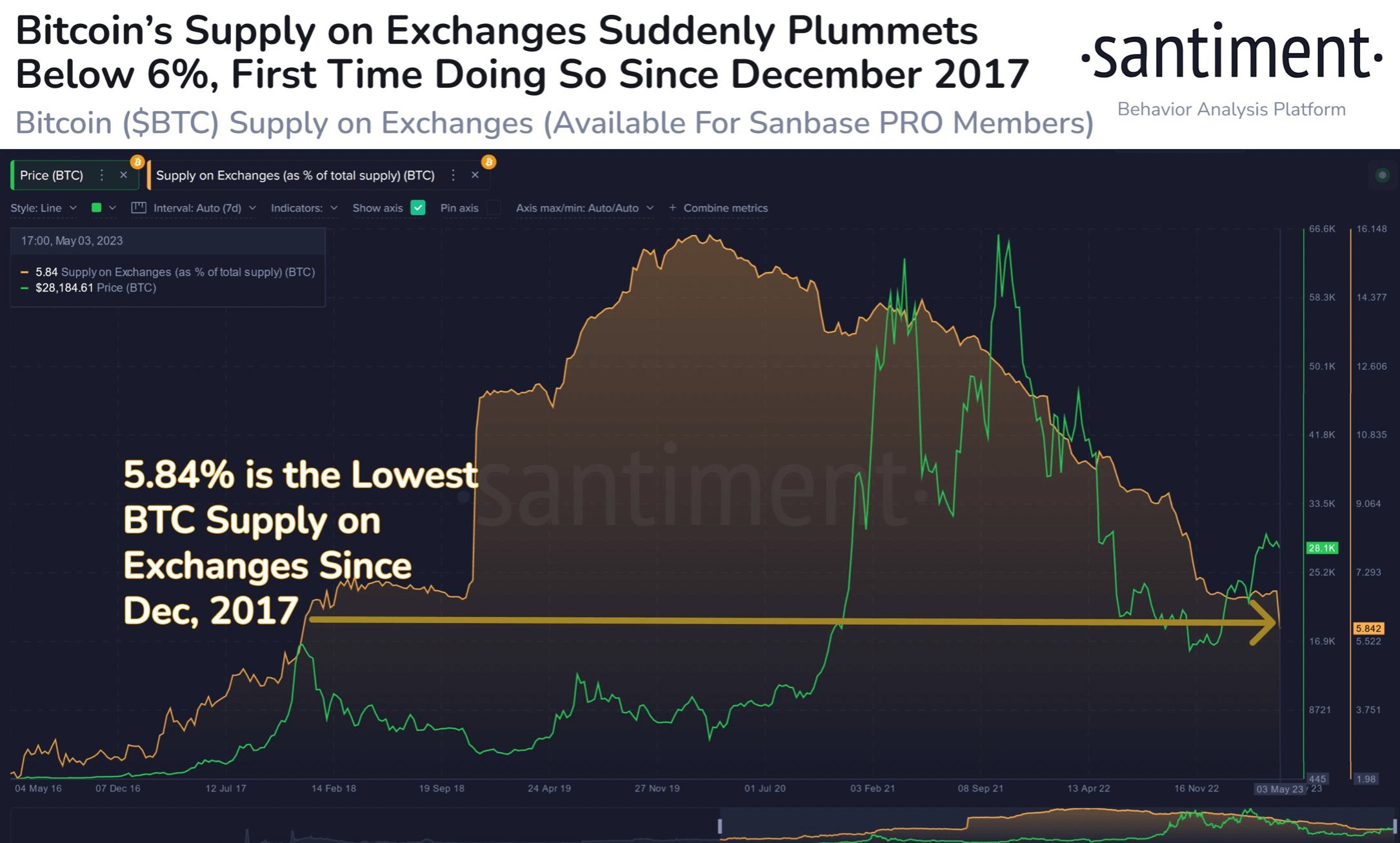

Crypto analysis platform Santiment pointed to the decline in the critical metric with a post on its Twitter account. According to data shared by Santiment, the amount of BTC on cryptocurrency exchanges has fallen to its lowest levels since December 2017. BTC supply on exchanges is at 5.84%.

BTC Supply on Exchanges at the Lowest Levels in the Last 5 and a Half Years

While the uncertainty of direction and high volatility in the cryptocurrency market continues, crypto analysis platform Santiment also pointed to the decline in the critical metric with a post on its Twitter account. According to data shared by crypto analytics platform Santiment, BTC supply on cryptocurrency exchanges fell by 5.84%, the lowest levels recorded since December 2017. Pointing to recent data, Santiment said on its Twitter account that the tendency of investors to transfer their BTC to their personal wallets may signal that the risk of new sales on exchanges is decreasing.

But of course, BTC outflows on exchanges may not be due to only one reason. In addition to the expectation of a rise, the decline in confidence in cryptocurrency exchanges may also lead to a decrease in BTC supply on exchanges.

What’s the Latest on the Cryptocurrency Market?

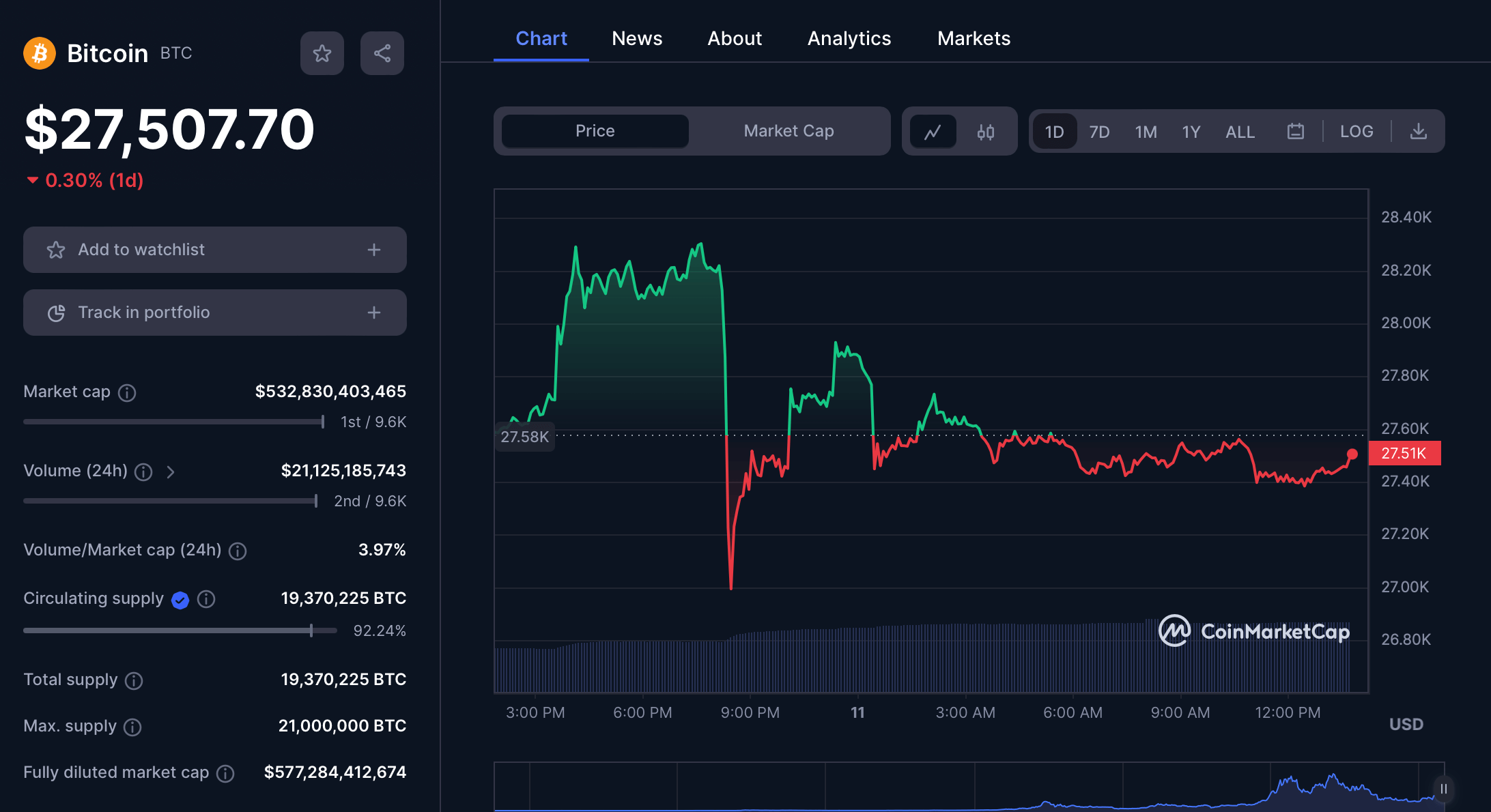

Bitcoin (BTC), the leading cryptocurrency, fell to around $27,500 after sharp declines since yesterday evening. The cryptocurrency market started the day with a decline due to the depreciation in Bitcoin. The total market capitalization of the cryptocurrency ecosystem retreated to $1.13 trillion, according to CoinMarketCap data, while Ethereum (ETH) lost nearly 1% in the last 24 hours and started trading at $1825.

Bitcoin (BTC), the leading cryptocurrency, fell to around $27,500 after sharp declines since yesterday evening. The cryptocurrency market started the day with a decline due to the depreciation in Bitcoin. The total market capitalization of the cryptocurrency ecosystem retreated to $1.13 trillion, according to CoinMarketCap data, while Ethereum (ETH) lost nearly 1% in the last 24 hours and started trading at $1825.

In addition, volatility in the cryptocurrency market increased due to the sharp declines in Bitcoin yesterday evening. According to Coinglass data, approximately $190 million worth of short and long positions were liquidated in the last 24 hours.

Disclaimer The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry risks due to their high volatility and should conduct their own research.