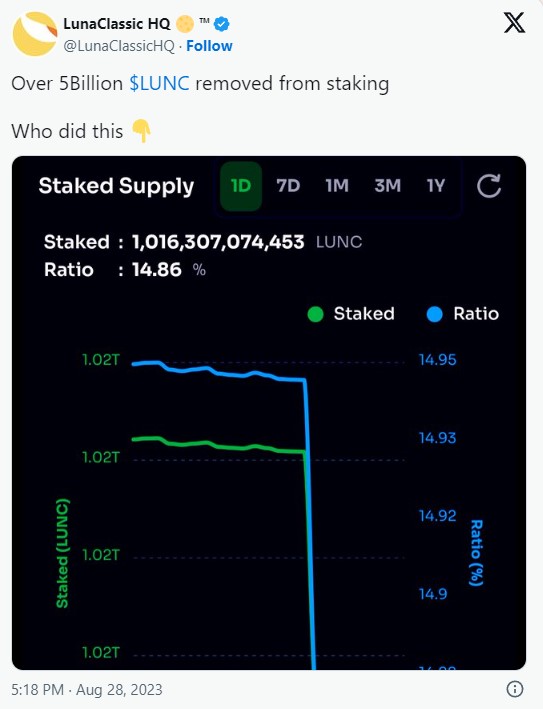

Terra Classic (LUNC) noticed a significant lack of token staking during the intraday trading session on August 28, which raised concerns about further price drops. More than 5 billion previously locked LUNC tokens were unlocked, representing approximately 0.08% of the circulating supply of 6.8 trillion LUNC.

Current Status and Price of LUNC Coin

So far this month, there has been a decrease in LUNC staking. The total percentage of staked LUNC, which was 14.95% at the time of writing, decreased by 1% from the circulating supply. This lack of staking activity may be attributed to the stable price decline of LUNC. The token lost more than 20% of its value last month. According to data from CoinMarketCap, the value of the altcoin, which has recorded minimal gains in the past year, has dropped by 38% since January 1.

At the time of writing, the cryptocurrency was trading at $0.000065. The recent price drop may be attributed to the decrease in LUNC accumulation. As can be seen from the daily chart, the demand for LUNC among daily investors started to decrease on July 23.

The Future of LUNC Coin

As demand decreased, a new bear cycle began, as indicated by the Moving Average Convergence Divergence (MACD) indicator. On July 23, the MACD line crossed below and since then, red histogram bars pointing downwards have formed.

At the time of writing, confirming the strength of bears, LUNC’s positive directional index (green) at 8.02 was positioned below its negative directional index (red) at 35.45. While the average directional index (yellow) was at 51.31, bulls may struggle to regain control of the market. An ADX value above 25 indicates a strong market trend and suggests that LUNC’s price is moving in a clear direction without the possibility of a reversal in the near future.

Regarding the momentum indicators of the cryptocurrency, they were positioned away from their centerlines at the time of writing. LUNC’s Relative Strength Index (RSI) was at 29.31, while the Money Flow Index (MFI) was at 38.68.

Interestingly, as LUNC’s price followed lower lows, the Chaikin Money Flow (CMF) diverged and entered an upward trend. At the time of writing, the indicator, which was above the zero centerline, gave a positive value of 0.10. This can typically be interpreted as a buying signal as it indicates liquidity inflow that could help boost the coin’s price.

Türkçe

Türkçe Español

Español