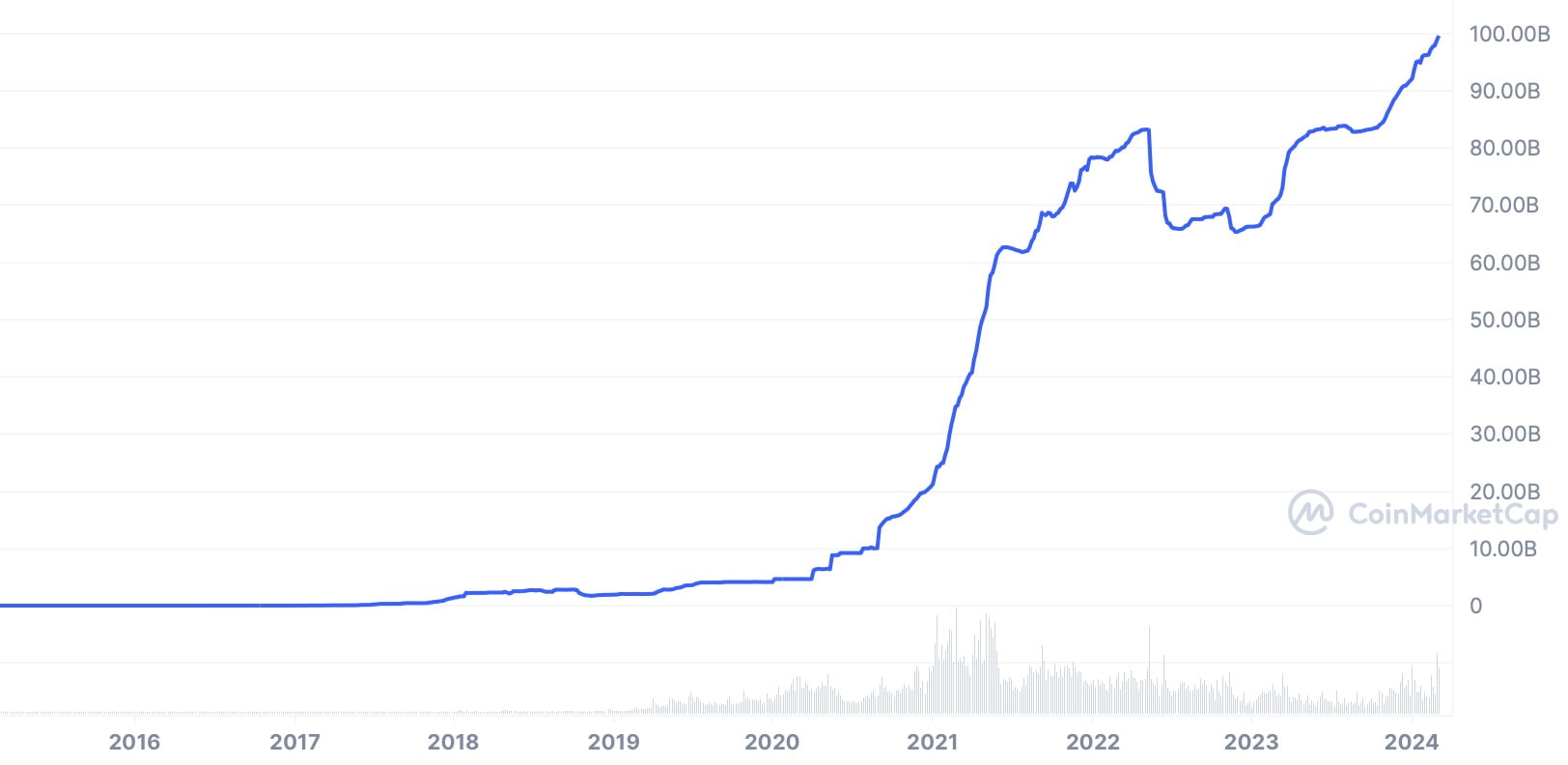

The world’s largest stablecoin, Tether‘s USDT, has approached a supply of 100 billion, reaching an all-time high of approximately 99.5 billion units. This marks a significant milestone for USDT.

Supply Nears 100 Billion Mark

The total market value of the stablecoin, calculated by multiplying the supply by the price, exceeded $100 billion at one point, despite occasional sharp price movements. Tether, which claims that each USDT is pegged at a 1:1 ratio with the US dollar, believes that the supply of USDT has increased this year in parallel with the rise in Bitcoin (BTC) and altcoins.

The increase in USDT’s supply is associated with various factors, including the launch of spot Bitcoin exchange-traded funds (ETFs) in the US. While ETFs contribute to overall market growth, stablecoins like USDT continue to play a significant role in facilitating trade and liquidity. According to CoinMarketCap, Tether’s market value was $91.69 billion at the beginning of the year and has since experienced notable growth.

The continued increase in the supply of Tether’s USDT has further strengthened its position as the market’s leading stablecoin, significantly widening the gap with competitors such as Circle’s USD Coin (USDC), which currently has a circulation supply of 28.9 billion. This dominance underscores Tether’s importance in the crypto world and serves as a vital tool for traders and investors seeking stability amid market fluctuations.

Tether Reports $2.9 Billion in Net Profit

The growth in USDT’s supply has translated into record profits for the company behind it. Tether announced a record net profit of $2.9 billion for the last quarter of the previous year, with a significant portion of the profit attributed to the appreciation of the company’s US Treasury bonds, Bitcoin, and gold assets, according to the attestation report. This significant profit is part of Tether’s strong performance of its core assets and its ability to generate substantial returns for stakeholders.

Despite its significant achievements, Tether has faced regulatory scrutiny and hurdles, particularly concerning reserve holdings and transparency. This remains a limiting factor for USDT’s growth, albeit a limited one.

Türkçe

Türkçe Español

Español