Recent developments in the cryptocurrency world have been so fast-paced that heads are spinning. One of the most influential figures in the crypto world, Changpeng Zhao, has resigned, and a new CEO, Richard Teng, has been appointed. Questions have arisen about the state of the cryptocurrency exchange following these developments. Recent fund outflows in the past 24 hours have been a topic of discussion. However, analysts believe that this is not a cause for concern.

Insightful Statement from Matrixport Analyst on Binance

Matrixport analyst Markus Thielen expressed his optimism about the recent agreement involving Binance and its CEO, Changpeng Zhao (CZ). Thielen highlighted that the outcome is extremely positive for both CZ and Binance, especially considering CZ’s resignation and the fact that the imposed fine was lower than the speculated $10 billion.

Thielen sees CZ’s resignation and the lower-than-feared settlement amount as a positive development. Despite recent challenges, Thielen predicts that Binance will maintain its position as one of the top three exchanges for the next 2-3 years.

Impact on the Exchange Landscape and Asset Movement Dynamics

Thielen believes that the agreement will encourage other exchanges to prioritize compliance and potentially lead them to participate in information-sharing agreements. This shift towards enhanced compliance is seen as a significant step that could pave the way for the approval of Bitcoin Exchange Traded Funds (ETFs) in the United States.

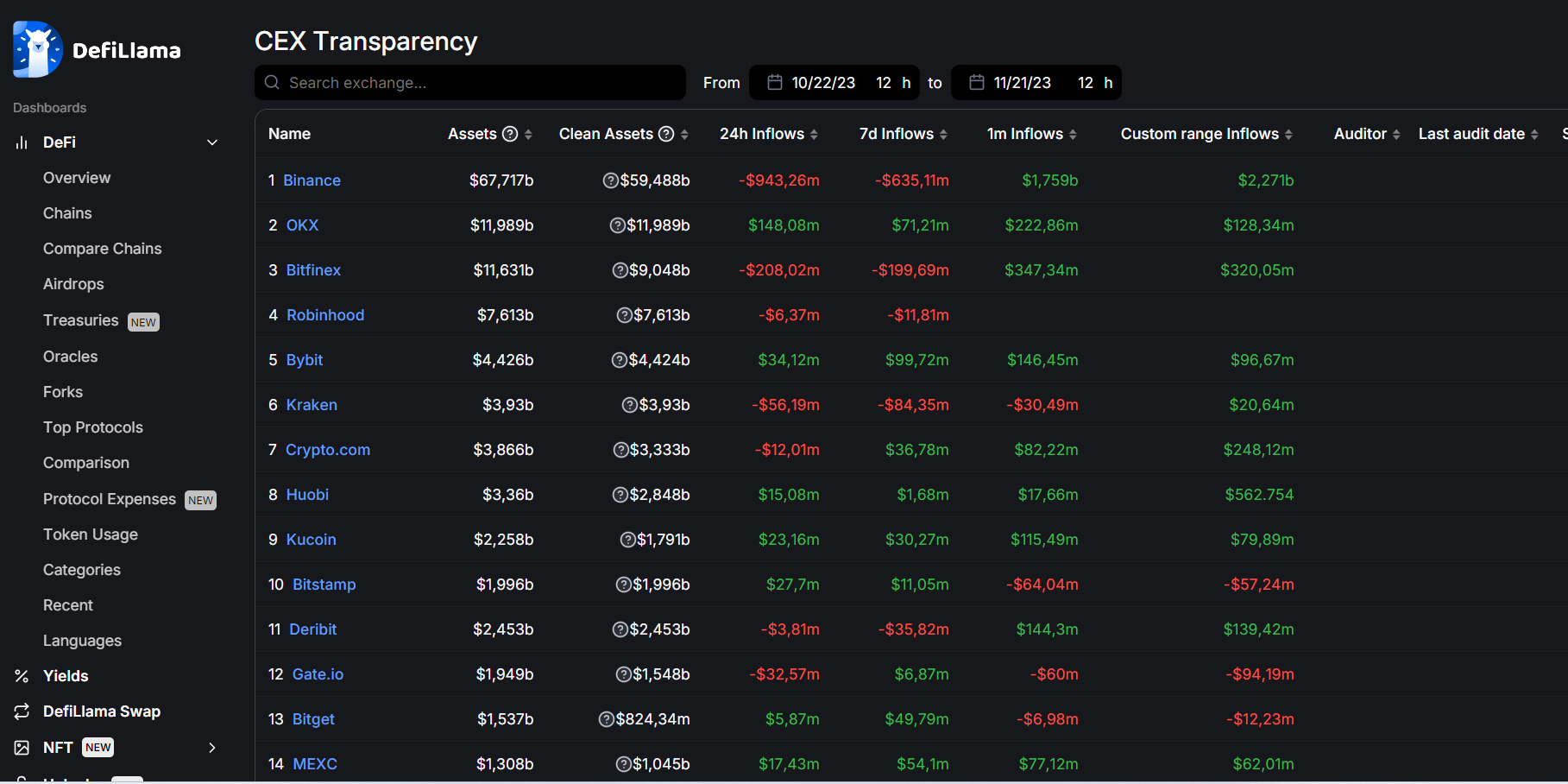

Latest data from DeFiLlama shows that Binance has experienced a net outflow of approximately $943 million in the past 24 hours. In contrast, OKX witnessed a net inflow of $148 million during the same timeframe. Nevertheless, Binance continues to maintain its position as the exchange with the largest assets, exceeding $67.7 billion.

Shaping Changes and Maintaining Dominance

In conclusion, Thielen’s positive outlook on the future of Binance indicates that the exchange is still in a good position in the crypto world following the agreement. With reduced financial impact, the strategic decision-making process is expected to strengthen Binance’s competitive position in the crypto exchange landscape. Ongoing changes in asset movement dynamics underscore Binance’s resilience and consolidate its dominance in the industry.