“They say this place is a big and wealthy city. I come from the poorest neighborhoods.” These lyrics taken from 50 Cent’s song “Big Rich Town” perfectly describe the current situation of Avalanche (AVAX), which has been struggling with losses for a long time.

When compared to other cryptocurrencies in the top 20 in terms of market capitalization, AVAX seems to be the only cryptocurrency in this situation. And although its holders hoped for a respite, that was not the case. Worse still, IntoTheBlock data showed that 99.5% of AVAX holders currently hold tokens at a loss.

Avax Analysis

Despite holding AVAX for a long time, its holders have not been able to make any profit that would demonstrate their loyalty. It is undeniable that AVAX’s performance this year is largely responsible for the current situation.

In the last 90 days, AVAX had lost 25.70% of its value. On a Year-to-Date (YTD) basis, it did not perform any better and experienced a 51.16% decline during this period. In addition to the price movement, other parts of the Avalanche ecosystem have also been in the same, and sometimes worse, situation.

This situation also reflected on Avalanche’s Total Value Locked (TVL). TVL is used to measure the total value of crypto assets staked or locked in a decentralized application, indicating how much trust investors have in a protocol. At the time of writing this article, Avalanche’s TVL had dropped to $536.12 million, experiencing an 18.55% decrease last month. Therefore, the decline in TVL may indicate that Avalanche has become a protocol that market participants are avoiding, which also exposes the future of the cryptocurrency to potential risks.

The Future of Avax Coin

However, in terms of development activity, Avalanche has ensured the continuity of upgrades on its network. At the time of writing this article, AVAX’s development activity had reached 29.9, indicating impressive public GitHub repositories associated with Avalanche. But can this change the course of price movement? The two-week price fluctuations have shown that AVAX’s price can deviate far from its current value.

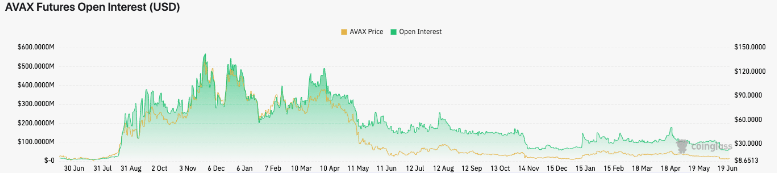

At the time of writing, the price volatility had risen to 0.069. However, this increase may indicate that AVAX’s price can move in both directions. In such cases, either the value increases significantly or the decline is substantial. As a result of AVAX’s weak state, traders have disregarded opening contracts related to the token.

At the time of writing this article, the Open Interest was $76.66 million. Open Interest is the total value of pending derivative contracts for an asset. Therefore, this decrease indicates a decrease in liquidity flowing into AVAX contracts.

i just wanna being in dis platform cuz us very unique