Meme coin king this year did not show the expected performance and Musk seems to have forgotten it for a long time. Investors who were hopeful in December have still not received what they were waiting for. While many altcoins reach their new all-time highs, why can’t DOGE stay above $0.1? What do current data and forecasts indicate?

Dogecoin (DOGE)

Since December 2022, the DOGE price has not been able to overcome the horizontal resistance area, and the movement below has led to new historical lows. The price, which tried to overcome the tough barrier several times, could not reach its goal for a long time. After the rise in October, DOGE surpassed this area on December 6 and set its 2023 peak on December 11.

Despite the peak on December 11, due to the fluctuation in BTC price, this week it fell below the resistance again. RSI is still above the neutral zone, but BTC does not support the rally. Due to the anxiety of the upcoming PCE inflation data on Friday and the volumes expected to weaken due to Christmas, DOGE sellers are reducing their risks.

BTC tested $43,500 during the early hours today as Asian markets opened, but could not sustain it. Because of the ETF excitement, a group of investors was told to start taking profit, so BTC is at $42,382 as this article is being prepared.

DOGE Price Prediction

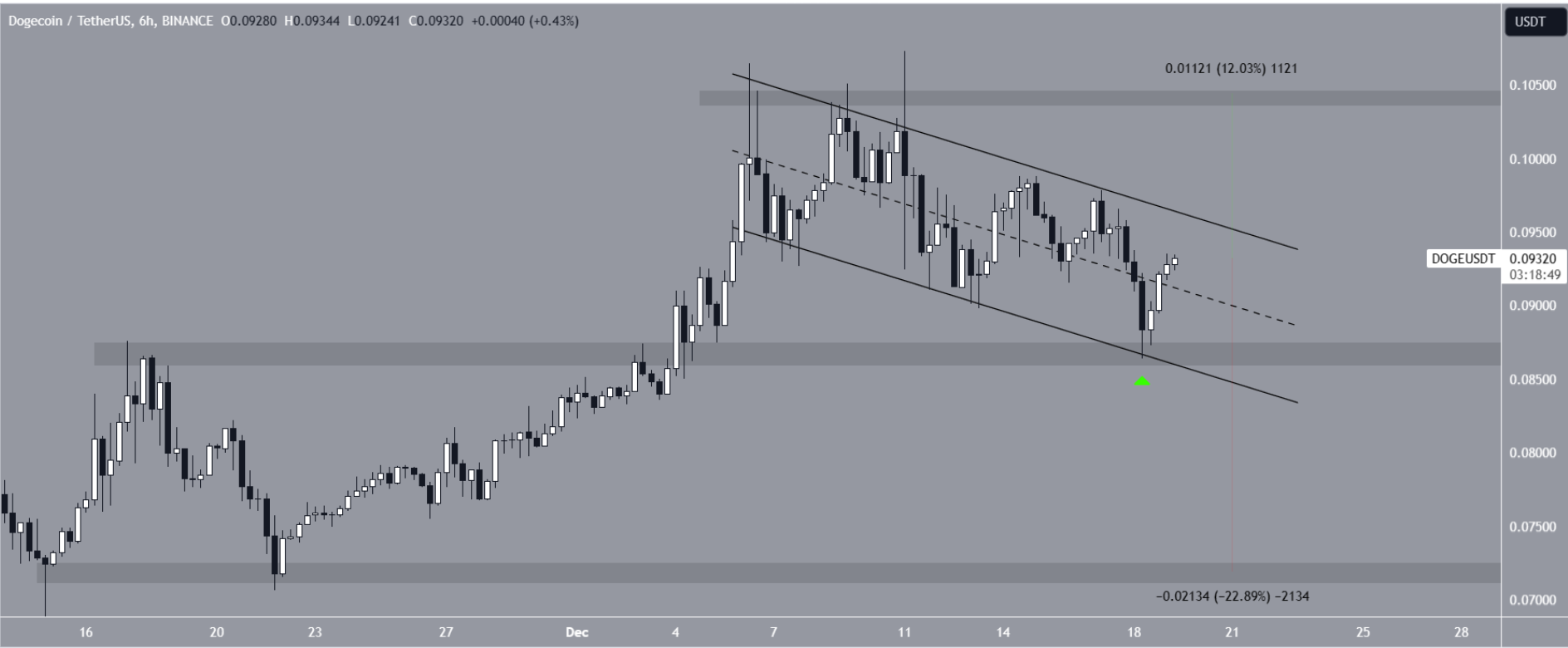

Readings on the daily chart are sending negative signals for DOGE. However, the 6-hour chart is relatively optimistic in the shorter term. The main reason for this is due to price movements. Since December, the DOGE price has been trading within a descending parallel channel, typically involving corrective movements. This will eventually lead to a breakout.

Yesterday, DOGE made a bounce at the support trend line of the channel and at the horizontal support area of $0.087, and popular crypto analyst ChiefraT said this was a turnaround from the bottom. According to the analyst, the DOGE price has started its upward movement. However, at the time of writing, DOGE was finding buyers at $0.09.

The price is currently trading at the top part of the channel, and the long-term resistance is at $0.095. If the optimistic scenario materializes, the price is expected to reach $0.105. Nevertheless, closures below the $0.087 support could lead to a drop to $0.072.