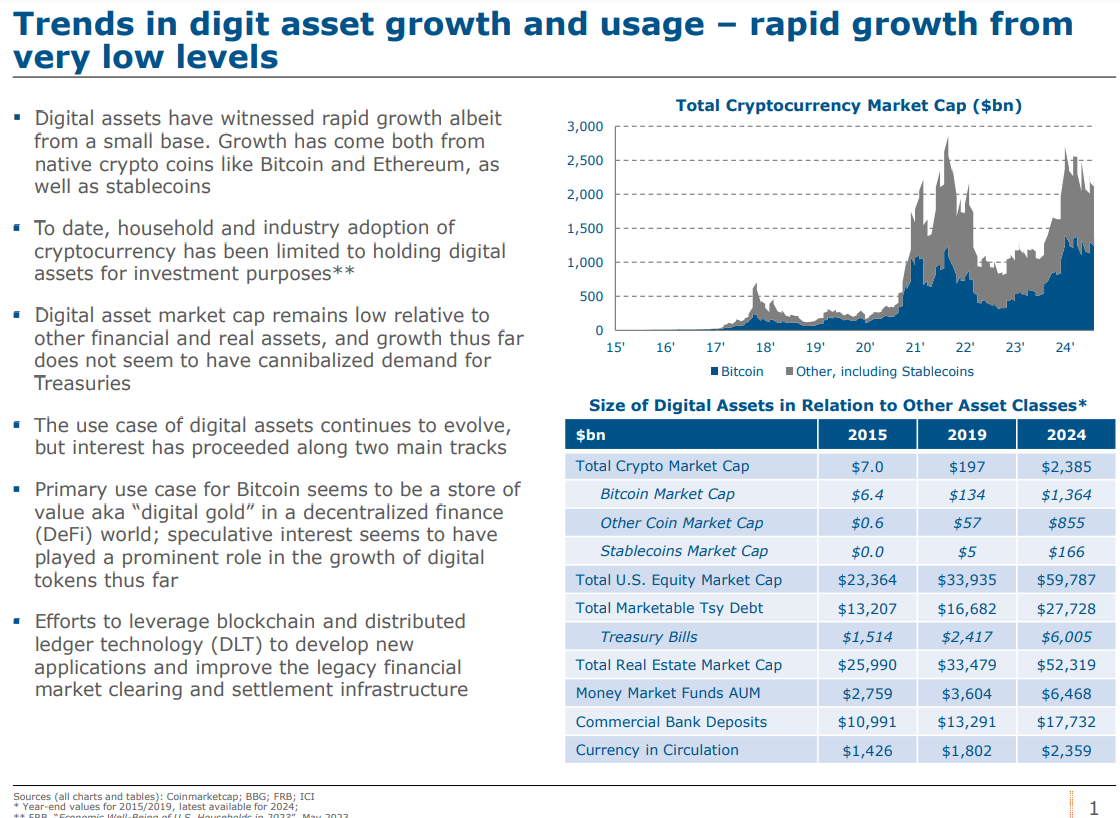

Interest in cryptocurrencies and blockchain technology continues to rise at the governmental level. The U.S. Treasury has published a comprehensive report that examines the effects of cryptocurrencies on Real World Assets (RWA). Major asset managers, including BlackRock, have taken steps in this field and have experienced significant growth in a short time.

U.S. Cryptocurrency Report

The U.S. Treasury shared a 17-page report on digital assets and tokenization. It mentions that the growth of stablecoins has led to modest increases in demand for short-term Treasury bonds. Essentially, during bull markets, the growth in stablecoins is expected to exceed tens of billions of dollars, and these modest increases can reach enormous proportions.

Currently, just Tether holds nearly $100 billion in U.S. Treasury securities, surpassing the reserves of many governments. The report notes that 80% of all cryptocurrency transactions utilize stablecoins and also focuses on the benefits of tokenization.

Details of the Cryptocurrency Report

The tokenization of real-world assets (RWA) is predicted to create a trillion-dollar market according to many major companies. While the growth of stablecoins is beneficial for U.S. Treasury bonds, risks are also anticipated. For instance, recent WSJ claims, if proven true, could lead to devastating results for USDT with tens of billions in redemptions.

“The collapse of large stablecoins like Tether could trigger a significant sell-off in U.S. Treasury bonds. While stablecoins play a crucial role in the crypto space, risks exist.”

The report emphasizes the need for regulation concerning stablecoins that risk losing their peg due to market fluctuations. This regulatory need is related to the relationship between small and medium-sized banks and money market funds with stablecoins.

In terms of regulation, the European Union and MiCA have made significant strides to protect investors and combat money laundering. However, it will take time to see this becoming a global standard.

The use of blockchain in finance is noted for enabling rule-based transactions to be automated, which can open the door to speed, security, and innovation.