Bitcoin’s (BTC) financialization process has reached a new phase with the initiation of spot Bitcoin  $104,867 ETF options trading today. According to Matrixport’s assessment, this development could enhance market liquidity and attract more institutional interest.

$104,867 ETF options trading today. According to Matrixport’s assessment, this development could enhance market liquidity and attract more institutional interest.

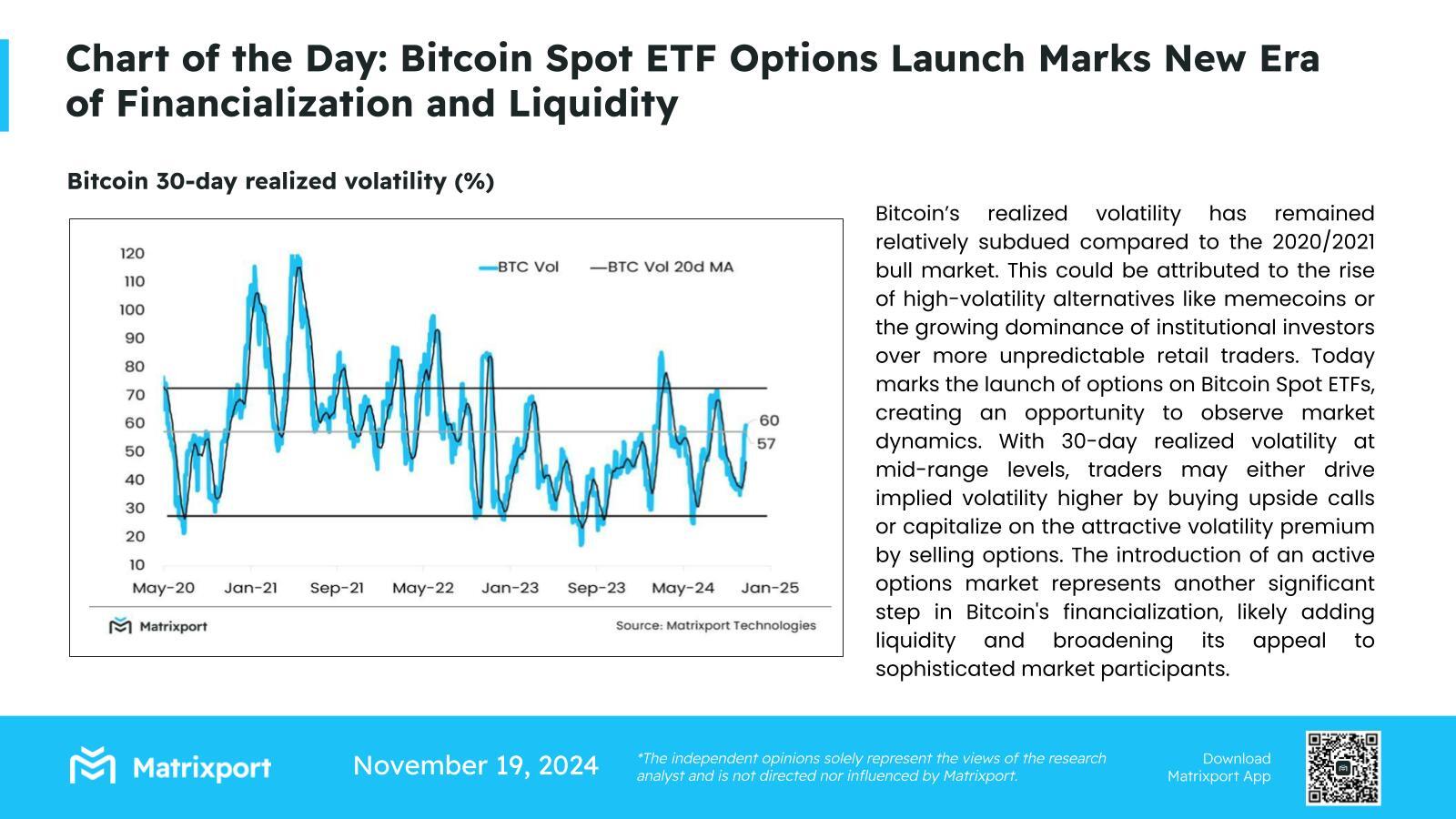

Bitcoin’s Volatility Remains Low

Matrixport reported that Bitcoin’s 30-day realized volatility continues to be low compared to the bull markets of 2020 and 2021. Experts suggest that the increase in popularity of alternatives with high volatility, such as memecoins, is a contributing factor. Additionally, the growing presence of institutional investors limits the impact of individual investors’ speculative trading. However, the introduction of spot ETF options may lead to shifts in the dynamics of the cryptocurrency market.

In this new market, investors can adopt various strategies. Some traders may increase volatility by opting for call options in anticipation of price rises, while others may sell options to take advantage of the current volatility premium. Matrixport believes that in both scenarios, spot ETF options will add a new dimension to the Bitcoin market.

Bitcoin Options Market May Increase Liquidity

According to Matrixport, the launch of options trading could make Bitcoin more appealing to a broader investor base. For those unfamiliar, options give investors the opportunity to hedge against price movements and implement more complex strategies. This could enhance liquidity and support a more stable market structure.

Moreover, institutional investors are expected to utilize this new tool more frequently. Options are typically favored by large-cap investors for risk management purposes, which could accelerate Bitcoin’s acceptance as a professional investment product in the long run. Spot ETF options are seen as a significant step in the ongoing institutionalization of the Bitcoin market.

As Bitcoin rapidly integrates into the financial ecosystem, spot ETF options appear poised to become a cornerstone of this process. Observers note that market reactions to this new instrument will become clearer in the coming days.

Türkçe

Türkçe Español

Español