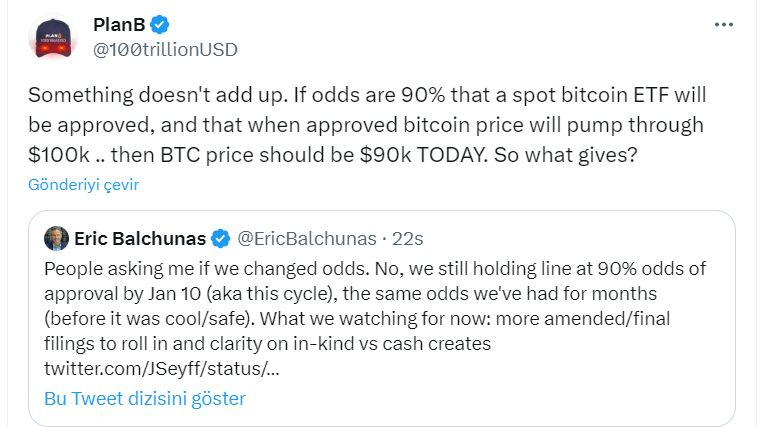

Crypto analysts, including Bloomberg analyst Eric Balchunas and the creator of the stock-to-flow model PlanB, entered into a discussion about a surprising scenario in the market. Despite a steady 90% probability that a Bitcoin ETF would be approved by January 10th, the anticipated surge in Bitcoin’s price to over $100,000 seems to be delayed. This inconsistency has sparked debates within the crypto community, questioning the factors affecting the current market situation.

Bitcoin and ETF: Exploring the Price Connection

Eric Balchunas reiterated his view that the likelihood of a spot Bitcoin ETF being approved within the current cycle is 90%. This unchanged forecast over months indicates a strong belief in the regulatory outcome. On the other hand, PlanB, known for accurate Bitcoin predictions and owner of the stock-to-flow model, says very different things.

According to the analyst, the market has no connection between the Bitcoin ETF and the price increase of BTC. PlanB expresses skepticism, pointing to the clear inconsistency between expected and observed price movements. If the probability of the ETF being approved is 90% and the price will be $100,000 when approved, then Bitcoin’s current value should be $90,000. The unexplained delay in Bitcoin’s price has led to a deeper investigation of market dynamics and potential influencing factors.

Key Factors Under Scrutiny

The crypto community is currently closely monitoring two important issues. The first is the possibility of additional amendments or final applications. The second is clarifying the distinction between in-kind and cash creations. These factors are expected to play a significant role in shaping the regulatory environment and, consequently, in influencing Bitcoin’s trajectory.

As discussions continue, crypto enthusiasts await other developments that could potentially solve the mystery surrounding Bitcoin’s current value. The weeks leading up to January 10th promise potential catalysts for further regulatory clarity and the anticipated market change.

Bitcoin, ETF, and Halving

As experts grapple with the inconsistency between projected ETF approval probabilities and Bitcoin’s current price, market participants are advised to carefully address these uncertainties. The crypto world continues to be dynamic with factors contributing to price movements beyond regulatory decisions. While the market waits for more definitive information, it is very important for both investors and enthusiasts to strategically observe and be prepared for potential changes.

PlanB’s emphasis on the 90% probability being a very strong likelihood and his emphasis on the BTC price reaching levels around $90,000 reveal an outcome. The analyst actually suggests that the issue of Bitcoin ETF will not contribute to the BTC price. The analyst had also mentioned in the past that halving was never priced in.

- Bitcoin’s expected price surge delays despite ETF optimism.

- Market dynamics and potential factors under deep analysis.

- Strategic observation crucial as market seeks clarity.