Despite the announcement of the PayPal stablecoin in the afternoon, Bitcoin (BTC) is finding buyers at a price below $29,000. What is concerning is that as volatility increases, so does the negative sentiment. Investors are worried about a possible drop to $27,500 in the coming days. So how did 2023 go for cryptocurrencies, and why are we not seeing the expected sustained rise? Kaiko has evaluated all of these in its latest report.

Will Litecoin Price Increase?

Last week, Litecoin reduced miners’ block rewards by half. The third halving did not result in a different outcome from the previous two. We saw that the price of LTC dropped as a result of this event. Many experts were already warning investors because the same thing happened during the previous two halving periods.

When comparing the performance of LTC before and after previous halving events to BTC, it can be seen that this trend is likely to continue. Historically, LTC has either performed better with a broader market after the last two halvings in 2015 and 2019, or it has shown lower performance.

This indicates that halvings are more of a “buy the rumor, sell the news” event rather than significant price catalysts. In summary, the decline in LTC may continue.

Bitcoin and the 2023 Predictions

Bitcoin is expected to experience its fourth halving event in April 2024. BTC usually performs better after halving, but as the market matures, its performance has gradually declined over the years. BTC experienced significant fluctuations in the months leading up to previous halvings. However, there has not been a significant increase in leverage or trading volumes so far. This suggests that we may not see a massive rally during the 2024 halving period. It is still early, with approximately 8 months remaining.

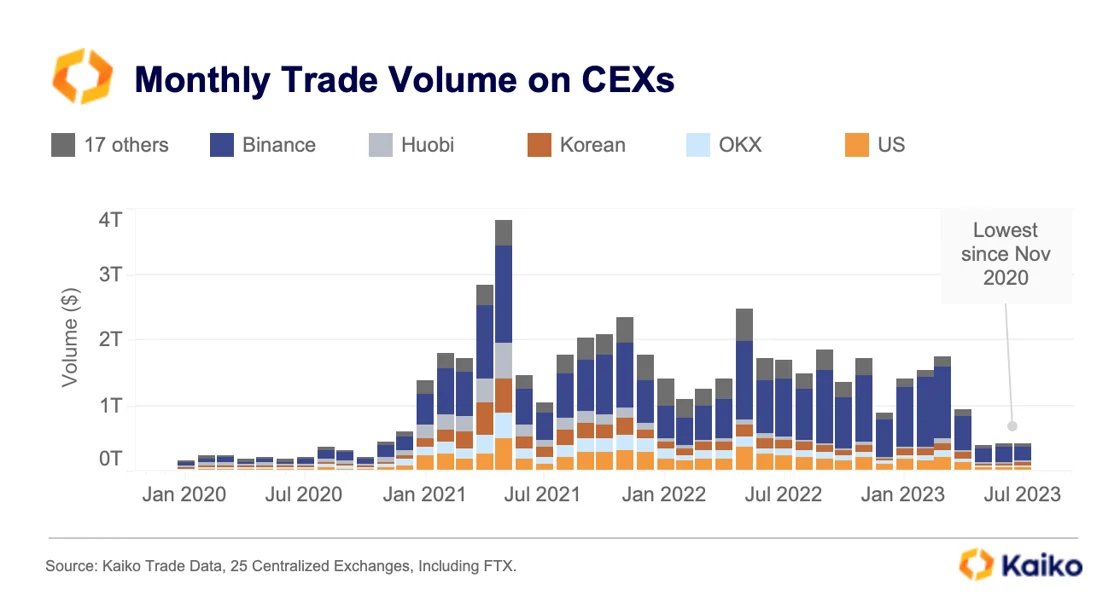

Despite a 75% increase in BTC price this year, trading volume continues to decline, and almost all exchanges recorded double-digit decreases compared to the previous year in July. This reflects a collapse in long-term volatility and indicates low overall market participation.

US exchanges experienced the strongest decline in volume, with an average of 80%. The lack of volume in the market makes it easier for speculators to manipulate it. Moreover, it should not be forgotten that the regulatory pressure from the US has also pushed major market makers away from crypto, especially as of May.