2023 was an extremely busy period, and this week we are publishing many year-end summary articles. They cover various topics. For example, over 160 significant developments throughout the year or the cryptocurrencies that showed the most growth among the top 200. You will see that year-end summaries on almost every topic are being published this week. You can access them from the search section.

Cryptocurrencies and Banks

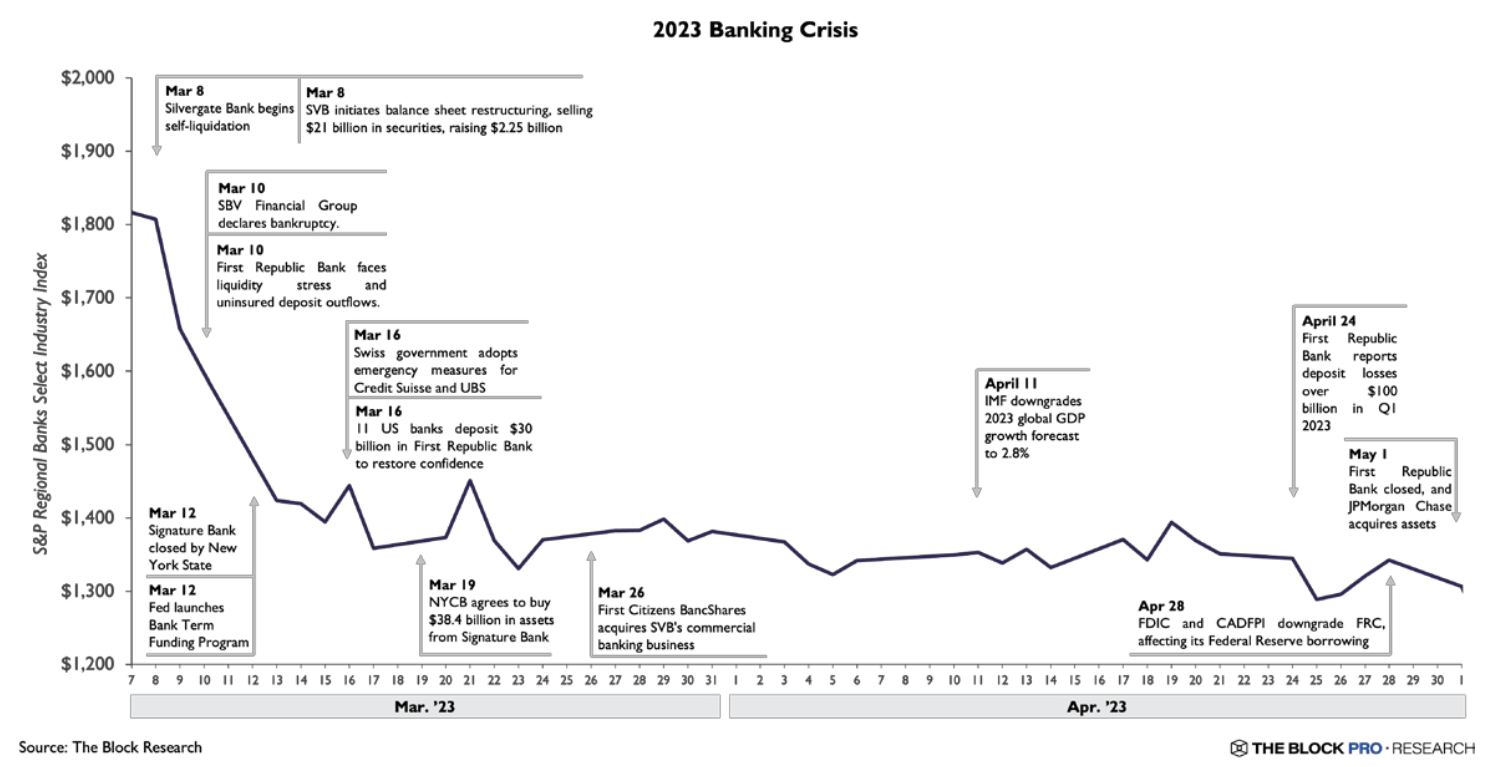

The 2023 Banking Crisis rapidly unfolded over a few days in March, leading to the shuttering of many banks. At the heart of this crisis were the collapses of Silicon Valley Bank, Silvergate Bank, Signature Bank, and First Republic Bank, which, along with the prominence of crypto businesses, impacted the markets. For those who don’t remember, banks had to apply discounts on the sale of bonds they had stockpiled in the past due to the Fed‘s excessively rapid interest rate hikes. These banks failed to adjust their risks properly, and when customers wanted to withdraw their money, those who were last could not succeed because the discounted bond sales had resulted in significant losses.

The Fed resolved the issue by opening the liquidity window, supporting banks, and guaranteeing amounts over $250,000. Although the March crisis was a major peak, the cryptocurrency warning issued by the Federal Reserve Board, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency was quite shocking.

In their joint assessments, institutions that touched on the risks of crypto assets for Banking Institutions advised banks not to enter this area.

Silvergate and Signature were the two banks most closely connected to the crypto sector. When we examine the details of their collapses in depth, a narrative emerges that highlights the delicate balance between innovation and stability in the intertwining of traditional finance and the crypto world. At that time, while USDC survived many crypto bankruptcies, it was going bankrupt because it held reserves in the bank. This was the most amusing joke of the year.

Current State of Crypto and Banking

The biggest crypto supporter banks are now gone, so how are US citizens overcoming this problem? The promises of Silvergate’s SEN and Signature Bank’s Signet in the cryptocurrency ecosystem were significant. US-based crypto companies relied heavily on these two networks for financial traffic between banks and crypto. The sudden disappearance of these networks disrupted operational flows and created greater difficulties in accessing liquidity, putting more pressure on an already shaken sector.

Although BCB Group’s Blinc and other emerging networks offer some hope, they currently lack the extensive customer base that these networks had.

Pennsylvania-based Customers Bancorp has actively embraced the crypto market. By launching a real-time payment platform similar to the now-defunct networks of SEN and Signet, it has attracted significant clients from the crypto world, such as USDC, Coinbase, and Bitstamp US’s primary issuer Circle.

Cross River Bank in New Jersey also serves Circle and Coinbase as a client. Lastly, Western Alliance Bancorp and Axos Financial have also stepped up to meet the needs of the crypto industry. So, the world hasn’t ended, life goes on.