Bitcoin price predictions continue to emerge every day. This time, former CEO of cryptocurrency exchange BitMEX, Arthur Hayes, shared his thoughts with his followers. Hayes, who stated that the Bitcoin rally will happen with the permission of the US government, drew attention to market returns for his predictions.

The Relationship Between Treasury Bonds and Bitcoin

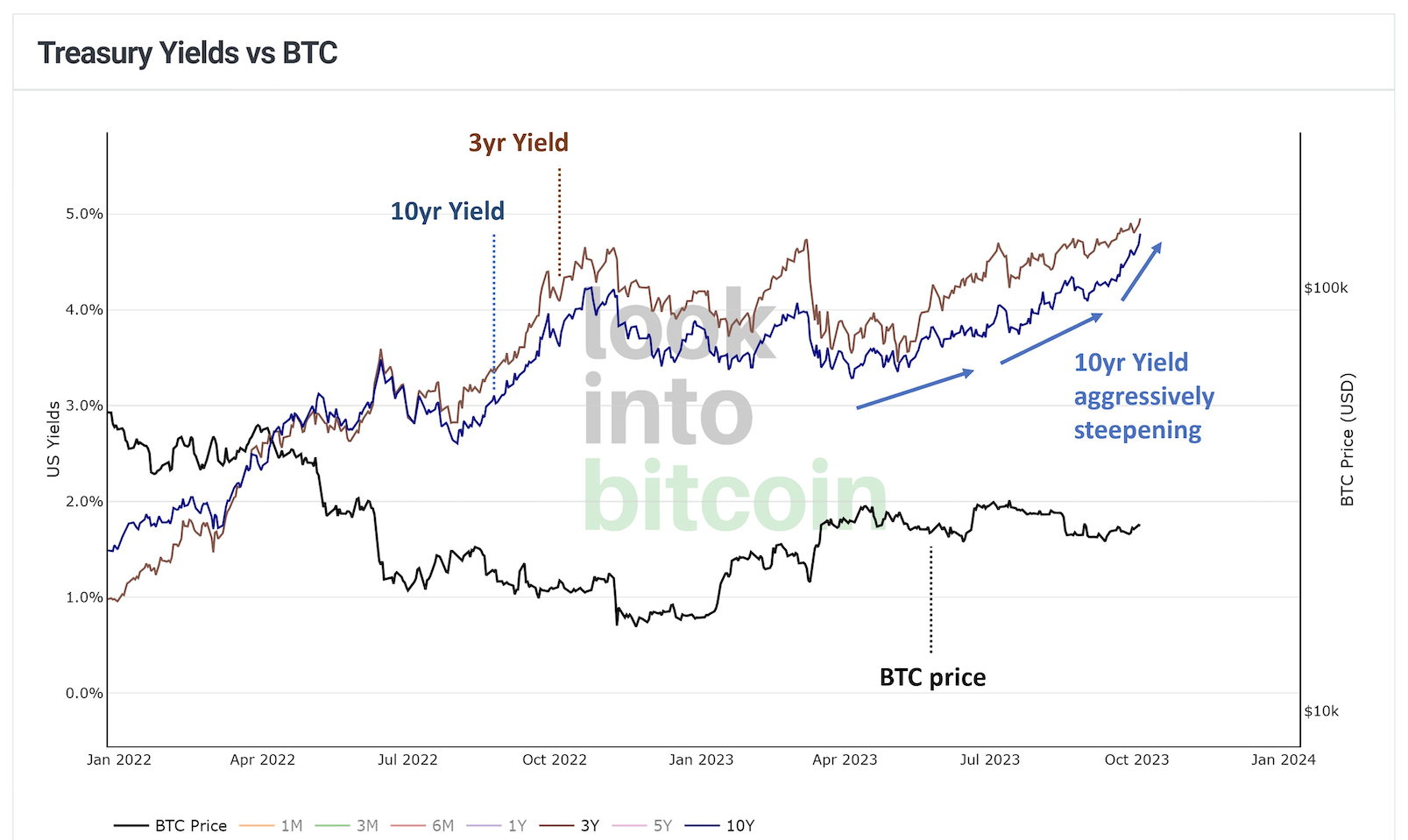

The returns on US Treasury bonds continue to rise. The former CEO stated that this situation will create a macroeconomic explosion and initiate a rally in the Bitcoin price in the future. He explains this with the phenomenon called the “bear steepening,” which defines the long-term interest rates rising more than short-term interest rates, and continues as follows:

“Why do I love these markets when yields are skyrocketing? There is no concept of a bear steepening in bank models. Due to leverage and non-linear risks in banks’ portfolios, they will sell bonds or make fixed payments to the IRS as interest rates rise. More selling brings more selling, which is not good for bond prices.”

Another data from TradingView shows that the 30-year US government bond yield reached 5% this week, which has not happened since August 2007, just before the Global Financial Crisis. Philip Swift, the founder of LookIntoBitcoin and co-founder of Decentrader, supported Hayes’ thoughts and shared a graph showing the relationship between Bitcoin and treasury yields. Swift, who also mentioned the expansion of money supply, continued his words as follows:

“This will be the main catalyst for the Bitcoin bull market.”

US National Debt Keeps Increasing

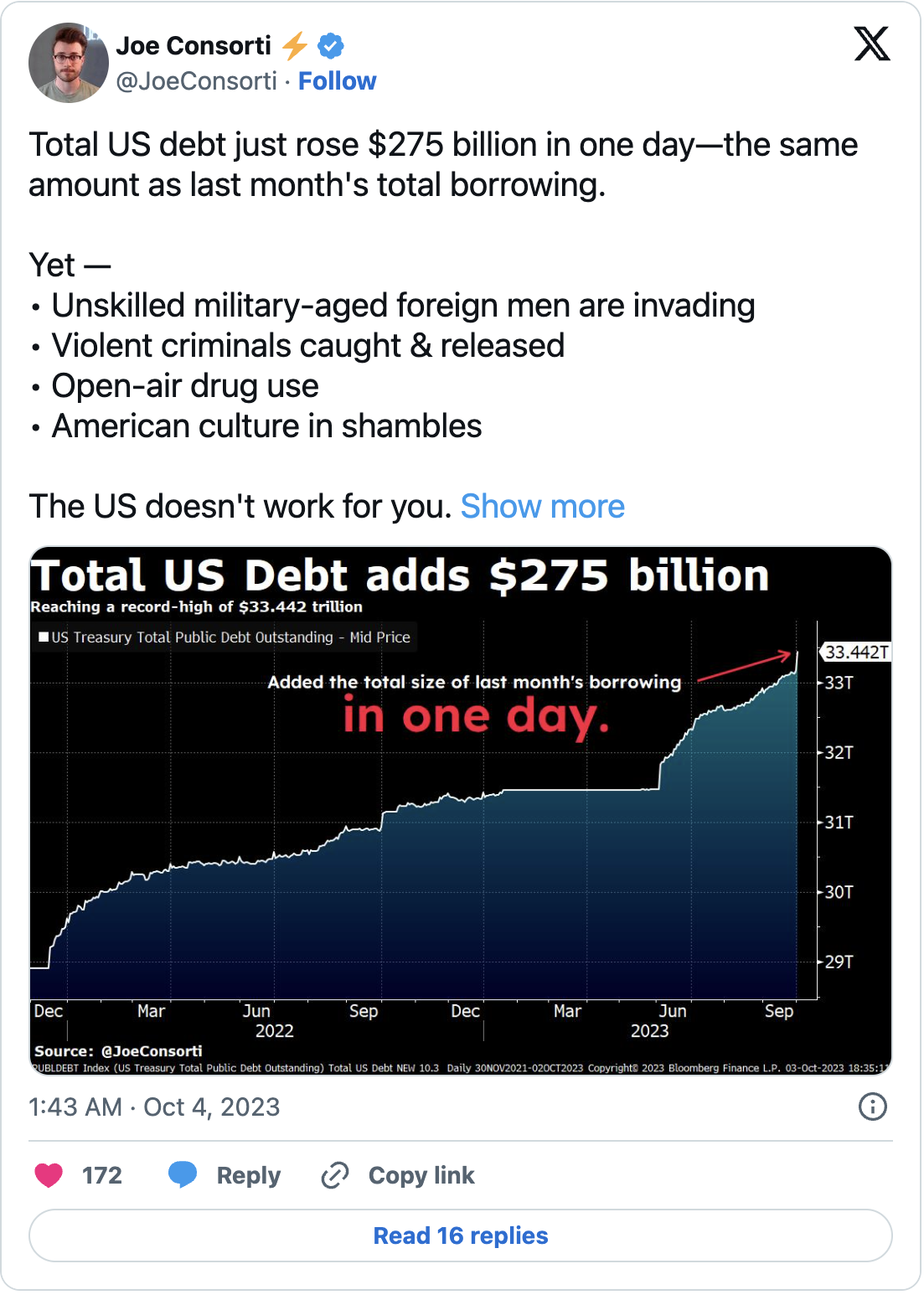

In addition, the US continues to increase its national debt at an astonishing pace. Moreover, the US is increasing its record-level national debt at a striking pace.

Just two weeks after surpassing the $33 trillion mark, the government increased the total debt by $275 billion in just one day. This situation did not escape the attention of financial commentators. Samson Mow, the CEO of Bitcoin adoption firm Jan3, commented on this situation:

“In a single day, the US added more than half of Bitcoin’s total market value as debt. That’s like 10 million BTC. And there are still people who are not sure if $27,000 is a good price to buy.”