authority monitors citizens’ activities related to cryptocurrencies using a sophisticated system based on artificial intelligence and network analysis. According to a blog post published by the agency, the system can detect suspicious activities and track the locations of individuals engaged in cryptocurrency trading.

Details of the Crypto Tax Implemented in Brazil

The revenue agency also targets cryptocurrency investments held by Brazilian citizens abroad. The Brazilian Congress approved a law on October 25 that recognizes cryptocurrencies as “financial assets” for tax purposes in foreign investments. Gains between 6,000 and 50,000 Brazilian reais (approximately 10,000 dollars) earned abroad will be subject to a 15% tax rate starting from January 2024. Above this threshold, a tax rate of 22.5% will be applied.

Since 2019, cryptocurrency exchanges operating in Brazil have been required to share all user transactions with the government. Capital gains derived from monthly cryptocurrency sales exceeding 35,000 Brazilian reais (approximately 7,000 dollars) are subject to a progressive tax rate ranging from 15% to 22.5%.

Currently, local players such as Mercado Bitcoin and Foxbit, as well as global cryptocurrency exchanges like Coinbase, Binance, Bitso, and Crypto.com, are operating in Brazil.