On September 18th, Bitcoin futures trading volume on derivative exchanges experienced a sudden increase of $1 billion. While initially, the lawsuits against Binance were cited as the reason for this surge, analysis of the data did not yield a clear result regarding the excessive buying or selling demand. The decision to reopen these mentioned files was made by the SEC, claiming that Binance did not cooperate.

Bitcoin Price Volatility

As the open trading volume reached $12.1 billion, the price of Bitcoin increased by 3.4% to reach a level of $27,430, the highest in two weeks. Following these developments, Federal Judge Faruqui rejected the SEC’s request to examine and share additional information about Binance US’s technical infrastructure. Additionally, the judge emphasized the issue of whether Binance International controls these assets, by requiring further details about Binance US’s custody solution.

By the end of the day, the open trading volume decreased to $11.3 billion, and the price of Bitcoin dropped by 2.4% to $26,770. It became apparent that investors were disappointed with the decision and no longer wanted to maintain their positions.

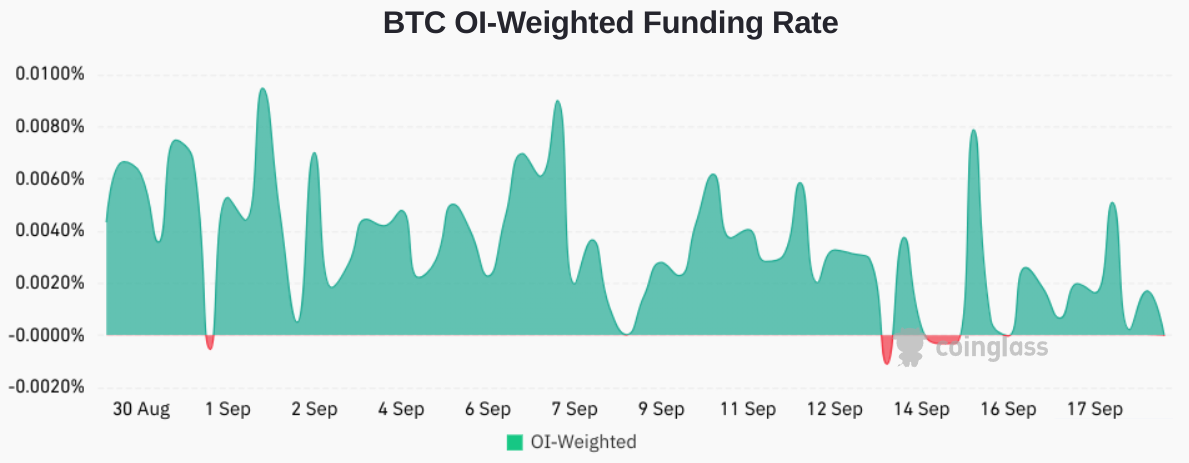

Looking at the content of the lawsuit, no one could have predicted that the unsealed documents would be in favor of Binance, considering that the decision was requested by the SEC. Additionally, the funding rate of Bitcoin futures contracts, which examines the ratio between long and short positions, remained relatively stable during this period.

What to Pay Attention to in Price Manipulation?

Regarding this situation, the most noteworthy and logical explanation could be the participation of market makers who execute purchase orders on behalf of important clients. In this case, they explain the initial enthusiasm in both the spot market and Bitcoin futures and cause an increase in the Bitcoin price. After the initial move, market makers completely avoid risks and eliminate the need for further purchases in their assets.

In the second stage, when the market maker has to sell BTC futures contracts and buy spot Bitcoin, this situation does not have any effect on the Bitcoin price. However, it may reduce interest and disappoint some participants who want to make additional purchases.

Instead of hastily manipulating with each “bar” formation, it is beneficial for investors to research arbitrage operations and carefully analyze the funding rate of Bitcoin futures contracts before reaching a conclusion. Thus, an increase in the Bitcoin price, like the one that occurred on September 18th, does not necessarily indicate a buying opportunity when there is no excessive demand for leveraged long positions.