Filecoin (FIL)

Selling is just as important for short-term investors as buying at the right level. This popular cryptocurrency, which is also traded on the Binance exchange, stands out with the possibility of experiencing extreme volatility in the coming hours. So, at what price range will it fluctuate? What can investors expect?

Like most altcoins, Filecoin led an impressive recovery since mid-June. However, it faced a familiar barrier at $5, which slowed down the rise. The summary decision related to the XRP case triggered the gains of the altcoin that has been labeled as a security. Over the next 2 years, the summary decision is expected to protect altcoins in terms of permission to trade on exchanges. More importantly, the recent decision may also suspend the delisting request sent to Grayscale.

At the time of writing, the FIL Coin price had recovered from the $4.25 support. The current support had been a lifeline for the bulls in January, May, and early July. The price may aim for $5 again in the coming days, and this level will likely continue to pose a tough barrier for the bulls.

FIL Coin Price Analysis

Bulls have been disappointed in the D1 downtrend block between $4.68 and $5.03 for a while. The negativity in the price of BTC and the interest rate decision to be announced on Wednesday evening may lead to further resistance rejections. In this case, the $5 barrier and the $4.25 urgent support appear to be an attractive area for short-term traders.

On the other hand, surpassing the $5 barrier will turn the D1 market structure into an uptrend and invalidate the bearish thesis mentioned above. However, FIL bulls should see closures above $5.2 to gain further advantage. Meanwhile, the Relative Strength Index has been oscillating above the neutral level, indicating fluctuating buying pressure in the past few days. However, the On-Balance Volume has recorded an increase in demand in the past few hours.

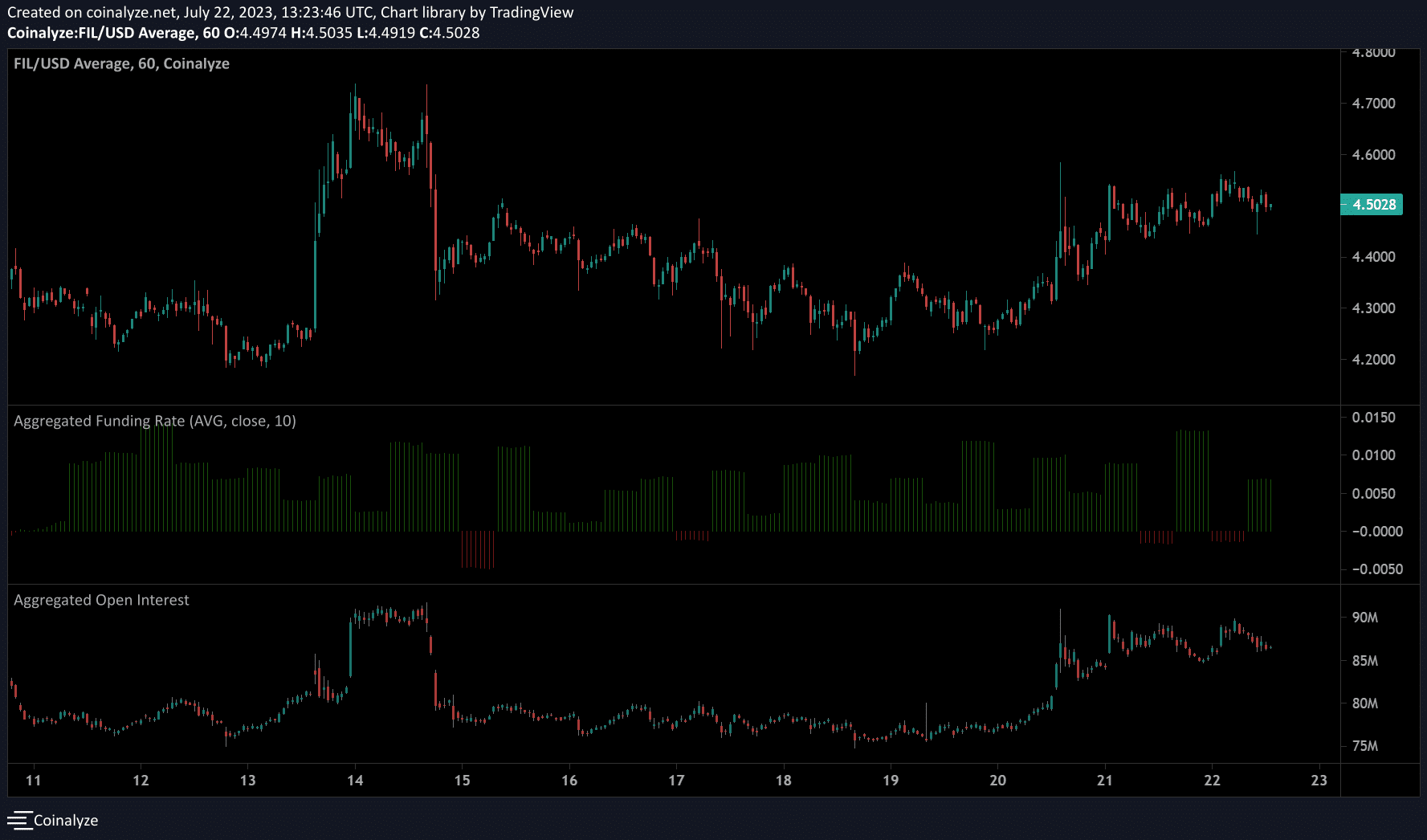

The Open Interest (OI) rates of FIL fluctuated in mid-July but have been increasing since July 19. This indicates an improvement in demand in the futures market during the same period. However, OI has fluctuated below $90 million since July 21, indicating a slowdown in demand during the same period. Funding rates are consistent with the trend of OI. There were significant fluctuations in funding rates between July 21-22.

In summary, a test aiming for $5 could present an opportunity for sellers.

Türkçe

Türkçe Español

Español