While the price had just surpassed $30, we were discussing the possibility of reaching $80 and $100 targets if the rally continued. Time is definitely flying, and SOL Coin is rising even faster. The popular cryptocurrency is still above $80 even after a pullback in BTC at the time this article was written.

Why Is Solana Rising?

FTX‘s collapse left the altcoin in critical condition, but it has since made a nearly 1000% increase from its low of $8.5. A statement by Vitalik Buterin, suggesting that Solana is now free from the influence of big money, resonates with investors. The price, which made a quick comeback, struggled at the tough resistance of $27 for a long time but eventually succeeded.

There are several reasons for the rise, and they are not independent of each other. Firstly, we know that the rapid recovery of BTC prices supported the SOL Coin rally. Other details are as follows;

- It was one of the altcoins with the highest inflow this year.

- The launch of JITO definitely supported the momentum of SOL Coin’s rise.

- GSOL is trading at a significant premium, and as the price increases, so do the gains of institutional investors with trust premiums. Therefore, GSOL holders must be doing something to push up the spot price. We saw this in the 2021 version of GBTC.

- Even though excitement for Layer1 is growing, the Solana network is extremely fast and cheap, and it is positioned as the network with the highest number of transactions, hence the outlook for 2024 is positive.

- Solana investors have healed a significant part of their wounds with BONK Coin (at least some of them). The price increased hundreds and even thousands of times for those who evaluated the airdrop and sold at ATH. This also revitalized the demand for SOL Coin.

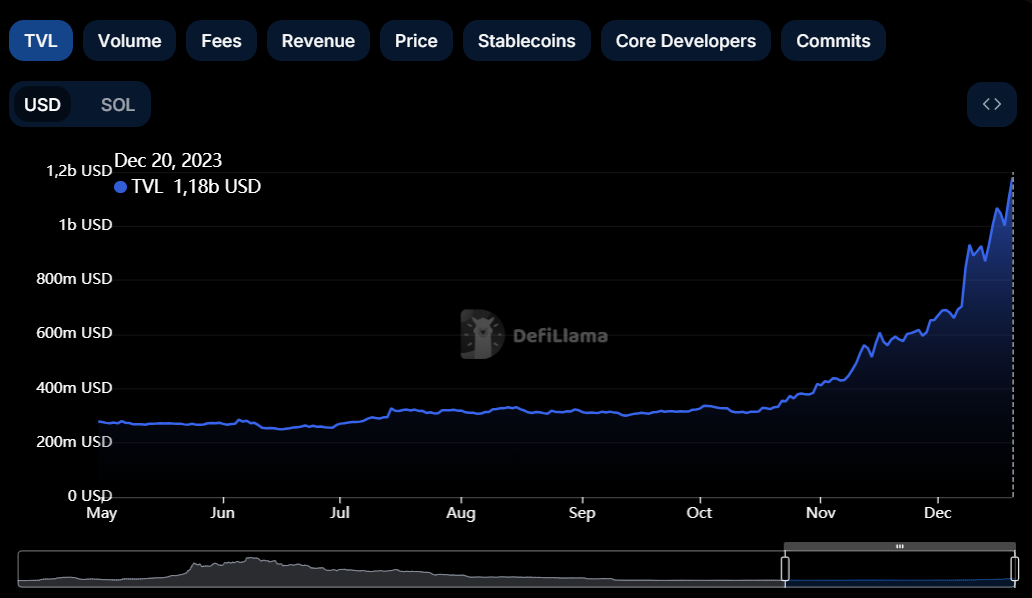

- Solana’s TVL is in the region of 1 billion dollars, indicating that the network is reviving.

Lastly, with the technical breakouts, $80 is no longer a tough target. Now investors can aim for the $96 and $120 regions.

The Future of SOL Coin

As long as optimism for BTC continues in the short term, three-digit prices for SOL Coin may not be a fantasy if massive sales do not occur. On the other hand, SOL Coin, which today ousted XRP Coin from its position in the ranking of top altcoins by market value, may next target Ethereum. A popular crypto analyst, Evanss6 X, explains on social media that Solana’s focus on mobile accessibility is exactly what crypto projects need to attract new users who don’t care if “the chain is decentralized enough.” Essentially, Solana’s user experience, whether for projects demanding high transaction capacity or just benefiting from low transaction costs, is leaving the competition behind.

Solana’s recent rally goes beyond meme coins, as evidenced by the growth of the network in terms of decentralized applications. Just three weeks ago, on November 29th, Solana’s total value locked (TVL) was only $654 million, representing a mere 1.4% market share. According to DefiLlama, this figure has now increased by 96% to $1.28 billion. So, there seem to be reasons to be optimistic about SOL Coin in the long term as well.

Türkçe

Türkçe Español

Español