Cryptocurrency markets saw a relatively steady rise in the first month of the year. But since mid-April, things have gotten messy. A significant portion of altcoins are running to their March lows. Some of them have even reached their lows. But things are a bit more complicated for the largest altcoin by market capitalization. Burns are at their peak, exchange supply is falling, and the price is melting.

Why is Ethereum Falling?

The Ethereum price made huge gains after the successful Shanghai Upgrade, reaching $2,150. A month later, Ethereum is down 14%. However, critical on-chain data suggests that the price should rise. There were fears of a massive sell-off after Shapella, but that didn’t happen.

Even a month after the Shanghai Upgrade, Ethereum is experiencing a drop in the new ETH 2.0 withdrawals. This came as investors started to delist the coins from exchanges. With staking deposits also reaching new highs, investors are preparing for the next price rally. However, while Bitcoin price has turned $27,600 into resistance, it does not look like it will give altcoins a bullish opportunity.

ETH Coin Comment

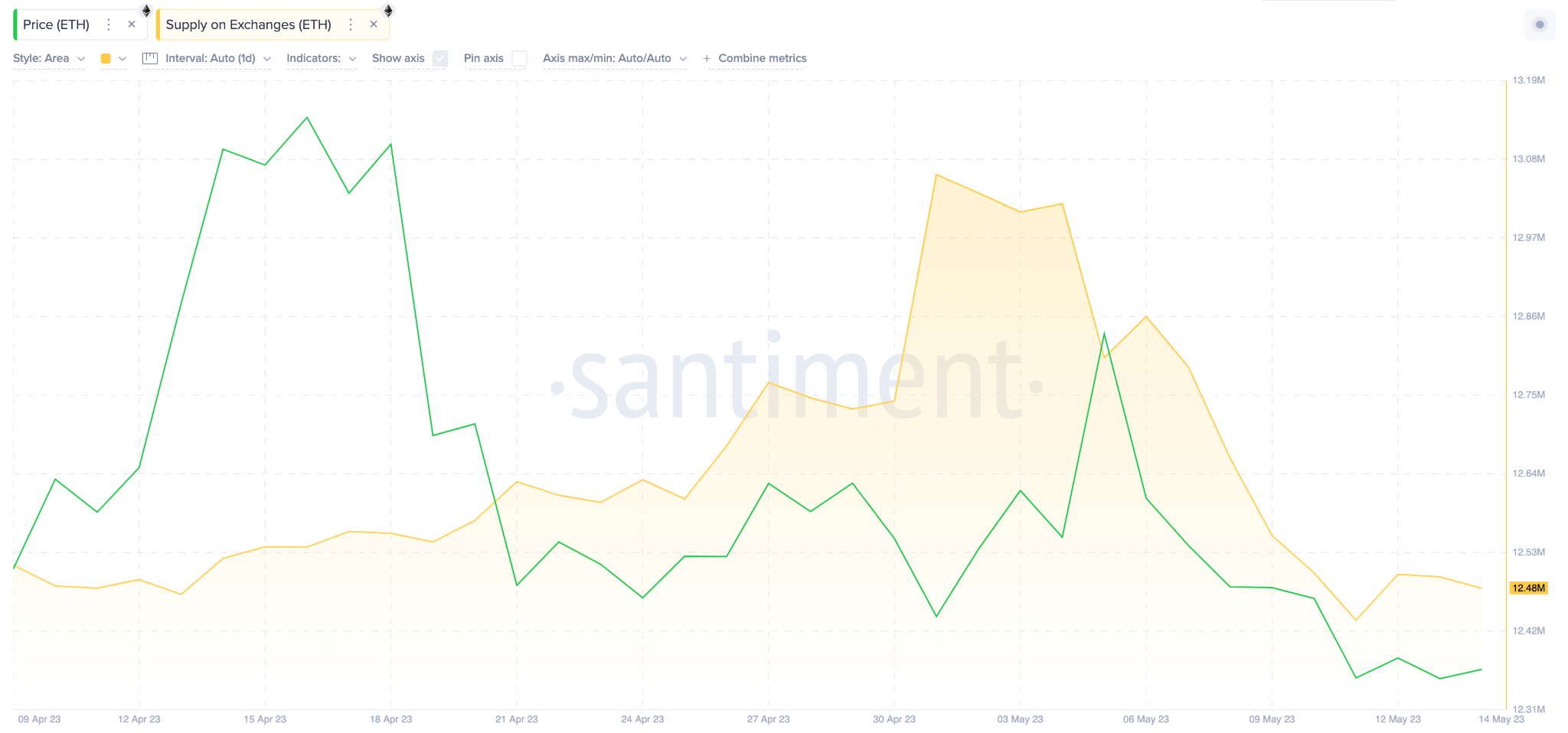

According to data from Santiment, ETH supply on exchanges is at its lowest level since the cryptocurrency began trading publicly in July 2015. The Supply on Exchanges metric evaluates the number of Ethereum coins currently deposited into recognized exchange wallets. The chart below shows how the supply on exchanges has fallen sharply since May 1.

Between May 1 and May 15, investors removed 550,000 ETH from exchanges. On May 11, the supply fell to an all-time low of 12.4 million, suggesting that the price should rise as there is now less ETH to sell.

In the last 2 days, investors have locked another 2.15 million ETH coins (1.76% of the total circulating supply) on smart contracts. At current prices of $1,800, the recently locked ETH coins are worth about $3.9 billion. This suggests that many of the ETH 2.0 non-stakers are investing their newly withdrawn coins in the Ethereum ecosystem.

If the ETH price breaks the $1,855 resistance, it could target $2,100 again. For now, the shallow liquidity in the market is working in favor of the bears, although current data suggests that the uptrend should begin.