The Bitcoin (BTC) price has surged beyond $97,000 following the opening of U.S. markets, reaching levels unseen since November. A decision by the Supreme Court regarding tariffs, anticipated today, has now been deferred to the following week. While it remains uncertain if a decision will be announced next week, White House expectations for a January announcement hint at imminent news. What, then, are the implications of the Federal Reserve’s announcements?

The Federal Reserve’s Announcements

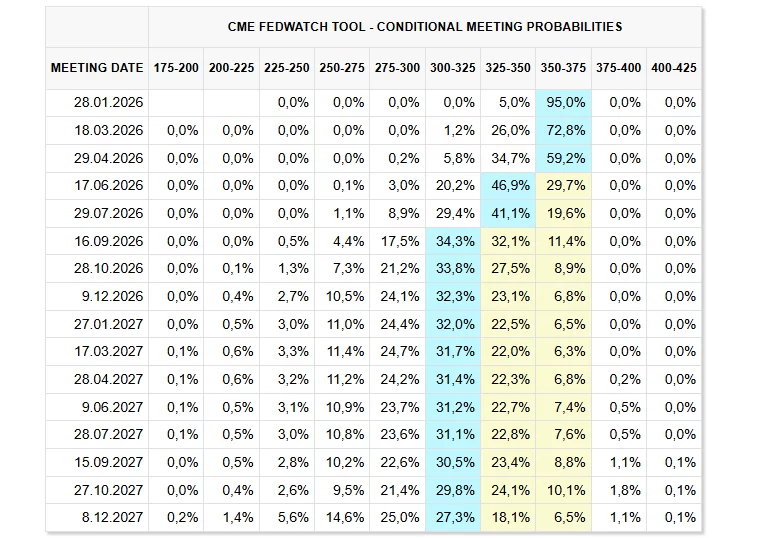

Miran, a key Federal Reserve member and representative of Trump at the Fed, made significant announcements recently. Miran advocates for lowering interest rates and consistently discusses “the necessity of such reductions.” After last week’s strong employment figures, it has become clear that the Fed will not opt for a rate cut in its January decision.

Highlights from Miran’s statements include:

Deregulation should exert downward pressure on prices, offering another reason for us. The central bank is expected to reduce interest rates.

Deregulation introduces a positive supply and productivity shock, enhancing the economy’s capacity while alleviating price pressures.

If central banks do not counteract the effects of deregulation, policy becomes overly restrictive, unnecessarily inhibiting growth. About 30% of regulations could be lifted by 2030, potentially decreasing inflation by half a point annually. Last year’s deregulation was considerable and is expected to continue.”

Trump asserted that tariffs, deregulation, and immigration policy would lower inflation. Despite opposing Producer Price Index results today, if inflation remains below 3% in the coming period, the Fed could feel more at ease, drawing interest rates to a more neutral level.

However, at least in the short term, Miran’s thesis is unlikely to convince a majority of Fed members of the need for rate cuts, meaning the pace of rate reductions will remain slow.