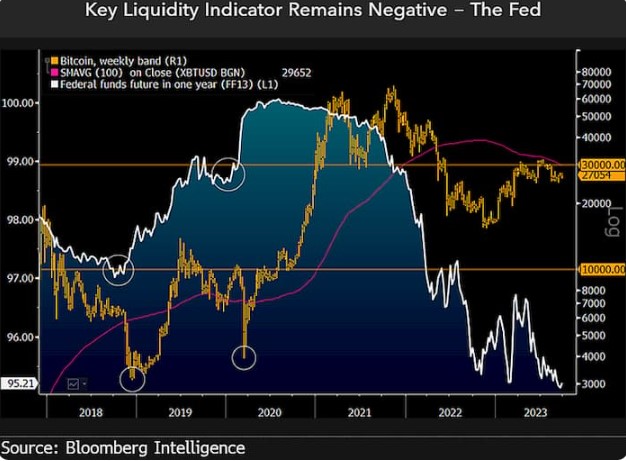

Famous strategist Mike McGlone, who works for Bloomberg, made a statement on October 2, 2023, through the X application (formerly known as Twitter). Bitcoin (BTC) had a strong start to the week and surpassed $28,000 as of Monday. Despite this price movement, McGlone reiterated his concerns about the market.

The Current State of Cryptocurrencies

In the statement by McGlone, he emphasized that the price stagnation in cryptocurrencies could lead to larger events. Considering cryptocurrencies, he highlighted that the third quarter of the third economy was weak. McGlone stated that this situation could lead to a short price increase or larger price stagnations. Regarding the analyst’s second opinion, he emphasized that it is a stronger possibility and made the following statement:

The weakness in cryptocurrencies in the third quarter could be either a recovery burst or a stagnation trend. Our bias is towards the latter, as almost all risk assets gained and handed over in 2023.

According to the analyst, the basis of this idea is the investment assets that have experienced significant price movements in 2023. Despite the interest rate hikes in the US, expectations of economic contraction in Europe, and the real estate crisis in China, central banks worldwide are not hesitant to take tightening measures. All these events create new opportunities for the examination of cryptocurrencies.

What Does Price Parallels Mean?

The strategist, who establishes connections between historical price movements, seems to be trying to bring a new perspective to the subject by supporting his thoughts with examples such as the increase in US Treasury yields before the 1987 economic crisis and the peak of oil prices in July 2008.

At the same time, the analyst seems to be questioning the parallelism between Bitcoin’s sharp price movements and the decisions and sanctions of the Fed. This research suggests that the changes in Bitcoin prices can be cited as an example and can provide insights into the examination of larger economic situations.

The decline in Bitcoin occurred before the Federal Reserve’s pivots, which can underline the cryptocurrency’s leading indicator nature and what may be needed to stimulate liquidity.

Türkçe

Türkçe Español

Español