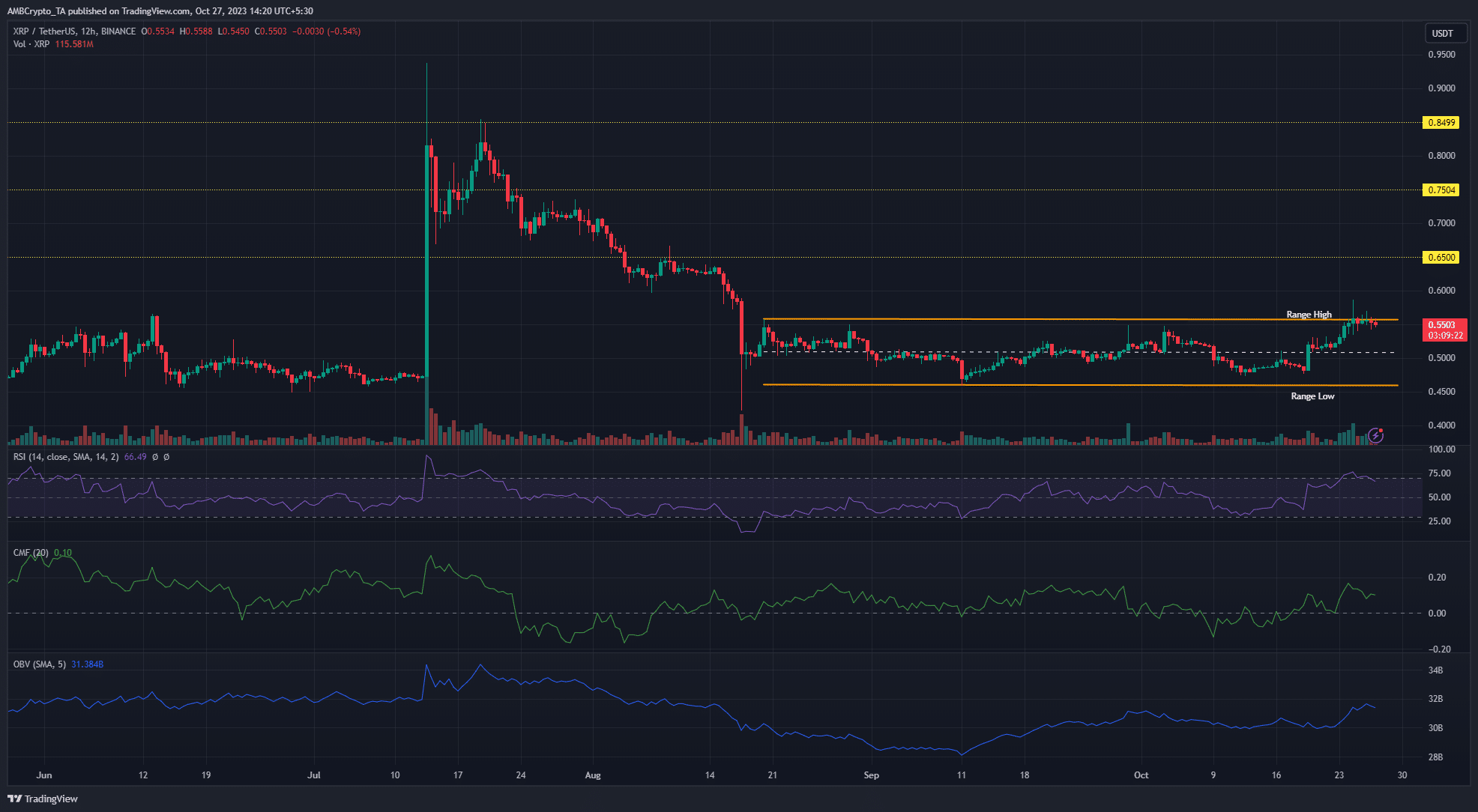

Last week, Ripple’s (XRP) buyers recovered to surpass the mid-level point with a 9.3% gain and took XRP to the highest range. However, selling pressure in the $0.55 price region prevented a break until this current position.

The Impact of BTC on Ripple!

In the broader cryptocurrency markets, Bitcoin (BTC) continued to trade above $34,000 with strong demand supporting the bullish sentiment. The 12-hour timeframe revealed that bulls encountered a challenging level at the $0.55 price barrier. This was observed in the downward rejections at the price level on September 29th and October 3rd.

A sell order block at the $0.55 price region limited the upward rally, as the token reacted to price changes in the past 48 hours. Despite the bearish trend at the $0.55 price, chart indicators pointed to increasing bullish momentum. The Relative Strength Index (RSI) remained in overbought territory, highlighting strong buying pressure.

Additionally, the Chaikin Money Flow was positive, indicating good capital inflows, while the On-Balance Volume (OBV) increase showed a rise in buying volume in recent days. Therefore, buying pressure could lead buyers to clear the bearish trend block with short-term profit targets in the $0.6 to $0.65 price levels.

XRP Price Prediction

The four-hour timeframe of the long/short ratio indicated increasing demand as buyers bid to scale the $0.55 price barrier. At the time of writing, long positions were dominant, holding 51.21% of open contract positions. This emphasized the bullish trend in the short term. Consequently, a move above $0.55 appears likely, and a close proximity of candles above this range could provide longer opportunities.

In conclusion, XRP rose to the $0.55 level with a 9.3% increase but struggles to surpass this resistance. Technical indicators suggest strong buying pressure, with long positions in the majority. Buyers are attempting to surpass the $0.55 level, but the difficulty of breaking the resistance persists, balanced by high demand and positive indicators. Long-term opportunities are anticipated.

Türkçe

Türkçe Español

Español