Cryptocurrency markets continue to be negative as US stocks fell by around 2%. Macro developments have been significantly affecting crypto for the past two years. Although the recent Fed meeting did not provide a clear message regarding interest rate hikes, the data suggests that there may be an increase in the November meeting.

Statements by Yellen and Mester

US Treasury Secretary Yellen made important remarks today, addressing the country’s increasing debt, its relationship with China, and many other issues. In addition, the afternoon’s JOLTS data showed that employment remained strong, which further accelerated the decline in cryptocurrencies.

Yellen stated:

“We have developed an excessive dependence on China for critical supply chains, and we need to reduce this risk. I’m not talking about a complete separation, and I don’t think about it, but we have an excessive level of dependence. I am optimistic about the outlook for the US economy.”

Fed member Mester made similar statements to other members. The comments made in recent days indicated the possibility of another interest rate hike. Indeed, the data supports this increase.

“I do not think that a rate cut will happen in the near future. We have raised interest rates based on various factors, including changes in the outlook. The current state of the economy suggests that another interest rate hike could be made in the upcoming meeting. We are probably at or near the peak in terms of interest rates. We can achieve our 2% inflation target by the end of 2025.”

US Economy and Cryptocurrency

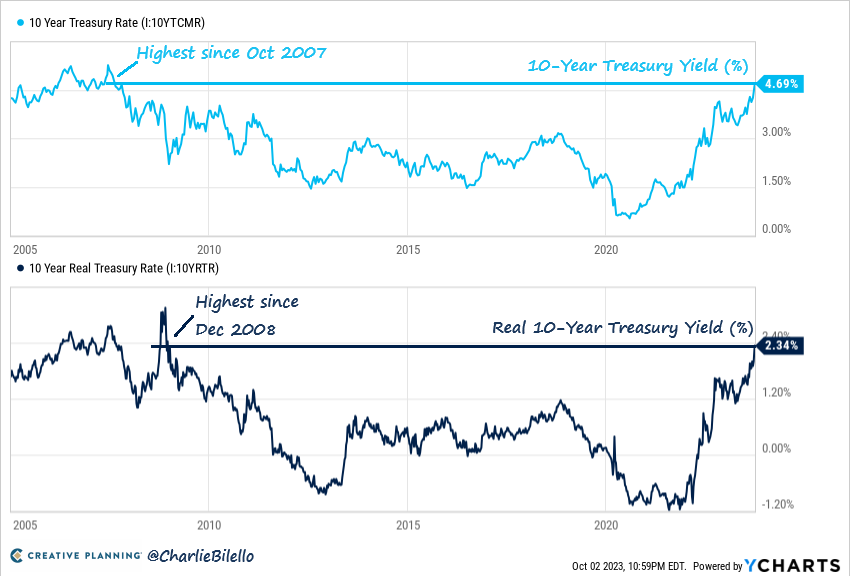

According to the inflation target graph, inflation is expected to be above 2% by the end of 2025. However, despite Mester’s optimistic expectations, she says there may be another interest rate hike at the November meeting. Multiple members making such statements, the increase in US Treasury yields, the rise of DXY, and the targeting of $100 for oil are not favorable for cryptocurrencies.

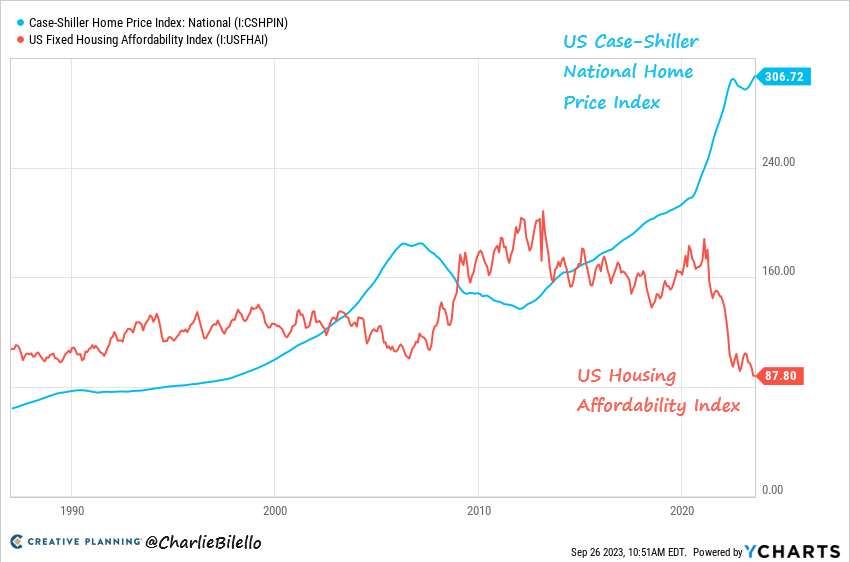

On the other hand, Charlie Bilello discussed important details about the US markets. Let’s start with the first one. Housing prices in the US reached their all-time high in July, showing a 40% increase in the past 3 years. Meanwhile, affordability is at record low levels, unlike the previous crisis, as banks are much more stringent in lending.

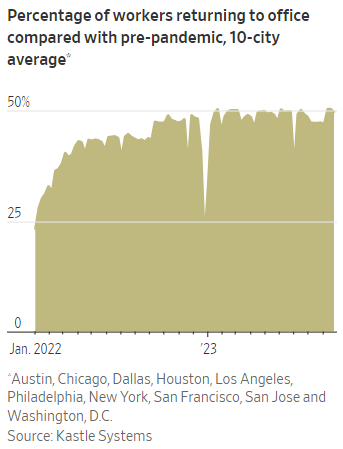

The office occupancy rate in the top 10 US cities is below 50% of pre-Covid levels. The average office vacancy rate in the US rose to 19.2% in the third quarter, just below the historical peak of 19.3% in 1991 (Moody’s Analytics).

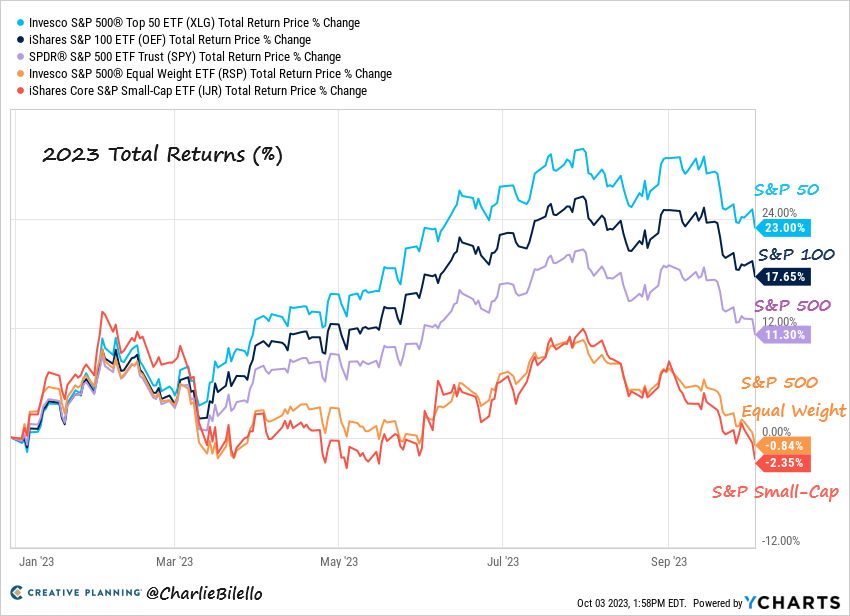

While the largest 50 stocks in the S&P 500 have seen a 23% increase this year, the equal-weighted S&P 500 and small-cap companies have experienced a 1% and 2% decrease, respectively.

The average price of a new home in the US has increased from $386,000 to $514,000 in the past 3 years, while mortgage rates have jumped from 3.07% to 7.31%. The result: a 115% increase in monthly mortgage payments and the most unaffordable housing market in history.

The 10-Year Treasury Yield reached 4.69% today, reaching its highest level since October 2007. The Real 10-Year Yield (adjusted for expected inflation) is at the highest level since December 2008, at 2.34%.

Türkçe

Türkçe Español

Español