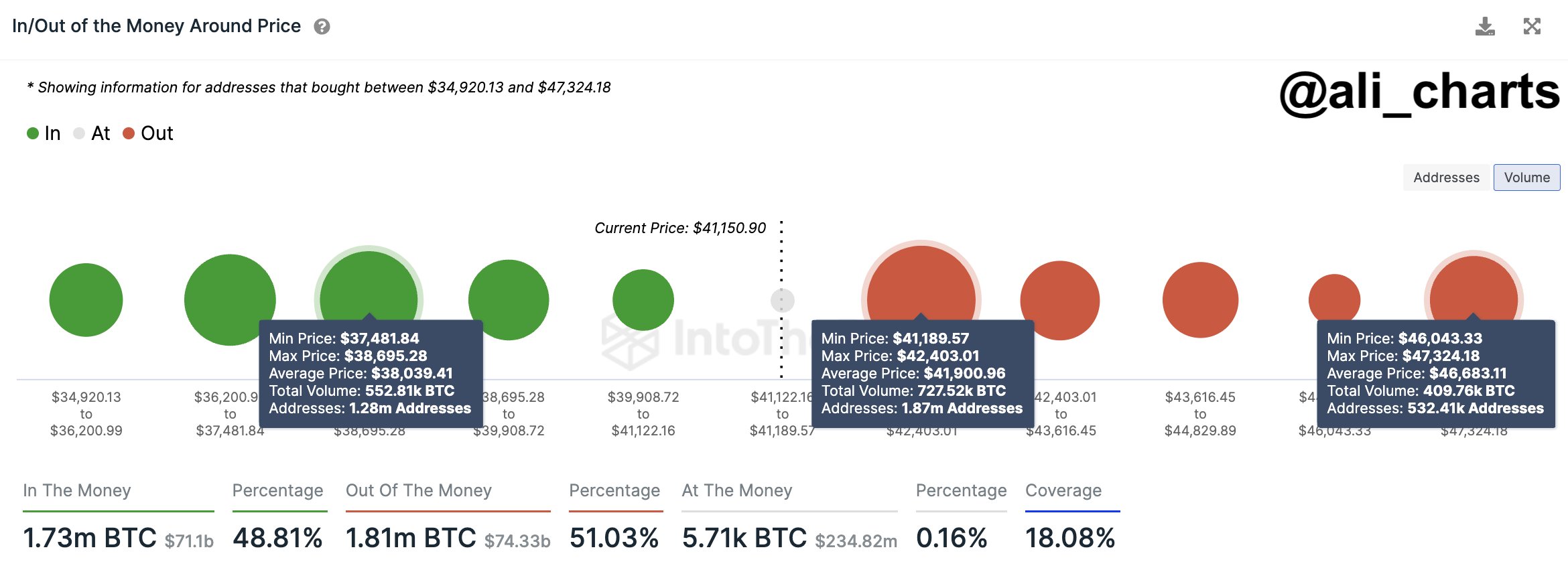

The breaking of this key supply area carries the risk of increased selling pressure. Analysts emphasize the importance of caution as Bitcoin‘s value hangs in a delicate balance. Analyst Ali Martinez suggests that if the selling momentum intensifies, the cryptocurrency may experience a decline, with the next critical level to watch being the demand zone ranging from $37,500 to $38,700.

In this next zone, 1.28 million addresses currently hold 553,000 BTC, indicating an important area where market dynamics could potentially change. Continuous decline in this demand zone is advised to be closely monitored by traders and investors as it could initiate a new phase of market sensitivity and trading behavior.

This latest development in the market underscores the need for strategic decision-making and risk management, given the inherent volatility in the cryptocurrency space. As Bitcoin navigates these critical levels, market participants will closely observe the interaction between supply and demand and anticipate potential changes that could influence the future overall trajectory of the cryptocurrency.

The Current State of Bitcoin and Altcoin Prices

As of writing, Bitcoin is trading at $42,092, indicating a relatively subdued start to the week following a weekend of relative retracement. In the 24-hour period, Bitcoin shows a 2% decline, while altcoins also exhibit some retracement. Ethereum is trading at $2,159, BNB at $325, and ADA at $0.55.

AVAX, which had risen to $45.33, is currently trading at $37.76 with a 10% decrease. Finally, XRP has pulled back to $0.59.

Türkçe

Türkçe Español

Español