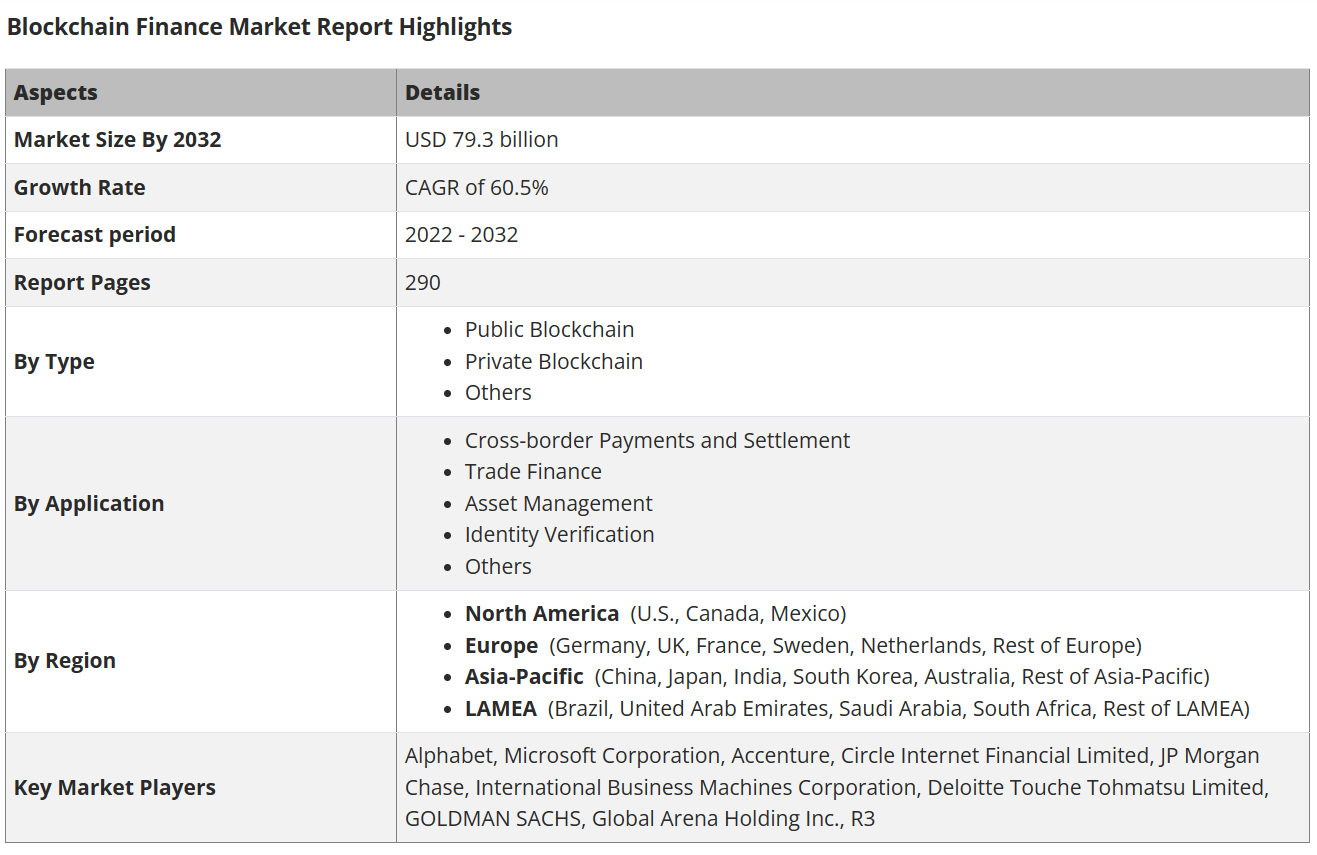

A recent study has drawn attention to the potential of blockchain technology, which has become increasingly prevalent in all aspects of life. According to the study, the global Blockchain finance market is expected to reach a value of $79.3 billion by 2032. This market encompasses various sectors, including public and private blockchain networks, trading platforms, and asset management.

Continued Growth in the Blockchain Finance Sector

A report prepared by Allied Market Research is based on various contracts, including strategic collaborations and acquisitions. The disruptions faced by the traditional financial market due to the COVID-19 pandemic have led to the revival of the blockchain finance market. The reduction in operational costs has paved the way for the widespread adoption of this sector.

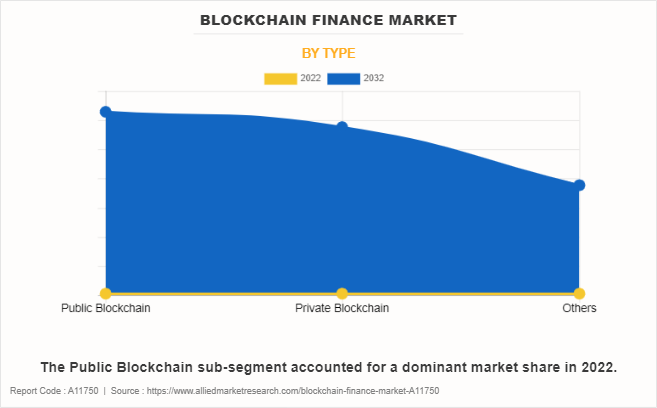

In today’s cryptocurrency market, public blockchain ecosystems represent the majority share in this industry. Particularly, considering that Bitcoin and Ethereum also have public blockchain ecosystems, as stated in the report, this sector has a competitive advantage:

“Public blockchain networks are ideal for storing large amounts of data related to financial transactions, leveraging significant computational power. These factors are expected to strengthen the blockchain finance market.”

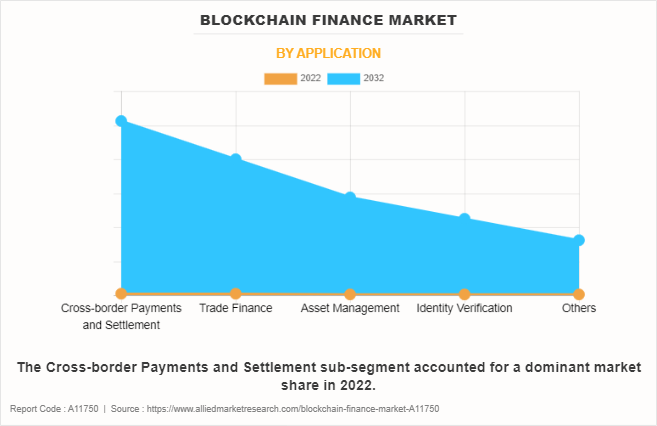

When it comes to the size of blockchain finance platforms, the increasing demand from individual users, businesses, traders, and international development groups can be seen as two major sub-services in this field – cross-border payments and trade.

As shown in the graph, the trend is expected to continue as users seek cheaper alternatives to transfer their savings worldwide. The North America region, in particular, stands out compared to other regions. It is expected to maintain its leadership in terms of adoption in the blockchain finance market in 2022.

Research Shared by Ripple

Based on data analysis of the trends and dynamics in the blockchain finance sector, Allied Market Research estimates an annual compound growth rate of 60.5% for the industry. Experts expect a market transformation of $79.3 billion by 2032 based on this estimate.

A recent report published by Ripple, a payment network, revealed that blockchain could save approximately $10 billion in cross-border payment costs for financial institutions by 2030. This report, released by Ripple, highlights how the blockchain ecosystem can provide significant cost savings for financial institutions by 2030. The report explains this situation as follows:

“More than 50% of the survey participants believe that lower payment costs, both domestically and internationally, are the primary benefit of cryptocurrencies.”

Türkçe

Türkçe Español

Español