Litecoin (LTC) halving event has been one of the significant events that followed changes in market trends. This time, an increase in accumulation was recorded shortly after the third halving of the blockchain. Since a month has passed since the event took place, investors may expect LTC to make gains on the price chart due to their accumulation of the cryptocurrency.

Litecoin Current Situation

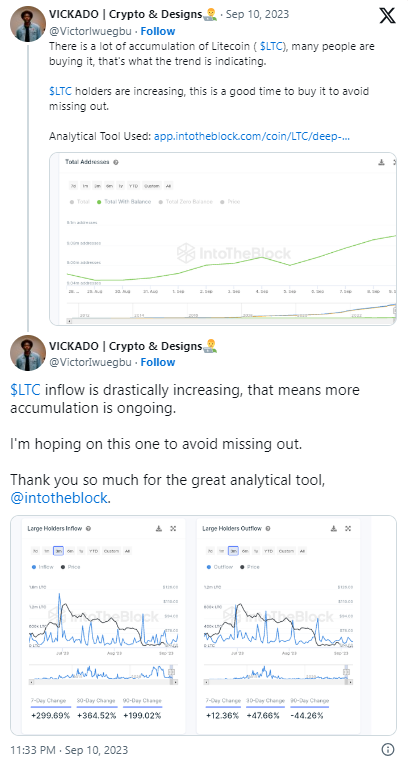

VICKADO, a crypto analyst, recently highlighted in a tweet that according to IntoTheBlock, Litecoin’s balance total addresses have sharply increased in the past few days. This clearly indicates that the buying trend is dominant in the market. Furthermore, it witnessed a significant influx in the blockchain. In fact, this figure has increased by over 360% in the last 30 days, which seems encouraging.

As previously reported, the number of long-term holders of Litecoin reaching 5 million also signaled their confidence in the cryptocurrency. While investors expect a jump in LTC’s price in the coming months, accumulation has increased after the halving event. Whale activity around LTC also remained high, indicating that major withdrawals could also be banking.

Litecoin Price Update

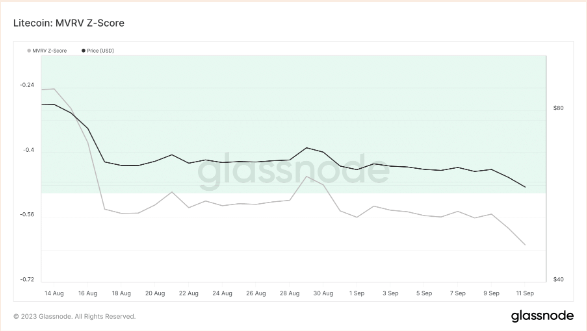

Despite high expectations from investors, LTC’s performance was not in line with it. According to CoinMarketCap, LTC has experienced a drop of over 5% in the last seven days. At the time of writing, it was trading at $59.68 with a market value of over $4.3 billion. However, there was also a possibility of LTC hitting the market bottom.

This seemed likely when looking at LTC’s MVRV Z-Score. This metric evaluates whether Litecoin is overvalued or undervalued compared to its “fair value.” A significantly lower market value than the realized value often indicates market bottoms. As can be seen from the chart, LTC’s MVRV Z-Score is below the green zone, which may indicate a market bottom.

Another notable metric was LTC’s aSORP (Average Spent Output Revenue Ratio). When the value of this metric is less than 1, it means that investors are selling their assets at a loss. It may indicate that the market has hit bottom in a bear market. At the time of publication, Litecoin’s aSORP value was 0.97.

Surprisingly, although the above measurements seem positive for LTC, the overall market was not entirely certain. LunarCrush’s data revealed that LTC’s sentiment for both rising and falling has increased by nearly 100% in the last seven days. The coin’s Altrank has also recently shown an increase, which could be a signal of a downturn.

Türkçe

Türkçe Español

Español