Less than nine months remain for the next Bitcoin halving event, and the common view among analysts and investors is that the event will push Bitcoin’s price to its all-time high, even surpassing $100,000. However, the lack of new entries into the crypto market, current macroeconomic issues, and Bitcoin’s recent price movements below $30,000 do not inspire much confidence in this theory in the short term.

The Most Important Development for Bitcoin

Sue Ennis, Vice President of Hut 8, recently shared her thoughts on how Bitcoin’s price will surpass $100,000 next year and how the upcoming halving event will affect BTC miners in an interview with Paul Barron. Hut 8 currently holds a balance of 9,152 BTC in reserve, with 8,305 of them unpledged. The company’s installed ASIC hash rate capacity is 2.6 exahash per second, and Hut 8 mined 44.6 BTC in July.

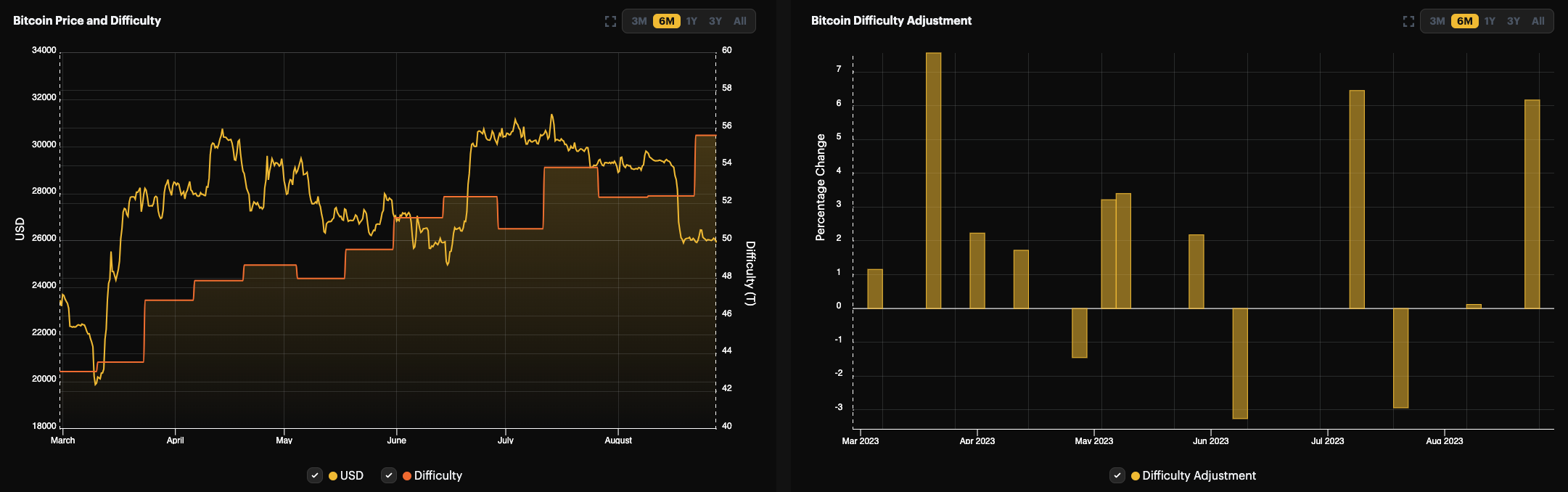

Barron asked Ennis if the increasing Bitcoin difficulty could lead to a new wave of selling pressure on BTC miners. Referring to Hashrate Index data, Barron observed that increases in Bitcoin difficulty were followed by decreases in its price. Barron questioned whether the upcoming halving event, as a result of creating a need for more efficient ASICs, would cause miners to sell Bitcoin and whether BTC’s price movement before and after the halving would rise as much as investors expected. According to Ennis:

“There are currently many unprecedented dynamics in the mining industry. The interesting thing is that despite Bitcoin’s price trading within a certain range, the hash rate continues to increase. We are currently seeing a slight decrease in Bitcoin’s price, but the hash rate continues to rise. What is truly exciting and different is that we are witnessing a massive influx of new participants into the global Bitcoin network.”

Miners Should Diversify Their Income

Ennis pointed out that in the Middle East, six gigawatts of nuclear and renewable energy are being produced, and with regional governments exploring Bitcoin mining as an option, more hash rate is coming online independently of the price. This is significantly different from the working style of publicly traded, US-based and forward-looking miners. Ennis argued that miners need to be in a position to avoid being “single-threaded” in order to survive after the halving event, meaning they need to find ways to generate multiple sources of income beyond Bitcoin mining.

Income diversification could involve exploring various artificial intelligence (AI) applications, allocating some warehouse space to GPUs for companies specializing in AI training, potentially offering industrial-level ASIC repair services, and even participating in demand response initiatives with major energy producers and distributors.

Regarding a potential target for Bitcoin’s price, Ennis said:

“I definitely think we could see a cost of $100,000 per Bitcoin in the next cycle, and that is based on Bitcoin capturing 2% to 5% of the $13 trillion gold market in institutional portfolios. If Bitcoin could even capture 2% to 3% of the market value of gold, it would have an incredible impact on its price and push it above $100,000.”