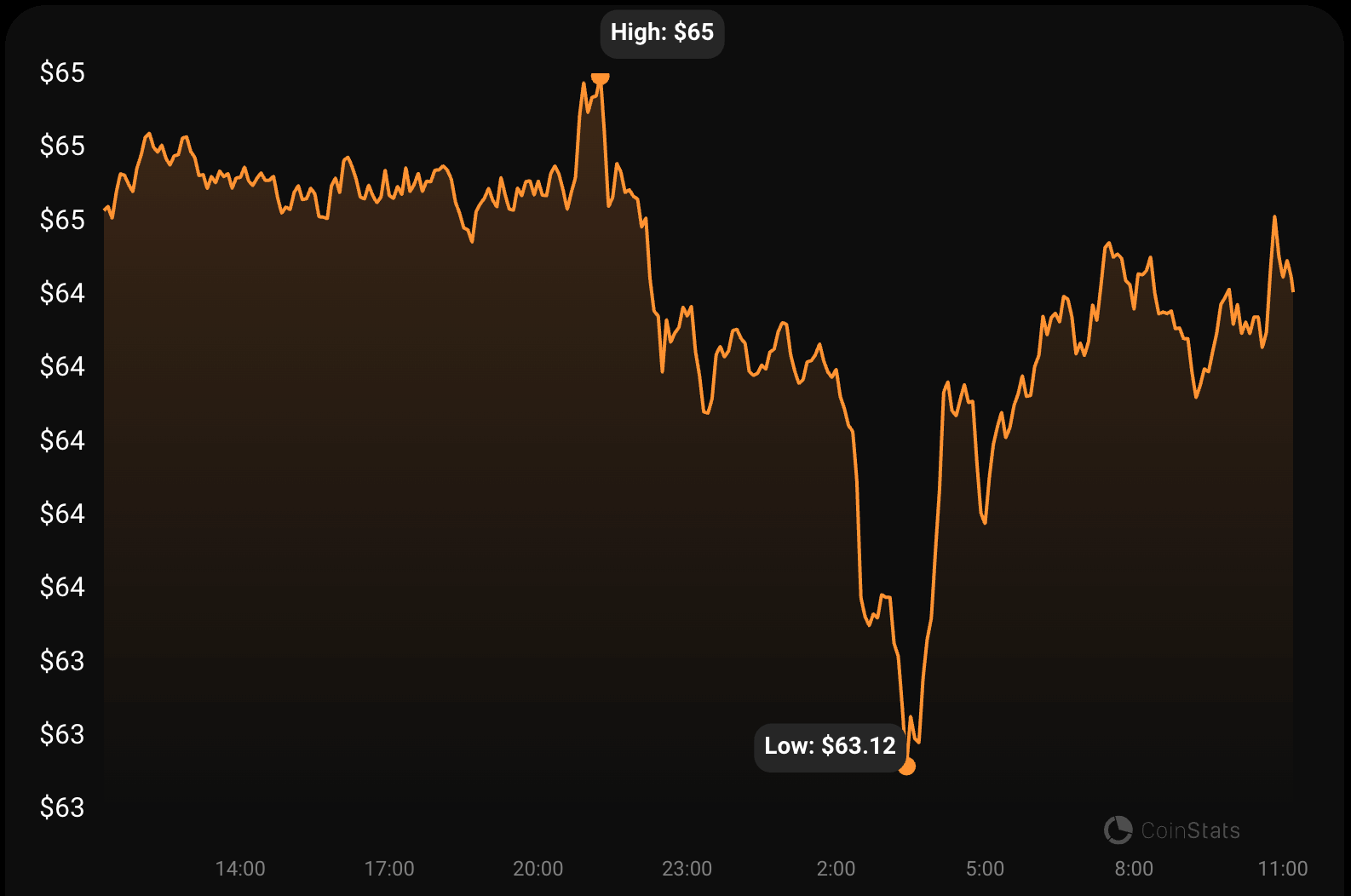

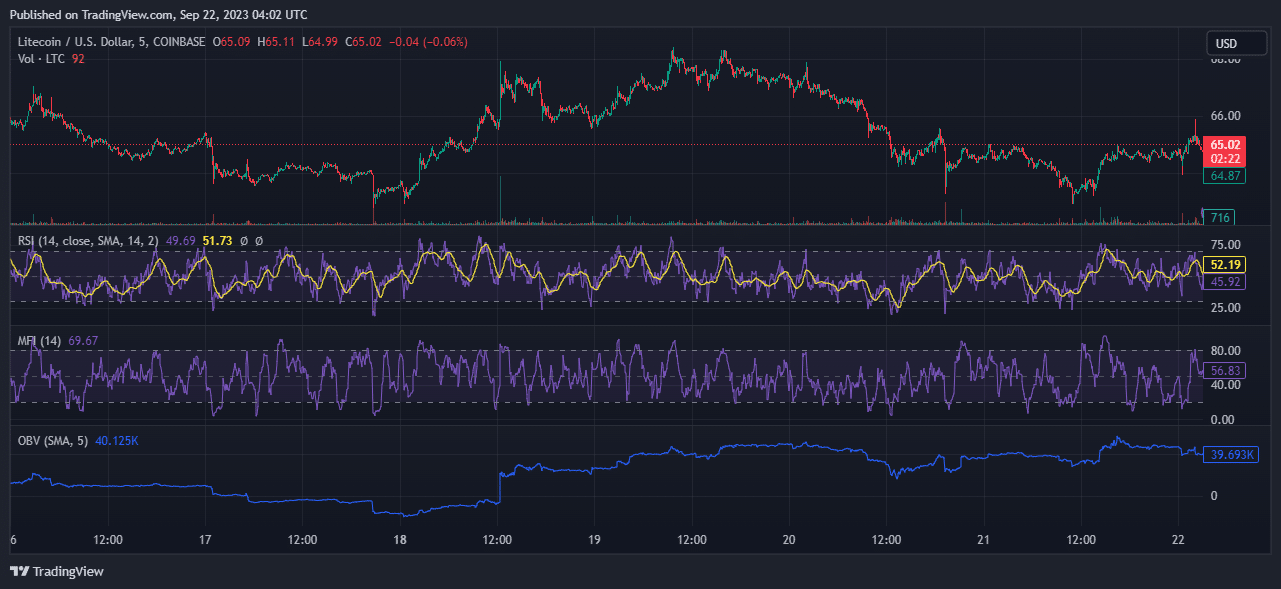

Litecoin (LTC) bulls and bears continued to battle for dominance in the price charts, with sellers holding the advantage. Last week, bulls made a strong recovery from the $57 support level. However, selling pressure at the $65 price zone limited the buying momentum.

The Halving Process in Litecoin!

On August 2nd, Litecoin’s third halving occurred when the network reached a height of 2,520,000 blocks, reducing miners’ rewards from 12.5 LTC to 6.25 LTC. Halving is a significant event programmed into specific cryptocurrency protocols, including Litecoin, that regularly reduces block rewards by half to verify transactions and secure the network.

The primary purpose of halving is to control the issuance rate of new tokens and manage inflation in the cryptocurrency system. The impact of halving is twofold. Firstly, it offers a scarcity of supply in the crypto ecosystem. As block rewards decrease, the rate at which new tokens enter circulation also decreases.

This creates a sense of scarcity among market participants and can potentially lead to an increase in demand for the cryptocurrency. Secondly, halving affects mining rewards for miners. As block rewards are halved, miners receive less money for their mining efforts. This can potentially reduce mining profitability, especially for miners with higher operating costs.

Mining Metrics in LTC!

If mining costs exceed rewards, some miners may be forced to exit the network, potentially resulting in a temporary decrease in the network’s hash rate and overall security. Litecoin, completing its third halving since its inception in 2011, will experience a decrease in its supply rate. This could lead to fewer new LTC being mined. This factor could trigger increased demand and speculative activities in the cryptocurrency market.

Additionally, miners may need to adapt to decreasing mining rewards, which can affect their profitability and mining operations. Experts hoped that halving would help Litecoin gain more market share in the PoW sector. Furthermore, experts turned to ChatGPT to highlight the various differences and advantages of multiple PoW cryptocurrencies.

According to the AI bot, Litecoin’s emphasis on faster transactions and lower fees is likely to attract more users and investors. As transaction volumes increase, Litecoin’s network activity may increase, making it an attractive fast and cost-effective cryptocurrency. However, the inflationary nature of Dogecoin contradicts the supply scarcity caused by Litecoin’s halving. Despite Dogecoin’s strong community and viral appeal, concerns about dilution due to its inflationary supply may work in favor of Litecoin in the short term.

However, users who value privacy and anonymity are more likely to stick with Monero (XMR) due to its unique privacy features. For those prioritizing speed and lower fees, Litecoin can be a practical alternative. As for Ethereum Classic (ETC), its focus on immutability and adherence to code principles may attract a different audience compared to Litecoin’s user base. The short-term advantage of each cryptocurrency may depend on specific use cases and the preferences of users and investors during this period.

Türkçe

Türkçe Español

Español