Ethereum (ETH) has witnessed the emergence of liquid staking protocols since its transition to the Proof-of-Stake (PoS) mechanism. These protocols have filled the gaps that were prevalent in traditional staking methods. According to DeFiLlama, projects like Lido Finance (LDO) have gained significant popularity and have become the largest DeFi protocol with a locked total value of $14.59 billion.

Increasing Demand in the DeFi Sector

However, the rise of liquid staking has brought significant changes to Ethereum’s supply dynamics and has caused shifts in demand, particularly in other DeFi sectors like lending. The traditional method fixes the minimum stake amount at 32 ETH, which is quite expensive for most individuals.

As a result, investors participate in a liquid staking pool and delegate their ETH to node operators who will stake on their behalf. In return, the individual receives liquid staking tokens (LST) as a representation of their staked ETH.

These tokens allow users to participate in staking while also providing them with the opportunity to use them elsewhere in the DeFi ecosystem for higher yield opportunities. According to a report by on-chain analytics firm Glassnode, Lido has become the dominant player in the market by staking approximately 32% of the circulating supply of ETH through its largest liquid staking protocol.

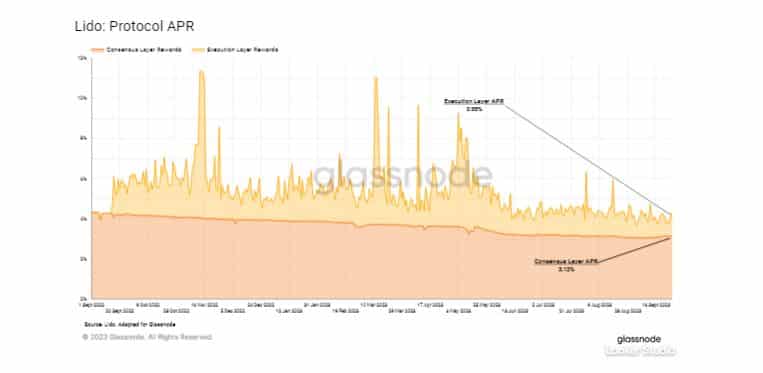

Furthermore, this implies that Lido may account for receiving 32% of all rewards accrued to the staked ETH, resulting in 32% of new ETH entering circulation through Lido. After deducting the 10% fee shared between node operators and the Lido treasury, the remaining incentives or 28.8% are distributed to Lido Staked ETH (stETH) holders.

This is where Lido potentially alters Ethereum’s planned emission dynamics. Without liquid staking, individual stakers would receive the entirety of their validator rewards. Additionally, Lido balances the supply flow of ETH by reinvesting a portion of the total rewards as part of its compound strategy.

New Analysis from Glassnode

According to Glassnode’s analysis, if Lido receives $221,000 in newly minted ETH, approximately $105,000 will be locked back in the staking pool, resulting in a net emission reduction of 116,000 ETH. Tokens like stETH represent each unit of ETH locked in the staking pool, providing continuous rewards and the ability to be used freely elsewhere. Many experts have dubbed sETH as the yield-generating version of ETH.

It has been observed that the number of new users utilizing ETH and its wrapped version, WETH, has stagnated since the collapse of stablecoin Terra USD (UST) last year. Conversely, demand for stETH and its wrapped version, wstETH, has increased by 142% since then. The Shapella upgrade completed earlier this year is believed to have played a significant role in this surge.